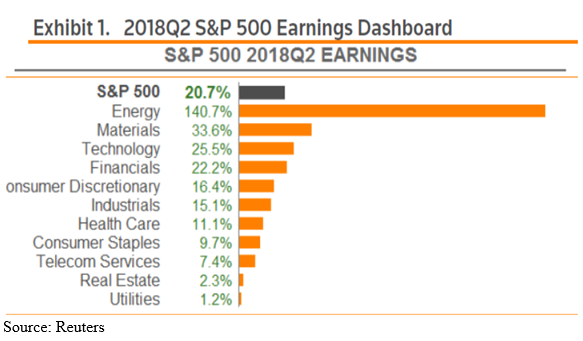

Earnings growth for Q2 2018 is forecast to be 20.7% according to Thomson Reuters data, following a gain of 26.6% in the first-quarter. It was the most robust expansion in seven years, marking another strong period of corporate results on the back of tax cuts passed late last year.

Wall Street's second-quarter earnings season kicked off last week, when four of the biggest U.S banks—Citigroup (NYSE:C), JPMorgan (NYSE:JPM), PNC Financial (NYSE:PNC) and Wells Fargo (NYSE:WFC)—all reported results on Friday. Three of the four beat on EPS expectations, an encouraging start.

"We expect this will be the second quarter in a row for earnings growth of greater than 20%, something that hasn't been recorded since 2010," Lindsey Bell, CFRA investment strategist, wrote in a June 28 report. "This time the robust growth rate is a reflection of strong sales growth and reduced tax rates from the new tax policy."

Though Financials may provided the opening salvo for this current earnings seasons, digging deeper into expectations for full second-quarter earnings growth, it's the Energy sector that will lead, with profit growth forecast to rise 140.7%, as it continues to emerge from a two-year earnings recession. At the sub-sector level, all six industry segments are predicted to report robust earnings growth for the quarter: Integrated Oil & Gas (100%), Oil & Gas Storage & Transportation (77%), Oil & Gas Refining & Marketing (75%), and Oil & Gas Equipment & Services (69%). However, estimates for the Oil & Gas Exploration & Production, and Oil & Gas Drilling are not applicable due to losses suffered in the year-ago period.

As a whole, revenue for the sector is expected to increase 21.8%, the second highest year-over-year sales growth of all eleven sectors, trailing only Materials (23.8%).

As for revenue growth, all six segments are also predicted to report double-digit growth: Oil & Gas Refining & Marketing (24%), Oil & Gas Drilling (24%), Oil & Gas Equipment & Services (23%), Integrated Oil & Gas (23%), Oil & Gas Storage & Transportation (12%), and Oil & Gas Exploration & Production (10%).

This unusually high growth rate for the sector has two drivers: the sharp year-over-year increase in oil prices and a comparison to unusually low earnings in the year-ago quarter. Indeed, the average price of oil in Q2 2018 ($67.91) was 41% higher than the average price of oil in Q2 2017 ($48.15), according to the U.S Energy Information Administration, thanks in part to ongoing efforts by global crude producers to cut back on production and prop up the market.

With all this taken into consideration now is an ideal time for investors to scoop up some energy stocks. Below we highlight the three most attractive names in the sector, based on expected earnings growth for the second quarter. Major energy firms on the S&P 500 are expected to start reporting Q2 numbers beginning the final week of July.

1. Chevron

Chevron (NYSE:CVX) is set to see a handsome 145.2% increase in second quarter earnings, according to FactSet, when it reports results before the market opens on Friday, July 27. The energy giant looks set to benefit from strengthening oil prices in its upstream business with less encumbrance from its smaller downstream unit.

The oil company is projected to post earnings per share (EPS) of $2.13 on revenue of $45.63 billion in the April-June period. Comparatively, Chevron posted much more modest earnings of $1.26 per share in the same quarter last year on revenue of just $34.88 billion.

Chevron shares have gained around 19% since July 2017 and are poised for further appreciation, riding on the company's healthy earnings growth prospects. In comparison, larger rival Exxon Mobil (NYSE:XOM), for example, has seen its stock go up a meager 2.5% over the same time period.

2. Occidental Petroleum

In addition to tailwinds resulting from the impressive jump in oil prices, many companies in the energy sector are also benefiting from coming up against easy year-ago earnings comparisons. Occidental Petroleum (NYSE:OXY) is a case in point.

The consensus estimate for the integrated oil and gas producer's Q2 EPS is $1.27, according to FactSet. That's up a whopping 693% when compared to a profit of just 15 cents a share in Q2 of 2017. The company is projected to have earned revenue of $4.07 billion in the second quarter, compared to sales of $3.08 billion in the year-ago period. Occidental reports results on Wednesday, August 1 before the market opens.

Shares of Occidental, generally referred to as Oxy, are roughly 40% higher than they were during July 2017, making it one of the energy sector's best performers over the past 12 months. The Houston-based company's results look set to receive yet another boost from its stellar Permian operations, where it is the region's largest landholder.

The Permian is the epicenter of Occidental’s business, CEO Vicki Hollub said recently, and it will continue to be the company’s focal point for years to come. Occidental also has a growing petrochemical business, OxyChem. It has holdings in the Middle East and is building out its Ingleside, Texas export terminal in order to ship crude oil worldwide.

3. Anadarko Petroleum

Anadarko (NYSE:APC) is forecast to earn 54 cents per share in the three months ended June 30, according to FactSet, up a staggering 174%, or $1.34, from last year’s Q2 loss of 77 cents per share. The revenue estimate for the second quarter is $3.03 billion, compared to revenue of $2.42 billion reported in the second quarter of 2017.

The oil exploration and development company's shares are up nearly 67% over the past 12 months. In comparison, the broader industry represented by the Energy Select Sector SPDR ETF (NYSE:XLE) has increased around 17% during the same period.

The Woodlands, Texas-based company should reflect a nice boost to results from increased oil production levels and higher crude prices when it reports second quarter results after the market closes on Tuesday, July 31. The company has sharpened its focus on the Denver-Julesburg (DJ) Basin, the Delaware Basin, and the Gulf of Mexico in order to achieve oil-levered growth.The company recently noted that the three regions combined could deliver a 10%-14% compounded growth rate for oil in the next three years.

In a promising sign for the future, Anadarko's board announced on July 9 that it is increasing its share buyback authorization by $1 billion, bringing the total to $4 billion. The company said it completed the first $3 billion buyback on June 28.

In addition, Anadarko said it will reduce its debt by an additional $500 million, bringing the total debt-reduction program to $1.5 billion.The company expects to accomplish the reduction by retiring its 2018 and 2019 debt maturities.