Brookfield reportedly launching cloud business for AI chip leasing

Gauging investor sentiment is a difficult task, particularly in an uncertain market environment. However, ETF fund flows can be a useful barometer in assessing sentiment and understanding investor behavior at a given point in time. For February 2023, ETF segments with the greatest net fund flows were Money Market Bonds ($ 8.40 bn), US Aggregate Bonds ($4.03 bn), European Blended Cap ($3.67 bn), Structured Products ($ 3.65 bn), and US Large Cap Value ($2.26 bn).

A look at each Segment and ETF Flows

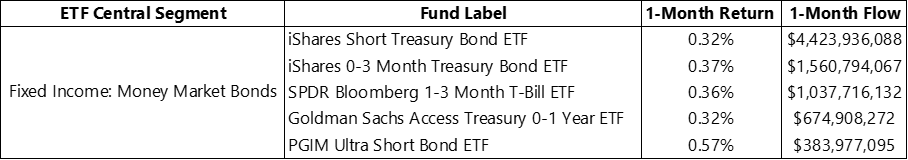

Money Market Bonds

As noted in a previous article, the increased pace of US interest rate hikes has elevated the yield-generation potential and expectations for most interest-bearing investments. Presently, 6-month and 1-Year U.S. Treasuries are yielding approximately 5%, making them very appealing to both investors and savers. For the month, two iShares Treasury offerings – SHV and SGOV – received the most inflows. While performance among the top four funds was similar, the PGIM Ultra Short Bond ETF (PULS) was able to distinguish itself with a higher return performance. Looking forward, as the US Federal Reserve indicates its intention to continue raising interest rates, it can be reasonably assumed fund flows into his segment will increase over the calendar year.

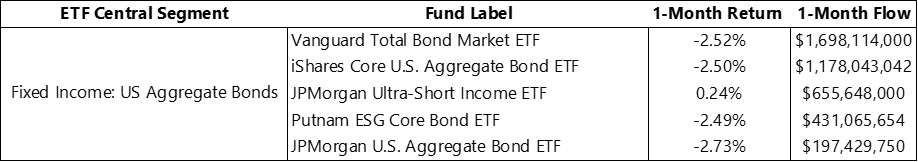

US Aggregate Bonds

Within the US Aggregate Bond segment, the Vanguard Total Bond Market (BND) garnered the most fund flows for the month. Given the downturn in equity market performance for the month, investors engaged in a flight to safety, pivoting towards US Treasuries or Multi-Sector fixed income solutions, such as BND. While similar ETFs, namely iShares Core U.S. Aggregate Bond ETF exhibited a similar fund flow and return performance profile to BND, the JP Morgan Ultra-Short Income (JPST) ETF truly differentiated itself from its top 5 segment cohorts, by having a positive return performance for the month.

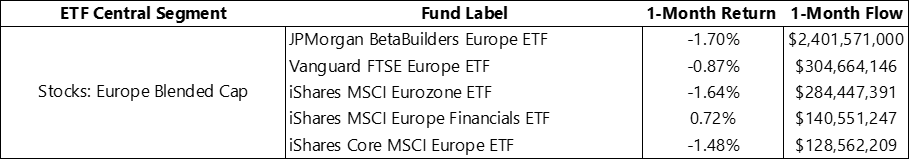

European Blended Cap Segment

Flows to the European stock category were primarily towards the JP Morgan BetaBuilders Europe ETF (BBEU). Increasingly, US investors are looking for investment opportunities beyond their borders and developed markets, such as Europe, are becoming areas of interest for many. As observed from the data, the magnitude of money flowing into the BBEU, relative to its peers, is indicative of the interest in said solution. From a performance perspective, the iShares MSCI Europe Financials ETF (EUFN) exhibited a positive return for the month.

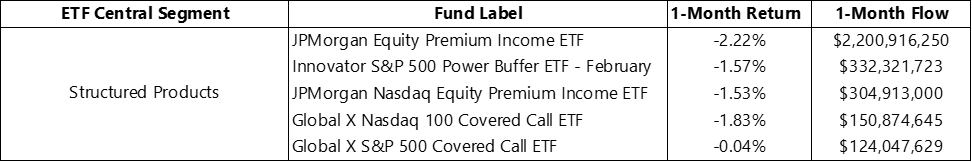

Structured Products Segment

Given the current market uncertainty, it is quite understandable why investors are taking a greater interest in structured product offerings. The JP Morgan Equity Premium ETF (JEPI) garnered the majority of fund flows in this segment for the month, as it has become a top-of-mind solution for market risk mitigation by many investors. The innovator S&P 500 Power Buffer ETF – February (PFEB) had the second largest fund flows for the month; as buffer ETFs have become one of the fastest-growing corners of the ETF market. From a performance perspective, the Global X S&P 500 Covered Call ETF performed the best among the top 5 ETFs in focus.

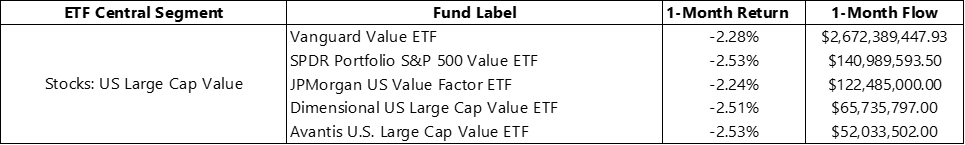

US Large Cap Value Segment

Against the backdrop of a ‘higher for longer’ interest rate environment, investors are pivoting their portfolios towards defensive sectors that are normally associated with value style investing. For the month of February 2023, the Vanguard Value ETF (VTV) garnered the most flows within this segment. The performance among the top 5 ETFs was relatively similar in nature.

This content was originally published by our partners at ETF Central.