At the end of June, we found using the Elliott Wave Principle (EWP) that Ethereum (ETH) was developing an almost picture-perfect Fibonacci-based impulse pattern, and:

“[A]s long as…$1838 holds, we can allow Ethereum to reach, ideally, $1945-1975...We should then look for a retrace to around $1770+/-25 before the next more significant rally takes place, which can propel ETH to as high as $2300+. Thus, even a rally to $1945+ will be followed by a…retrace and a…rally.”

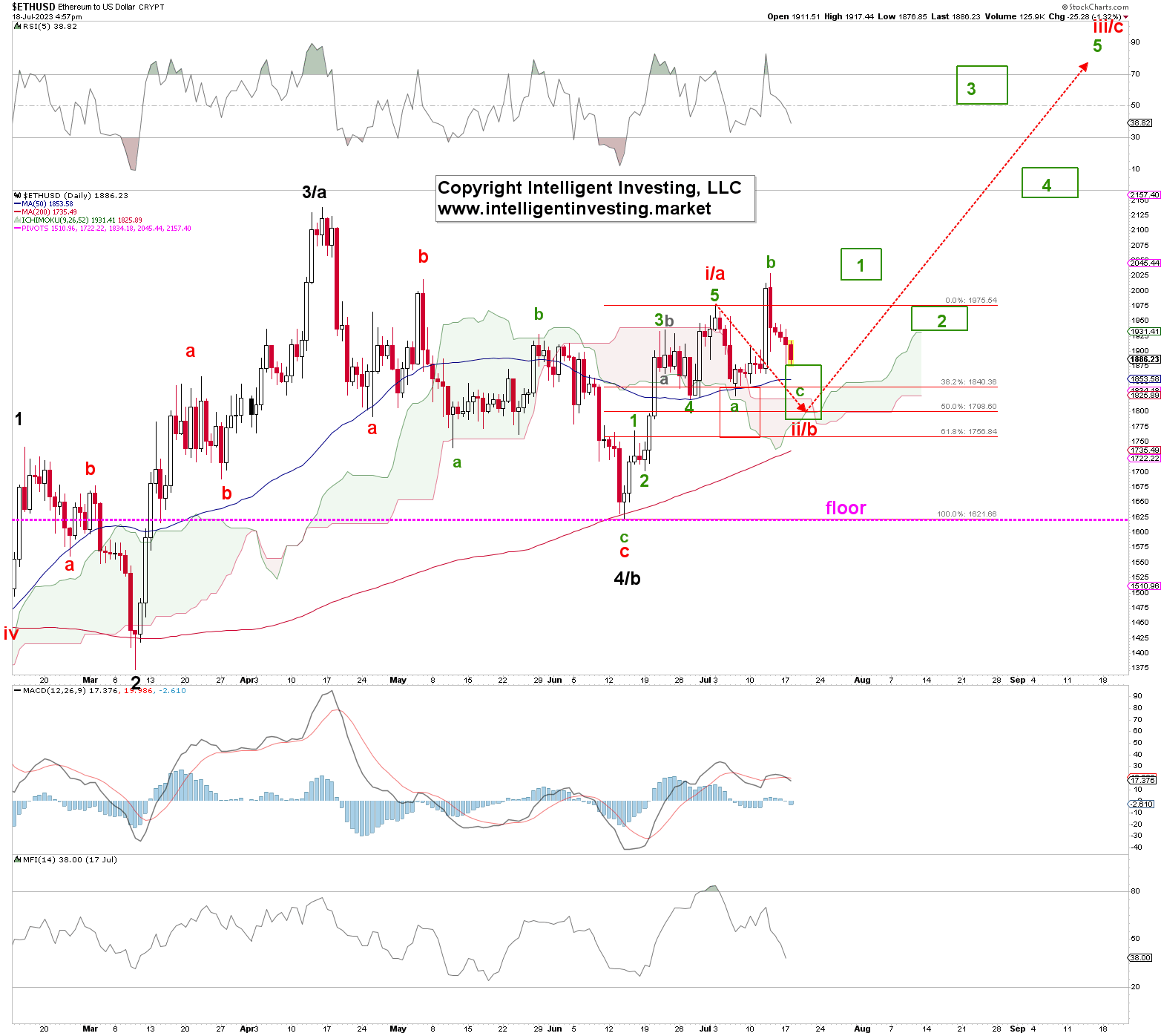

The cryptocurrency reached $1976 on July 3, dropped to $1826 on July 7, and rallied again last Thursday to as high as $2013 on to be trading today at $1880s again. See Figure 1 below. Thus, indeed, the cryptocurrency topped exactly where it had to ($1976 vs $1975) and dropped as expected. But the recent rally and subsequent drop throws a small, short-term wrench in our overall Bullish thesis. Namely, since the $1976 high, ETH has been correcting. Corrections are either a zigzag, a triangle, or a flat, so the question is “What correction is Ethereum in?”

