In this Ethereum (ETH) price prediction 2025, 2026-2030, we will analyze the price patterns of ETH by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

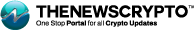

Ethereum (ETH) Current Market Status

What is Ethereum (ETH)

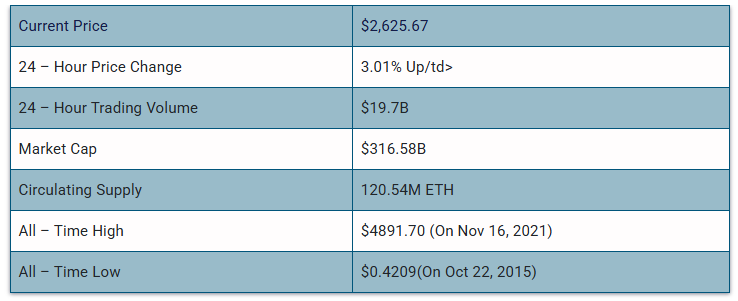

Ethereum (ETH), known as Ether, is the native cryptocurrency of Ethereum. Ethereum is an open-source blockchain platform that revolutionized the blockchain and DeFi sector by the introduction of smart contracts. This second-generation blockchain was launched in 2015. Its native crypto coin, ether (ETH) was launched through an initial coin offering (ICO) in August 2014. The entire Ethereum network is fueled by Ether (ETH).

The blueprint of the Ethereum network was first released in its whitepaper in 2013 by Ethereum Co-founder Vitalik Buterin. Since its launch, the blockchain-based software platform functions as a potential launchpad for several other crypto tokens, DeFi protocols, and numerous decentralized applications (dApps). Thus, Ethereum is regarded as the “world computer.”

The smart contracts are coded programs that execute autonomously with pre-defined conditions on Ethereum. These smart contracts are deployed and executed via the Ethereum Vending Machine (EVM).

Ethereum has successfully transitioned to Proof-of-Stake (PoS) with The Merge completed on September 15, 2022. Originally built on the energy-intensive Proof-of-Work (PoW) system, Ethereum developers began preparing for this shift in 2020. However, the PoS upgrade reduces Ethereum’s energy consumption, as validators now stake ETH instead of mining. Additionally, this transition has turned Ether from an inflationary asset into a deflationary one, with reduced new ETH supply and transaction fee burns.

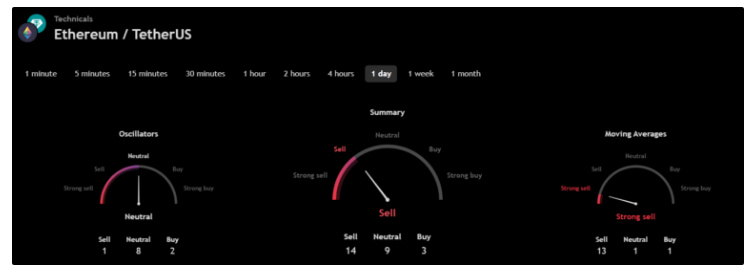

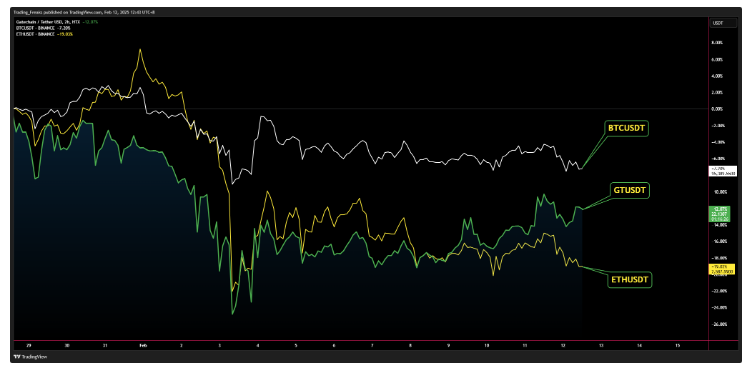

Ethereum 24H Technicals

Ethereum (ETH) Price Prediction 2025

Ethereum (ETH) ranks 2nd on CoinMarketCap in terms of its market capitalization. The overview of the Ethereum price prediction for 2025 is explained below with a daily time frame.

