Energy shock seen hitting Asia the most, followed by Europe and US: MS

There’s an old, stock market adage familiar to most investors: “Sell in May and Go Away.” The idea behind the strategy—if one can call it that—is that from November to May equity markets are seasonally stronger than from May to November.

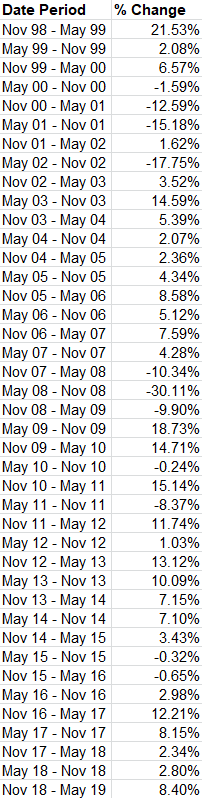

The problem, however, with many old maxims is that there's a tendency for them to be taken as gospel, without any fact checking to test if they're true. Given that May has started, we've decided to look at the S&P 500's performance for the past 20 years over the periods mentioned above, to figure out if it's actually worth selling in May and going away?

The hard data tells a pretty clear story.

Over of the past two decades, the S&P’s performance from November to May has been better than during the following six months, from May to November, 75% of the time, or 15 out of 20 times.

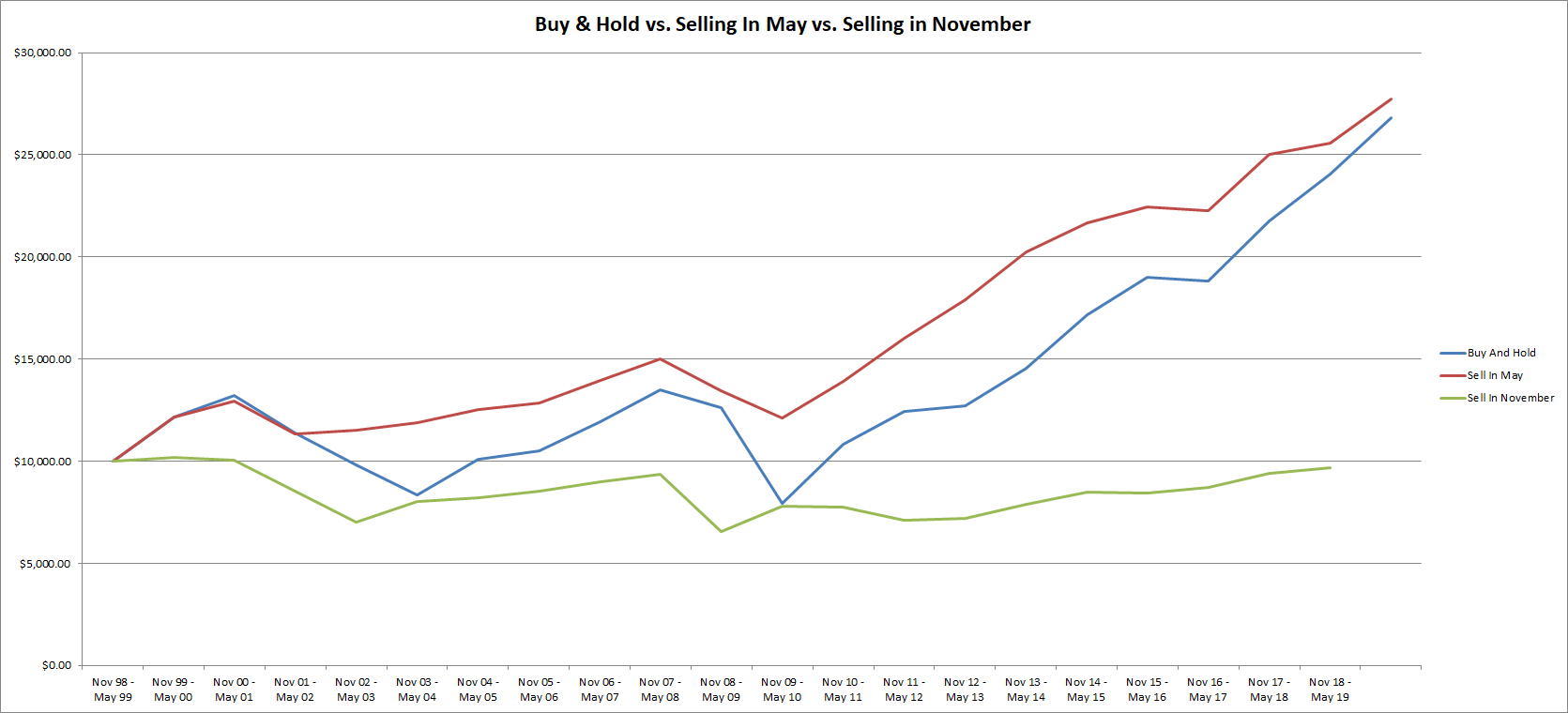

But these numbers alone don't tell the full story. Had one invested $10,000 in the S&P during November 1998, and left it untouched, it would have grown to $26,812 today, a gain of +168%—a 4.69% annualized return. That may seem low, but remember that almost exactly 20 years ago markets were on the verge of the bursting of the dot.com bubble. Thus, returns were negatively impacted by the chosen timeframe.

Had you sold in May and gone away every year since 1998, the same $10,000 would now amount to $27,735, +177%, or 4.98% annualized return. Conversely, selling in May and going away, then buying back in November would have netted an extra 3.45% over the same 20 years. However, taking into account transaction costs and capital gains taxes this strategy would have had a worse return than buying and holding—even if the performance from November to May was indeed better on average than the S&P’s performance from May to November.

Finally, for the sake of curiosity, what if one went contrarian and decided to sell in November and go away? Would returns possibly be even better? The answer is a resounding no.

Investing $10,000 from May to November over the past 20 years would have resulted in just $9,667, a negative return of 3.33%, and that's before the additional costs are factored in. Clearly, the simplest of all strategies, buying and holding is the best choice, which makes a certain kind of sense. It's often true, after all, that the less tinkering done, the better the result.