The days of heated arguments and flame wars on StockTwits message boards are over. Today, Gen Z is more likely to communicate an investment thesis via a funny meme on Reddit or through a Discord channel. Case in point, the idea of inversing Jim Cramer.

The results can be unpredictable to say the least. On the one hand, you have Keith Gill, also known as r/DeepF*ckingValue pocketing tens of millions of dollars during the 2021 GameStop (NYSE:GME) short squeeze. On the other hand, you have the "genius" hivemind of r/WallStreetBets, which somehow managed to lose to a stock-picking goldfish.

Naturally, enterprising ETF managers out there have launched ETFs tracking this new wave of investor sentiment. Thanks to the increased connectivity of the last decade, it's become easier and easier to get a sense of what retail is buying (or selling).

Let's take a look at three of the most notable ETFs that invest based on social media sentiment.

VanEck Social Sentiment ETF (NYSE:BUZZ) (BUZZ)

BUZZ tracks the proprietary BUZZ NextGen AI US Sentiment Leaders Index, which holds 75 large-cap U.S. stocks exhibiting "the highest degree of positive investor sentiment and bullish perception." According to BUZZ, this is assessed via content aggregated from social and financial media. The ETF charges a 0.75% expense ratio and has attracted around $56 million in assets under management (AUM).

The fund's top holdings are a hodge-pot of frequent tickers listed on Reddit, with names such as Gamestop, Tesla (NASDAQ:TSLA), Nvidia, Apple (NASDAQ:AAPL), Palantir, and AMD. Many of these tickers have their own dedicated subreddits and investor communities, notably Gamestop which has spawned the financial equivalent of a few cargo cults since the January 2021 squeeze.

SoFi (NASDAQ:SOFI) Social 50 ETF (NYSE:SFYF) (SFYF)

Brokerage platforms have been getting in on the ETF action too, with SoFi releasing SFYF. This ETF tracks the top 50 most widely held U.S. listed stocks on SoFi Invest as measured by the number of accounts invested in each stock. Each holding in SFYF is weighted according to how much money SoFi members have invested in each company at the end of every month.

SFYF is essentially a popularity contest. The SoFi Social 50 Index takes stocks that are becoming popular, while kicking those falling out of favor out. As usual, names like Apple, Tesla, Nvidia, and Microsoft (NASDAQ:MSFT) make up the top holdings. SFYF currently charges a 0.29% expense ratio, but has only attracted AUM of around $12 million dollars due to its more niche nature.

Roundhill MEME ETF (NYSE:MEME) (MEME)

MEME debuted on December 8th, 2021 as the first ETF to explicitly track meme stocks. Specifically, it is benchmarked to the Solactive Roundhill Meme Stock Index. This index targets stocks that exhibit a combination of elevated social media activity and high short interest, which is exactly how many users on r/WallStreetBets screen for their next play. The ETF charges a hilarious 0.69% expense ratio.

The ETF screens holdings based on a "social media score", based on the number of text-based mentions of a company’s name or its ticker over a trailing 14-day period on specific social media platforms, and excludes computer generated, false, or deceptive posts. Fifty stocks remaining are then ranked based on short interest, with the top 25 selected and equally weighted.

Thoughts on this strategy

In my opinion, ETFs like BUZZ, SFYF, and MEME are a crude way of capitalizing on the momentum factor. This investment strategy is based on the idea that stocks that have performed well recently are more likely to continue performing well in the near future.

If a stock is popular on social media and its price has been rising, this might be an indication that it has momentum. By buying such stocks, investors are essentially betting that the trend will continue, and they can profit from the ongoing price increase.

On the other hand, investors could simply make do by buying a dedicated momentum ETF like the iShares MSCI USA Momentum Factor ETF (MTUM) and avoiding the higher expense ratios and greater volatility of these social sentiment ETFs.

