The Energy sector experienced a challenging week, demonstrating the instability of the global economy. The WTI Oil price saw a significant decrease of -1.75% during this period, with this decline largely due to concerns around relatively weak demand and an increase in US refinery inputs.

Indeed, for the week ending August 18, the average US refinery inputs stood at 16.8 million barrels per day, marking an increase of around 30,000 barrels per day compared to the previous week's average. According to the Energy Information Administration (EIA), in total there was a rise of 1.5 million barrels in motor gasoline inventories compared to the prior week.

Poor global manufacturing data added further fuel to the fire. And, despite US crude inventories falling by 6.1 million barrels during the third week of August (as reported by the EIA) this optimistic announcement failed to alleviate investor concerns.

The relationship between demand expectation and production realization is certainly complex and inevitably impacts the prices of WTI Oil. Energy-linked ETFs display high sensitivity towards geopolitical and macroeconomic trends, thus demonstrating their effectiveness as indicators of global economic health.

Group Data: Energy

Index Data

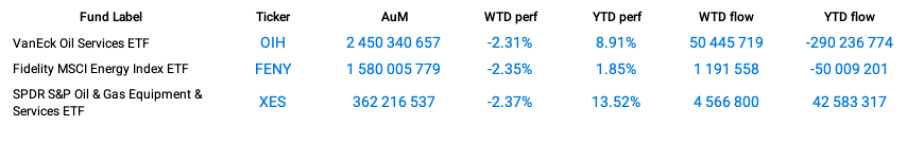

Funds Specific Data: OIH, FENY, XES

This content was originally published by our partners at ETF Central.