5 big analyst AI moves: ASML top semis pick for 2026, Adobe downgraded

Despite there being a sentiment of uncertainty regarding the strength of the US economy, recent economic indicators have pointed to modest growth in spending and production. For April 2023, ETF Central’s segments with the greatest net fund flows were US Government Bonds ($6.30 bn), US Aggregate Bonds ($4.03 bn), US Multi-Factor ($3.74 bn), Structured Products ($ 3.74 bn), and US Corporate Investment Grade Bond ($3.37 bn).

A look at each Segment and ETF Flows

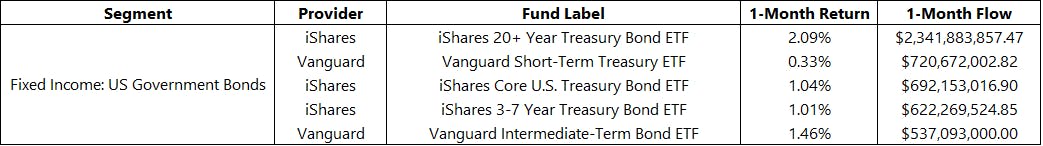

US Government Bonds

Continuing the trend seen in March 2023, the US Government Bond segment took in the greatest flows for the month of April 2023. As observed from the data, intermediate and long-dated treasuries that offered higher interest rates were the preferred choice among investors. Among asset managers, BlackRock’s iShares offerings held three of the top five category leading ETFs, with the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) being the leading recipient of fund flows, while exhibiting the best performance of the group.

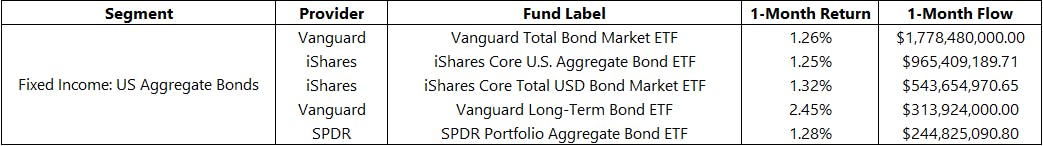

US Aggregate Bond

Within the US Aggregate Bond segment, the Vanguard Total Bond Market ETF (BND) garnered the most flows for the month. Given the high degree of uncertainty still present in the economy, US Aggregate bond solutions provide investors with broad exposure to the investment grade segments of the US Fixed Income market. Though BND received the most flows, the Vanguard Long-Term Bond (BLV) had the best performance of the group.

US Multi-Factor

The US Multi-Factor segment saw the third most flows for the month, building on the strong performance exhibited from the month prior. The US Multi-Factor segment continues to be a safe haven for investors, given the diverse offering of investment strategies that investors can utilize within their portfolio. Though all top 5 ETFs exhibited strong performance for the month, the Invesco Russell 1000 Dynamic Multifactor ETF (OMFL) had the highest return, while the iShares Edge MSCI USA Quality Factor ETF (QUAL) garnered the highest flows. As uncertainty about the US economy remains, it is possible that flows into this category will continue to grow, as investors will feel most comfortable utilizing strategies that have a clear value proposition and have proven their ability to perform through different stages of the economic cycle.

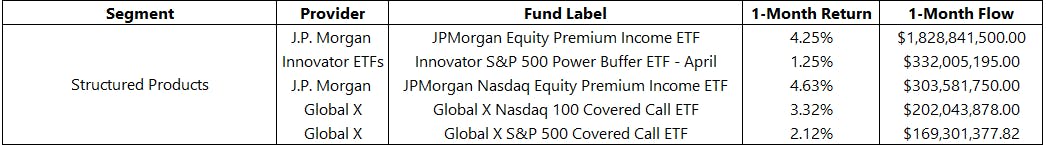

Structured Products

Given the current market uncertainty, it is quite understandable why investors are taking a greater interest in structured product offerings. The JP Morgan (NYSE:JPM) Equity Premium ETF (JEPI) garnered the majority of fund flows in this segment for the month, as it has become a top-of-mind solution for market risk mitigation by many investors. The innovator S&P 500 Power Buffer ETF – April (PAPR) had the second largest fund flows for the month; as buffer ETFs have become a popular offering among ETF providers. From a performance perspective, the JP Morgan Nasdaq Equity Premium Income ETF (JEPQ) performed the best among the top 5 ETFs in focus.

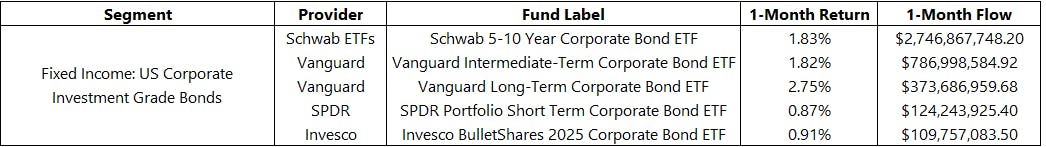

US Corporate Investment Grade Bonds

The US Corporate Investment Grade Bond segment received the fifth most flows for the month. Within the grouping, the Schwab 5-10 Year Corporate Bond ETF (SCHI) received the most flows, however the top performing solution was the Vanguard Long-Term Corporate Bond ETF (VCLT). With the current interest rate environment being ‘higher for longer’, the appeal of US corporate investment grade bonds has increased, as investors are seeking investment solutions that can be a source of income generation for their portfolio.

This content was originally published by our partners at ETF Central.