In a changing energy landscape globally, ExxonMobil (NYSE:XOM) is showcasing its resilience with net income of $33.7 billion and historic shareholder distributions in 2024.

With strong free cash flows, the company is doubling down on high-value production, cost discipline, and aggressive expansion into carbon capture, a nascent space with potential to reset its long-term profitability.

ExxonMobil’s Earnings: Strong Profits, Big Payouts, and a Bold Bet on Carbon CaptureExxonMobil reported a good earnings performance consistent with its disciplined capital strategy and strong cash generation in tough energy climates. ExxonMobil reported 2024 net income of $33.7 billion in its latest quarterly report, driven by resilient oil and gas production, cost discipline, and greater contributions from low-carbon solutions.

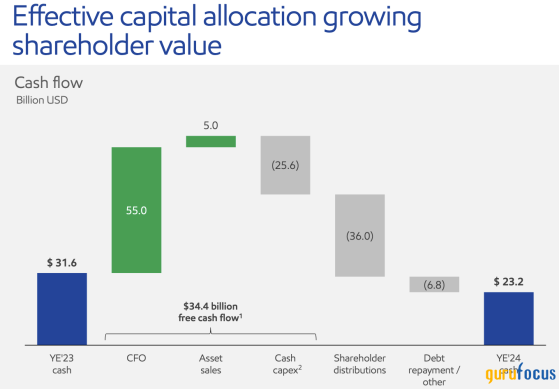

ExxonMobil free cash flow was over $55 billion, which supported ongoing aggressive dividend distributions to shareholders for $36 billion in a combination of $17.5 billion in dividend and $19.1 billion in share repurchases. Although oil prices declined from historic levels, ExxonMobil was able to maintain high operating margins for all three of its upstream, refining, and chemical businesses, thus making it more financially robust.

In 2024, ExxonMobil invested $27.6 billion in capital and exploration expenditures, in line with full-year guidance. With ongoing macroeconomic volatility, ExxonMobil’s solid balance sheet, low leverage, and capital discipline provide optionality for future growth. While still a hydrocarbon believer, strategic refocusing to energy solutions and carbon management is a broader alignment with shifting industry realities.

Record Production, and a Bold Growth PlanExxonMobil’s historic Permian Basin and Guyana production and increased high-value product sales countered market headwinds. ExxonMobil also maintained industry leadership in distributions to shareholders with a return to shareholders in dividend and share repurchases of $36.0 billionmore than all but a few S&P 500 companies. ExxonMobil’s overall cost reduction since 2019 was $12.1 billion, which allowed the company to weather inflationary pressures and stay profitable.

In the future, ExxonMobil’s growth strategy continues to focus on developing its portfolio of high-value assets, cost discipline, and capital discipline. ExxonMobil is aiming for a $20 billion earnings and $30 billion cash flow growth to 2030, fueled by its high-margin project portfolio. Growth drivers include integration with Pioneer Natural Resources (NYSE:PXD), with over $3 billion in synergies per year, and Guyana oil production ramp-up to establish the region as a preeminent global supplier.

In 2025, ExxonMobil will invest $27 billion to $29 billion in high-returning upstream projects, low-carbon alternatives, and petrochemical and specialty products growth. Of particular relevance is ExxonMobil’s $20 billion per annum share repurchase program to 2026 and 42-year dividend growth track record, which demonstrates its commitment to returning value to shareholders.

ExxonMobil’s Valuation: Is the Market Pricing in CCS Growth?XOM appears reasonably valued relative to its estimated GF Value of $99.03, against a price of $105.44. This suggests that the stock is trading modestly in excess of estimated intrinsic value, suggesting investor enthusiasm for its future profitability and capital discipline. Its price to earnings ratio (PE) of 13.45 and forward PE ratio of 14.29 reflect modest valuations relative to history and to industry levels, although a Shiller PE ratio of 19.22 reflects a more pricey valuation relative to past cycles.

ExxonMobil’s EV-to-EBITDA ratio of 6.59 reflects that the company is reasonably valued relative to earnings potential, while its EV-to-FCF ratio of 15.73 reflects that shareholders are willing to pay a premium for free cash flow generation. Although these are opposing measures of value, the company’s high return on invested capital (ROIC) of 8.46% and high free cash flow yield of 6.76% reflect that it is able to create shareholder value.

From a balance sheet perspective, ExxonMobil has a sound balance sheet with a low 0.16 debt-to-equity ratio and adequate interest coverage of 39.81x, with low solvency issues. Its estimated free cash flow valuation of $136.14 and Peter Lynch value of $194.75 reflect substantial upside potential should Exxon be able to continue generating cash and capital efficiency.

Of concern, however, is a negative net current asset value (-$22.46) that reflects short-term liquidity rigidity. While fair value models like the Graham Number ($103.04) and Median PS Value ($98.58) agree with fair valuation, recent declines in shares from 2023 highs reflect that the market is pricing in future volatility.

Unless oil prices remain favorable and Exxon is able to continue delivering on capital efficiency and shareholder return, however, shares may not be able to hold a premium and instead have limited upside potential unless macroeconomic conditions improve.

TakeawayExxonMobil’s ability to adapt while staying true to its core strengths positions it well for the future. The company’s disciplined capital allocation, aggressive cost-cutting, and continued investment in high-margin assets signal confidence in its long-term growth trajectory.

Beyond traditional oil and gas, ExxonMobil’s push into carbon capture and low-carbon solutions reflects a forward-thinking approach that could unlock new revenue streams in a rapidly evolving energy landscape. While market volatility and regulatory uncertainties remain, ExxonMobil’s strategic pivots suggest it is not just weathering industry shiftsbut actively shaping them.

This content was originally published on Gurufocus.com