- EUR/USD back in an uptrend ahead of the Fed.

- The pair could challenge 1.12 resistance if the Fed opts for a 50 bp cut.

- Meanwhile, weakness in the US dollar is a tailwind too.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

This week’s spotlight is on central bank decisions across England, Japan, Norway, and Turkey, but the main event is the US Federal Reserve's meeting.

Markets are anticipating a significant shift as the Fed kicks off a new cycle of rate cuts, with recent expectations favoring a substantial 50 basis point reduction.

As the dollar stumbles, attention turns to how the Fed’s actions and accompanying statements will influence market dynamics.

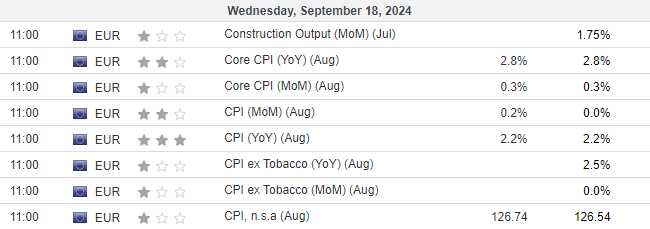

Additionally, eurozone inflation data released on Wednesday could influence the ECB's future monetary policy path. If it favors further rate cuts, it could set the stage for EUR/USD to challenge key resistance at 1.12.

Will the Fed Opt for a Larger Rate Cut?

Just last week, the consensus pointed to a 25 bps cut, but sentiment has shifted toward a potential 50 bps move.

This change in expectations has weighed on the US dollar, which has been weakening against major currencies. Investors are increasingly pricing in a larger rate cut, and the upcoming Fed meeting could confirm this shift.

Two scenarios are in play:

- A 25 bps cut would likely result in little to no impact on the US dollar, or perhaps even spark a short-term weakening.

- A 50 bps cut could negatively affect the US dollar and spark a stock market correction, depending on the accompanying tone from the Fed.

The market will also be watching for signals from Fed Chair Jerome Powell during his press conference, which could offer clues about the path of rate cuts through the end of the year.

ECB Stuck with Few Options

The European Central Bank (ECB) faces its own set of challenges, with inflation, GDP, and industrial data suggesting a very complicated path ahead.

Wednesday’s eurozone inflation figures are expected to reinforce the current outlook, leaving the ECB with little choice but to continue cutting rates.

The baseline remains a 25 bps cut, though any surprise is more likely to involve a larger reduction rather than a smaller one.

EUR/USD Poised for a Push Toward 1.12

EUR/USD has been trending upward for months, with occasional pullbacks. The most recent correction began in late August, as the pair found support near the 1.10 level.

Now, buyers are eyeing a return to the 1.1150 zone, which could pave the way for a breakout toward the key 1.12 resistance. If bulls succeed in breaking through, the next major target will be the 2023 highs near 1.13.

As central banks around the world navigate rate decisions, EUR/USD traders are watching for the next big move, with the 1.12 level in sight.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.