In this Fantom (FTM) price prediction for 2023, 2024-2030, we will analyze the price patterns of FTM by using accurate trader-friendly technical analysis indicators and predict the future movement of the cryptocurrency.

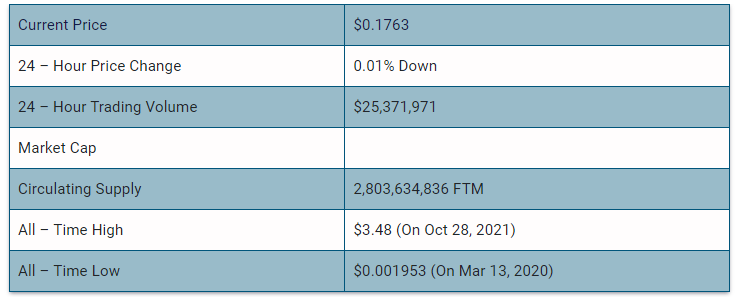

Fantom (FTM) Current Market Status

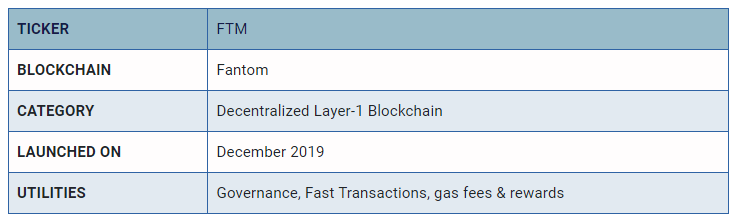

What is Fantom (FTM)

Fantom (FTM) is the native cryptocurrency of the Fantom blockchain. It exists both as an ERC-20 token and a BEP-20 token confirming that it is compatible with both Ethereum and Binance Smart Chain (BSC) blockchains.

Fantom is a layer-1 EVM-compatible smart contract-based blockchain that was launched in 2019. The blockchain operates on a specialized proof-of-stake (PoS) consensus protocol called Lachesis. Lachesis is an asynchronous Byzantine Fault Tolerant (aBFT) PoS protocol that is based on a directed acyclic graph (DAG) algorithm.

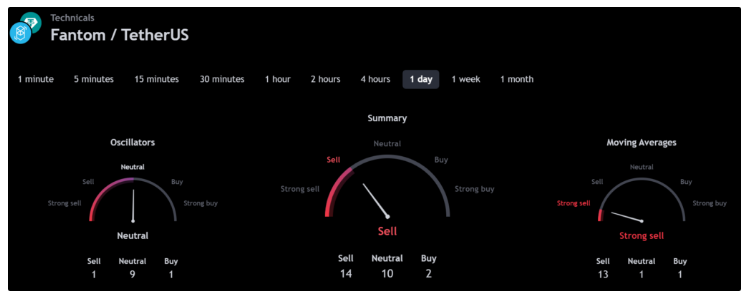

Fantom 24H Technicals

(Source: TradingView)

Fantom (FTM) Price Prediction 2023

Fantom (FTM) ranks 63rd on CoinMarketCap in terms of its market capitalization. The overview of the Fantom price prediction for 2023 is explained below with a daily time frame.

FTM/USDT Falling Wedge Pattern (Source: TradingView)

In the above chart, Fantom (FTM) laid out a falling wedge pattern. The falling wedge is a bullish pattern. Together with the rising wedge formation, these two create a powerful pattern that signals a change in the trend direction. The falling wedge pattern occurs when the asset’s price is moving in an overall bullish trend before the price action corrects lower. Within this pullback, two converging trendlines are drawn. One of the main features of the falling wedge pattern is the volume, which decreases as the channel converges.

The most commonly falling wedge pattern occurs in a clean uptrend. The price action trades higher, however, the buyers lose the momentum at one point and the bears take temporary control over the price action.

At the time of analysis, the price of Fantom (FTM) was recorded at $0.1763. If the pattern trend continues, then the price of FTM might reach the resistance levels of $0.1889, and $0.2101. If the trend reverses, then the price of FTM may fall to the support of $0.1747.