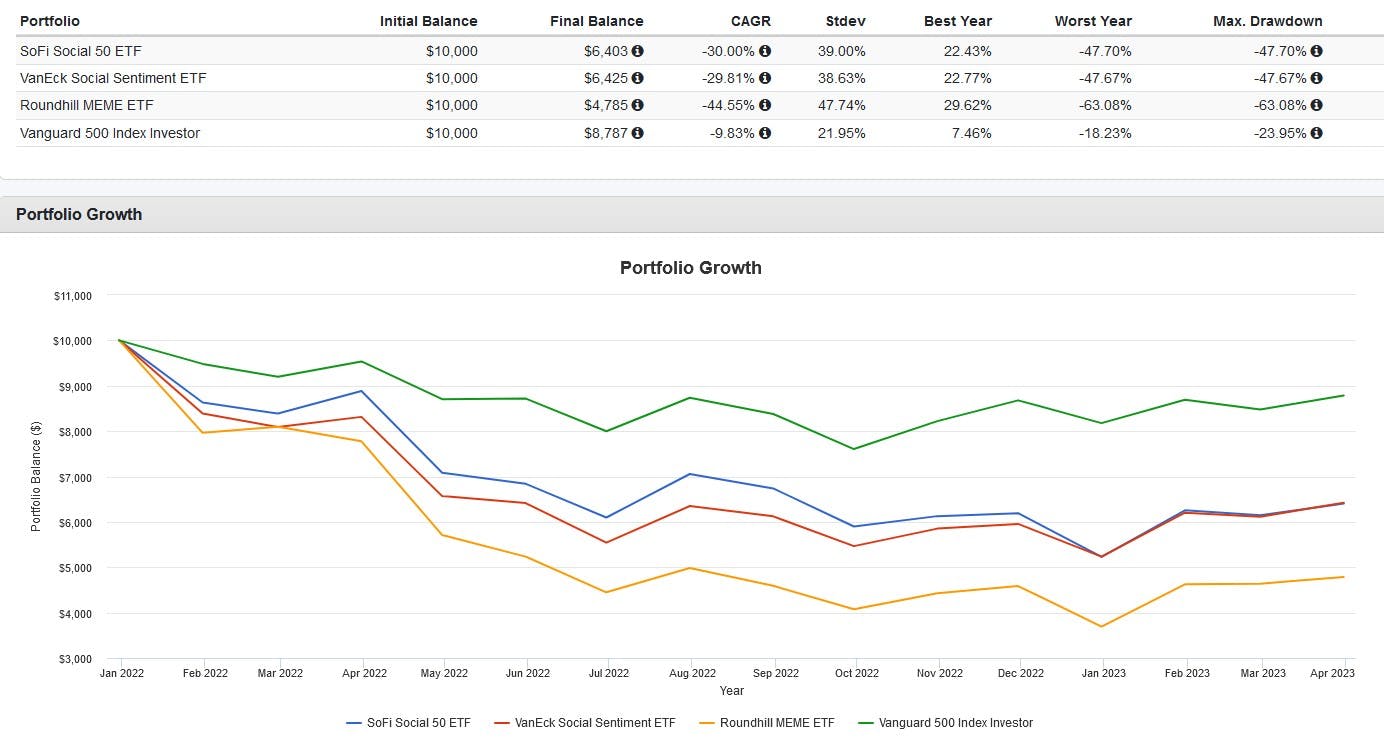

As seen below, from December 21st 2021 to March 31st 2023, BUZZ, SFYF, and MEME have significantly underperformed the S&P 500 index and exhibited much greater volatility and drawdowns.

We know the average retail investor is terrible at picking stocks, and this behavior only gets amplified by the groupthink and herding tendencies prevalent in online social media forms, many of which can turn into echo chambers. Sure, you might make a lot of money on the way up – but the downside risk has historically been outsized.

How many investors are likely to stay invested through average volatility of 40% or higher, or stare down a max drawdown of over 60% without panic selling? Then again, maybe the "diamond hands" investors of r/WallStreetBets know something I don't.

This content was originally published by our partners at ETF Central.