Figure 1

ETH’s strong rally last Thursday, only to be erased a few day later, smells, per the EWP-“olfactory test” like a B-wave, as shown in Figure 1 above. This means red W-ii/b is most likely becoming an irregular flat: green W-a, -b, and -c from the red W-i/a high (see here) with an ideal target zone of $1775-1875 depending on the relationship between W-a and W-c (c=a to c=1.618x a).

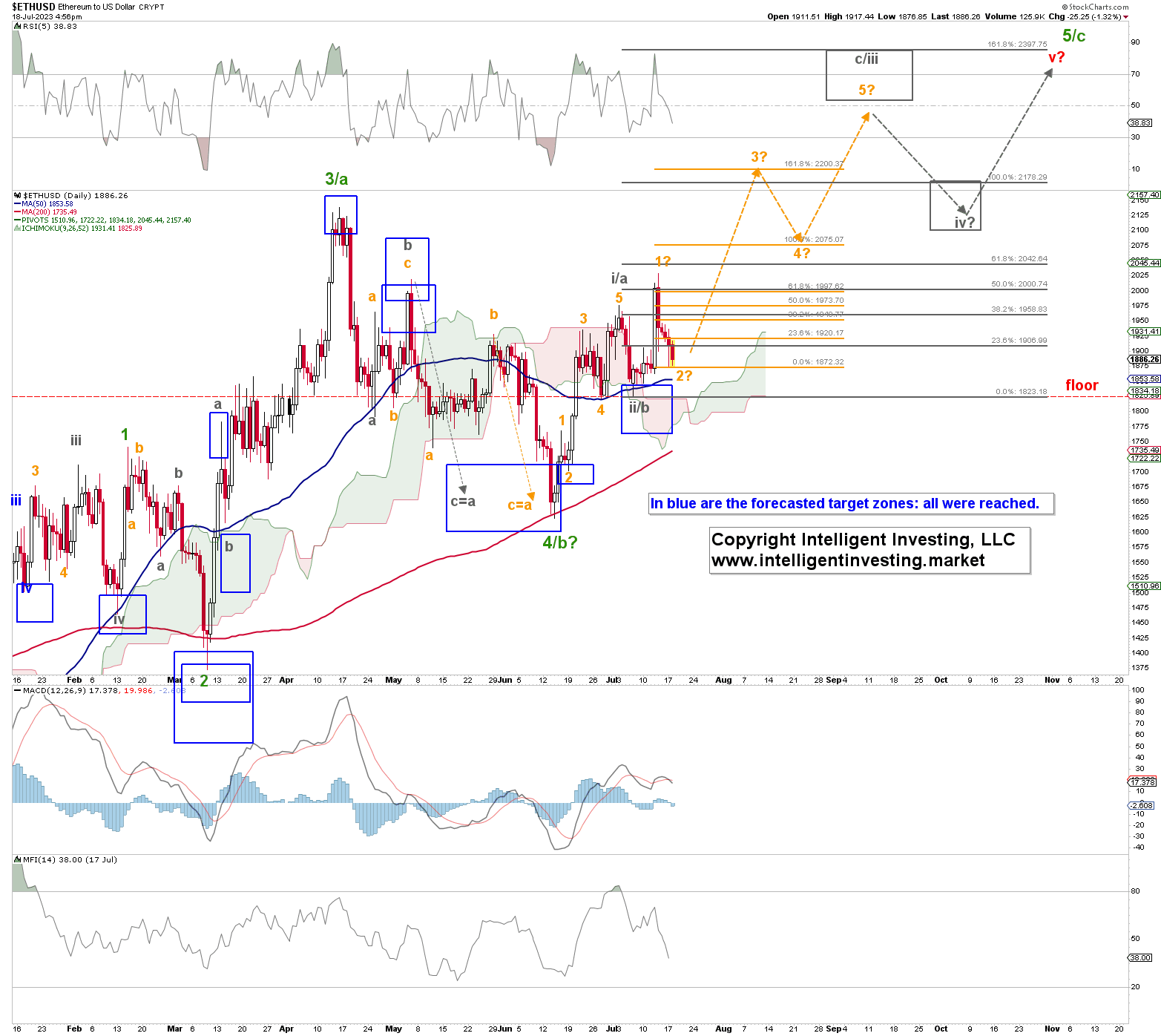

The alternative is shown in Figure 2 below, where the crypto is already in the (orange) W-1, 2 setup. But for that pattern to hold, ETH cannot move below the (red) “floor” level at $1923 and it will have to break above $2025 rather directly.

Figure 2

Regardless, thanks to the EWP, we know that even if the irregular flat targets (slightly) lower prices first, it will be followed by another impulse higher targeting >$2300, with a first pitstop at ideally around $2050-2100. Thus, for now, we can let ETH decide how it wants to fill in the short term, with a preference for the irregular flat, while we keep an eye on higher prices over the longer term.

The cryptocurrency will have to drop below the June low, with a first warning for the Bulls below $1750 to nullify our overall Bullish thesis.