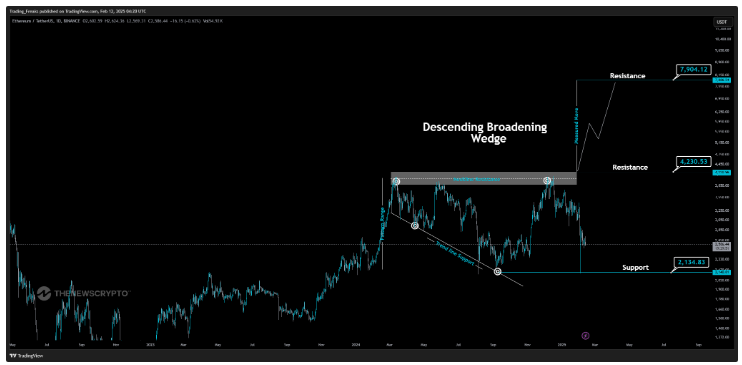

In the above chart, Ethereum (ETH) laid out a Descending Broadening Wedge, The descending broadening wedge occurs when price moves within two diverging trendlines, creating a broadening shape. This indicates increased market volatility and suggests a potential trend reversal. As price fluctuates, it forms lower highs and higher lows, signaling a shift in market sentiment.

Investors should watch for a breakout, as moving past the resistance level could signal a bullish reversal, despite the pattern’s bearish appearance. Proper timing and caution are key for capturing potential upside.

At the time of analysis, the price of Ethereum (ETH) was recorded at $2,586.44. If the pattern trend continues, then the price of ETH might reach the resistance levels of $4,230.53, and $7,904.12. If the trend reverses, then the price of ETH may fall to the support of $2,134.83.

Ethereum (ETH) Resistance and Support Levels

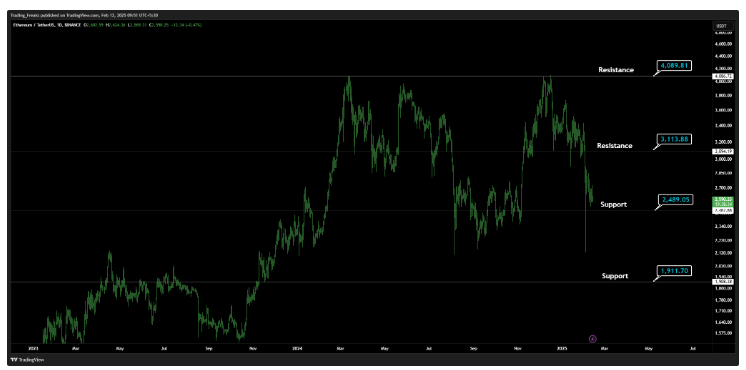

The chart given below elucidates the possible resistance and support levels of Ethereum (ETH) in 2025.

From the above chart, we can analyze and identify the following as resistance and support levels of Ethereum (ETH) for 2025.

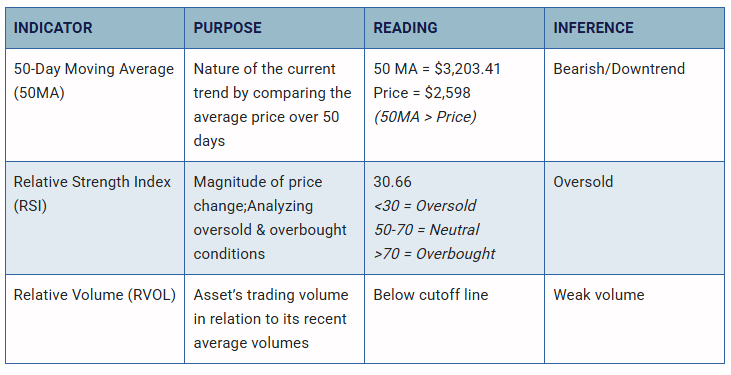

Ethereum (ETH) Price Prediction 2025 — RVOL, MA, and RSI

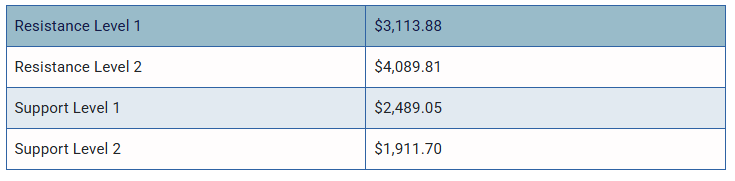

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bitcoin (ETH) are shown in the chart below.