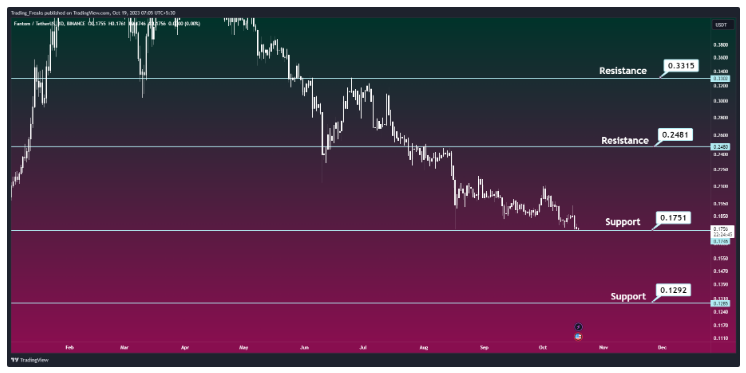

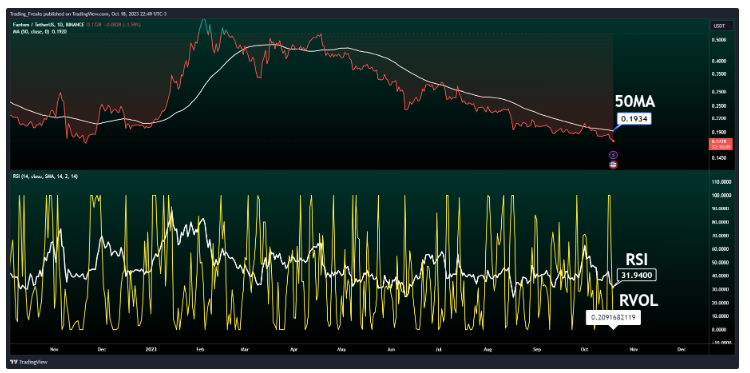

Fantom (FTM) Resistance and Support Levels

The chart given below elucidates the possible resistance and support levels of Fantom (FTM) in 2023.

FTM/USDT Resistance and Support Levels (Source: TradingView)

From the above chart, we can analyze and identify the following as resistance and support levels of Fantom (FTM) for 2023.

FTM Resistance & Support Levels

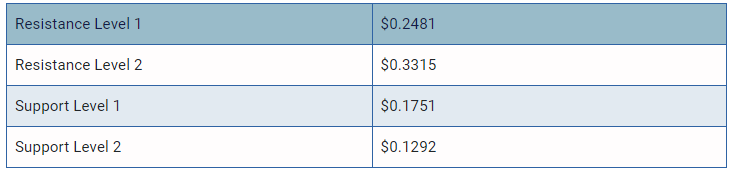

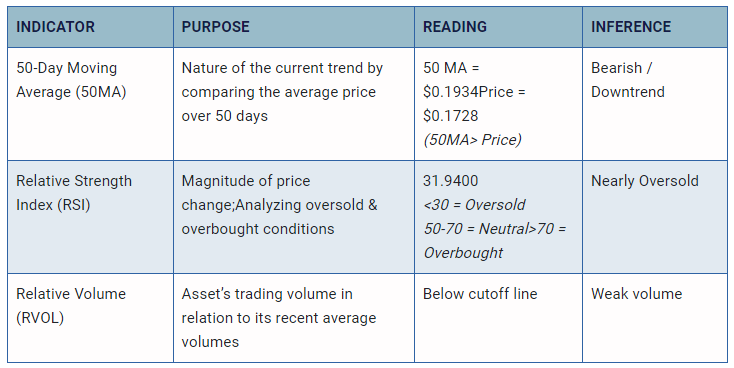

Fantom (FTM) Price Prediction 2023 — RVOL, MA, and RSI

The technical analysis indicators such as Relative Volume (RVOL), Moving Average (MA), and Relative Strength Index (RSI) of Bitcoin (FTM) are shown in the chart below.

FTM/USDT RVOL, MA, RSI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the current Fantom (FTM) market in 2023.

