The pandemic-affected global macroeconomic backdrop is highlighting aspects of sectors we have never seen before, testing their core trade models and making them rethink their commercial practices and changed business direction. From the asset-backed and collateral heavy sectors such as real estate, international transportation and clean energy to “servicified” sectors such as telecommunications and financial institutions, the year 2020 saw major changes to their operations. Against this backdrop, it is interesting to evaluate the strength and position of these sectors in Europe, to see how the world’s most advanced continent in terms of trade is weathering daunting macroeconomic externalities. In this insight paper, we take a look at six of the leading sectors: real estate, transport and logistics, telecommunications and technologies, clean energy, financial institutions, and food and agriculture. We will consider how they fared during Europe’s first wave, how they restructured their dynamics, and their crisis-resistant commercial practices and provide our perspective on the near-term outlook for each.

The real estate sector saw interest move to the logistics and warehousing reality space from the traditional office and hospitality property space. While this structural change was a result of pandemic-driven consumption patterns, we believe it marks a turning point in the property business. The transport and logistics sector saw its marine, air and land transport subsectors plateau simultaneously, but recovery stories have largely been mixed. The marine transport subsector, with its use of different types of vessels, capitalised on the unique opportunities that arose amid the peak of the pandemic in mid-2020 and are now using its global capacity effectively as international trade normalises. The air transport subsector, however, which is more passenger driven, is likely several years away from reaching pre-pandemic levels due to the changing restrictions on global travel and tourism. In Europe’s telecommunications sector, the pandemic amplified the need for rigorous customer engagement, highlighting the significance of network consolidation, digitalisation and implementing cybersecurity best practices. The clean energy sector gained prominence as the global community increasingly accepted its importance and sustainability discussions gained traction, although a number of phased construction projects were suspended.

Operations of financial institutions (FIs) were characterised by fiscal flexibility of the respective sovereigns and the quantitative easing necessitated by severe financial strain. The lending business thrived, while lenders acknowledged the need for robust cost structures amid record low interest rate regimes and thin profit spreads. Moreover, with the relaxation of bank capital requirements [riskweighted asset (RWA) base reductions], the focus on risk control is increased. The food and agriculture sector, which pioneered tech-driven agronomy practices even before the pandemic, strengthened further due to the need to reduce reliance on mass labour and shift to mechanised processes.

We focus on Europe because many of the sectors we consider in this paper originated in the region, their trade was amplified in the age of colonialism, and the region still controls their trade. Moreover, Europe has historically innovated trade practices, shaping the direction for the rest of the world. It's pioneering in trade should be carefully observed, especially in times such as the present. While it is premature to comment on the performance of all sectors amid the pandemic, analysing the effect on trade of the initial shock would help formulate an insightful and informed outlook for the near to medium term.

Detailed sector outlook

Real estate: logistics and residential emerge the winners

Europe’s real estate sector faced many challenges amid the pandemic. The hospitality subsector was affected by the travel restrictions and adverse economic conditions, and office real estate faced uncertainty due to the work-from-home (WFH) arrangement. Nevertheless, the sector generated satisfactory returns in a low interest rate market, which particularly benefitted residential real estate.

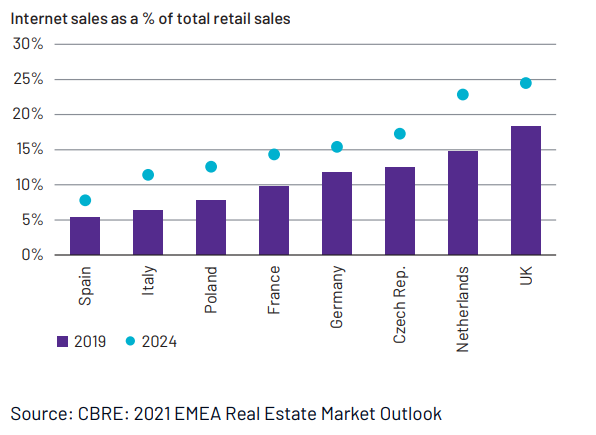

Increased dependence on e-commerce proved favourable for logistics real estate, at the expense of retail real estate.

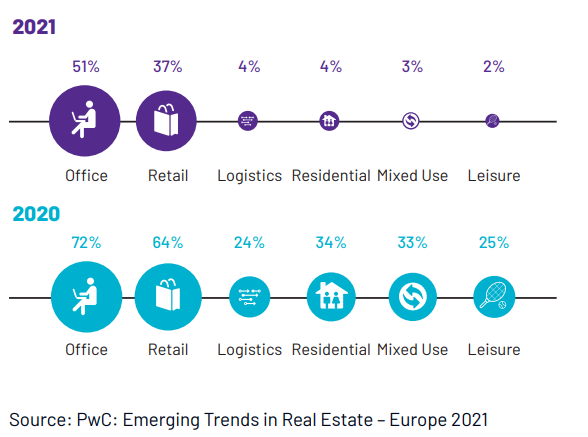

Accelerated restructuring of real estate subsectors: The pandemic has fast-tracked emerging trends in real estate, revolutionising the way in which we live and work. With constant lockdowns and social-distancing restrictions, remote working has become the norm, helping businesses worldwide operate as usual. We expect companies to look at incorporating a more hybrid work environment after the situation normalises. This would increase uncertainty of demand for office real estate, especially co-working spaces, which were unutilised amid social-distancing restrictions.

Dependence on e-commerce boosted the transition from physical to online shopping. This is likely to result in a tangible restructuring of both retail and logistics real estate, shifting demand to warehousing space from physical retail stores.