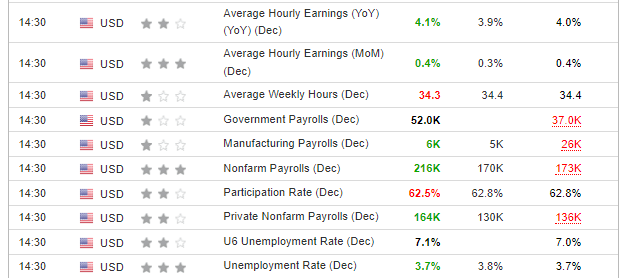

- The labor market remains strong despite downward revision in recent months.

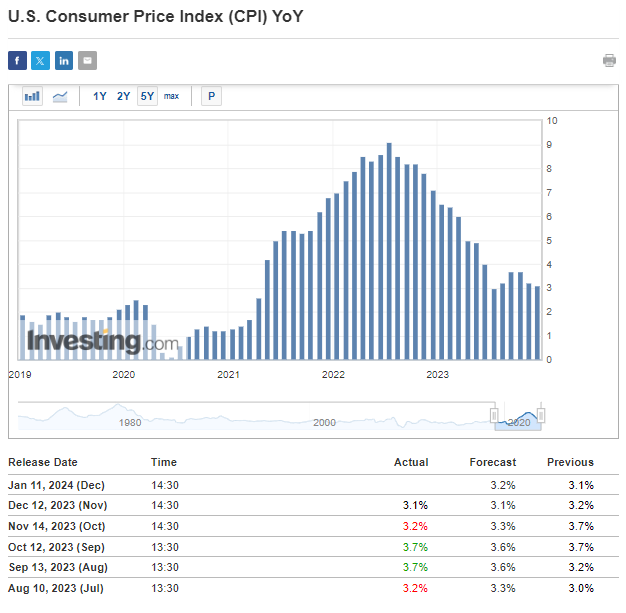

- Disinflation dynamics may decelerate post Thursday's data.

- Meanwhile, the EUR/USD pair is consolidating in an upward trend.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The beginning of the year has seen minimal changes in the overall strength of the US labor market.

Initial readings for the new year exceeded expectations for both new nonfarm payrolls and the unemployment rate.

Despite this positive outlook, recent signals from the Federal Reserve make it clear that a cycle of interest rate cuts is imminent; the only uncertainty lies in the timing of the first move.

A pivotal indicator to watch this week is the inflation data for December in the U.S. If, in line with forecasts, it will likely indicate a slowdown in disinflation, struggling to breach the 3% year-on-year barrier.

The U.S. labor market remains a source of optimism for the Federal Reserve, with the latest data, released on Friday, revealing an increase in new nonfarm payrolls to 216,000 and the unemployment rate maintaining levels below 4%.

Source: Investing.com

However, this optimistic picture is disturbed by further downward revisions of all months in the August-November period. This is because the data are coming in gradually, even with a delay of several months.

Despite this, the strength of the labor market can be considered extremely surprising for the largest monetary tightening in the US in many decades.

Optimistic data from the labor market, combined with positive readings of economic growth dynamics measured through GDP, make the so-called soft landing scenario a real possibility.

However, we are still a long way from declaring full success, although if subsequent quarters confirm this development it will be a very positive long-term signal for stock markets.

At the moment, the probability of interest rate cuts in March has fallen somewhat, however, it is still slightly above 60%.

Inflation in the US stuck above 3%

Since last July, when the y/y inflation rate reached 3%, we have seen a stabilization of the rate in the range of 3-4%.

The readings for December imply a continuation of this sideways trend, which confirms that the last stage of reaching the inflation target is the most difficult when the high base effect-based boost is no longer available.

Based on the Fed minutes, As the cycle of interest rate cuts begins, it becomes apparent that the focus is shifting away from the battle against inflation.

The primary objective now seems to be steering clear of pushing the economy into a recession.

This means that the labor market, industrial production dynamics, and GDP should become increasingly important, and depending on the next readings the pace of monetary easing will be adjusted.

EUR/USD consolidates: A pause before the next push upward?

After the release of Friday's data from the US labor market, EUR/USD failed to determine a specific direction and is stuck in a local consolidation.

A possible upside breakout will be a very important pro-growth signal indicating the possibility of initiating another demand wave.

The potential breakout aligns with the ongoing trend and is a reflection of the continued depreciation of the US dollar, driven by the diminishing possibility of the Federal Reserve initiating interest rate cuts as early as March.

Buyers' initial target lies within the supply zone around the price level of 1.12, established based on this year's highs. Conversely, a break of the local trend line is anticipated to extend the unwinding, reaching at least the vicinity of 1.0750.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.