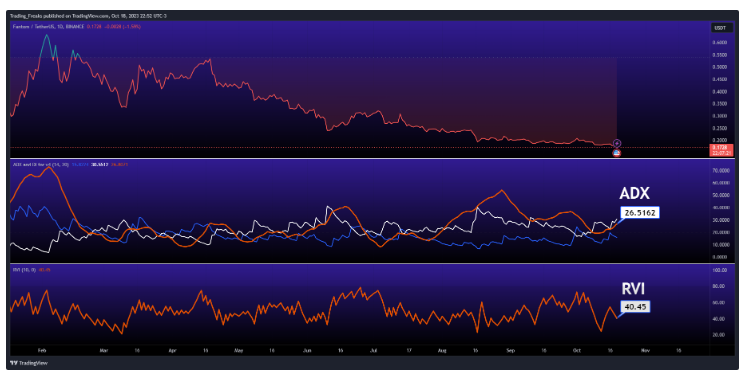

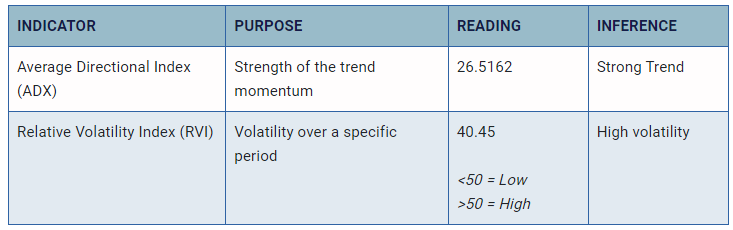

Fantom (FTM) Price Prediction 2023 — ADX, RVI

In the below chart, we analyze the strength and volatility of Fantom (FTM) using the following technical analysis indicators — Average Directional Index (ADX) and Relative Volatility Index (RVI).

FTM/USDT ADX, RVI (Source: TradingView)

From the readings on the chart above, we can make the following inferences regarding the price momentum of Fantom (FTM).

Comparison of FTM with BTC, ETH

Let us now compare the price movements of Fantom (FTM) with that of Bitcoin (BTC), and Ethereum (ETH).

BTC Vs ETH Vs FTM Price Comparison (Source: TradingView)

From the above chart, we can interpret that the price action of FTM is similar to that of BTC and ETH. That is, when the price of BTC and ETH increases or decreases, the price of FTM also increases or decreases respectively.

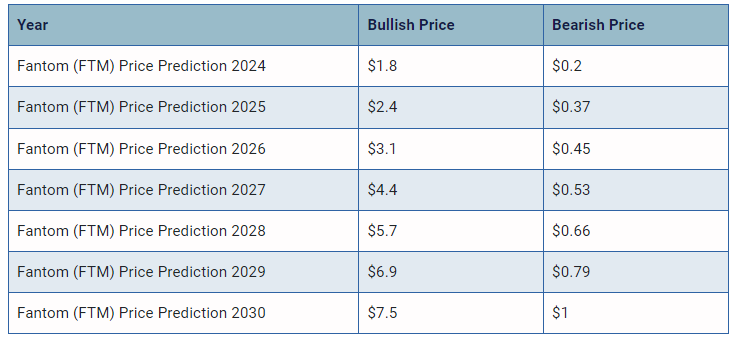

Fantom (FTM) Price Prediction 2024, 2025 – 2030

With the help of the aforementioned technical analysis indicators and trend patterns, let us predict the price of Fantom (FTM) between 2024, 2025, 2026, 2027, 2028, 2029, and 2030.

Conclusion

If Fantom (FTM) establishes itself as a good investment in 2023, this year would be favorable to the cryptocurrency. In conclusion, the bullish Fantom (FTM) price prediction for 2023 is $0.3315. Comparatively, if unfavorable sentiment is triggered, the bearish Fantom (FTM) price prediction for 2023 is $0.1292.

If the market momentum and investors’ sentiment positively elevates, then Fantom (FTM) might hit $1. Furthermore, with future upgrades and advancements in the Fantom ecosystem, FTM might surpass its current all-time high (ATH) of $3.48. and mark its new ATH.

This content was originally published by our partners at The News Crypto.