U.Today - Even though the market remains bearish, the prices of some coins have returned to the green zone, according to CoinStats.

ETH/USD

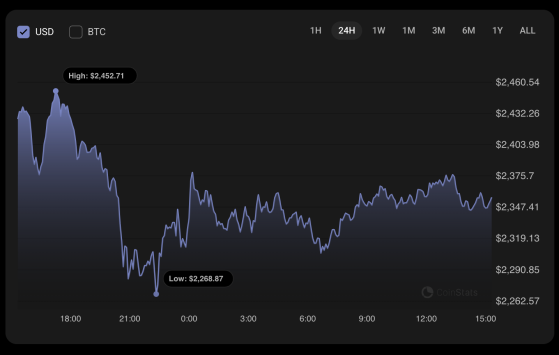

The rate of Ethereum (ETH) has declined by 3% since yesterday.

On the hourly chart, the price of ETH is closer to the resistance level of $2,378. If buyers can hold the gained initiative, there is a chance to see a breakout, followed by further growth to the $2,400 area.

On the daily time frame, the rate of the main altcoin has once again bounced off the recently formed support of $2,313.

Even if the candle closes far from that mark, bulls have not accumulated enough energy for a sharp move. In this case, sideways trading in the range of $2,350-$2,540 is the more likely scenario.

From the midterm point of view, there are no reversal signals yet. If the weekly bar closes around the current prices, traders may witness a test of the $2,000-$2,100 zone soon.

Ethereum is trading at $2,350 at press time.

This content was originally published on U.Today