From the readings on the chart above, we can make the following inferences regarding the current Ethereum (ETH) market in 2025.

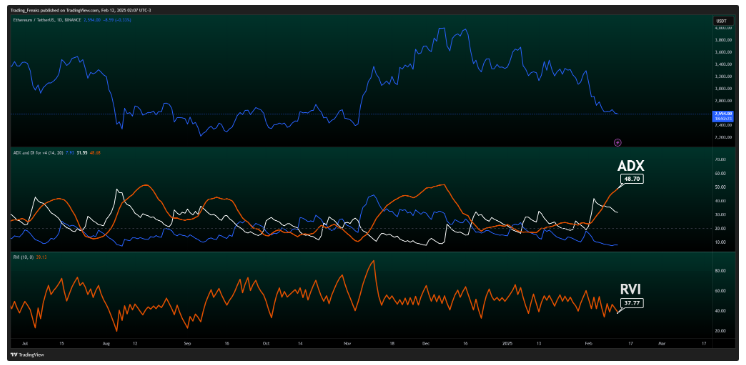

Ethereum (ETH) Price Prediction 2025 — ADX, RVI

In the below chart, we analyze the strength and volatility of Ethereum (ETH) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we can make the following inferences regarding the price momentum of Ethereum (ETH).

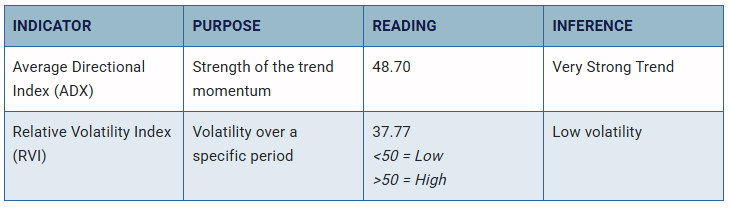

Comparison of ETH with BTC

Let us now compare the price movements of Ethereum (ETH) with that of Bitcoin (BTC), and Ethereum (ETH).

From the above chart, we can interpret that the price action of ETH is similar to that of BTC. That is, when the price of BTC increases or decreases, the price of ETH also increases or decreases respectively.

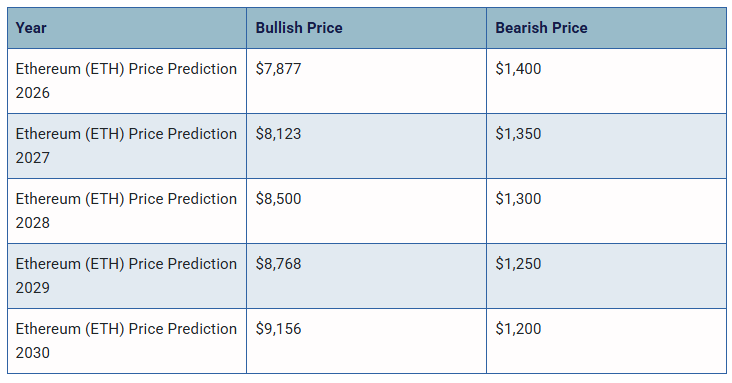

Ethereum (ETH) Price Prediction 2026, 2027 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Ethereum (ETH) between 2026, 2027, 2028, 2029, and 2030.

Conclusion

If Ethereum (ETH) establishes itself as a good investment in 2025, this year would be favorable to the cryptocurrency. In conclusion, the bullish Ethereum (ETH) price prediction for 2025 is $4,089.81. Comparatively, if unfavorable sentiment is triggered, the bearish Ethereum (ETH) price prediction for 2025 is $1,911.70.

If the market momentum and investors’ sentiment positively elevate, then Ethereum (ETH) might hit $6000. Furthermore, with future upgrades and advancements in the Ethereum ecosystem, ETH might surpass its current all-time high (ATH) of $4891.70 and mark its new ATH.

This content was originally published by our partners at The News Crypto.