Imagine you are about to pause a hiking cycle, and in the run-up to the event, you have stock markets pushing higher and animal spirits running loose: what do you do?

You still deliver the pause you promised, but you sound as hawkish as you can - in other words: jawboning.

Powell’s press conference and the Dot Plot (the most overhyped and useless Fed tool, more on this later) were designed as hawkish as possible to try and deter a melt-up bid in S&P 500 in response to the actual pause.

Cutting through the noise, the reality is that the Fed is pausing as they are more confident in a soft landing and don’t want to run the risk of overtightening and be blamed for causing an avoidable recession.

It reminds me of late 2006: pause, dream of a soft landing in 2007, recession in 2008.

History doesn’t repeat, but it often rhymes.

The Summary of Economic Projections (SEP) says a lot about the Fed’s high confidence in a soft landing:

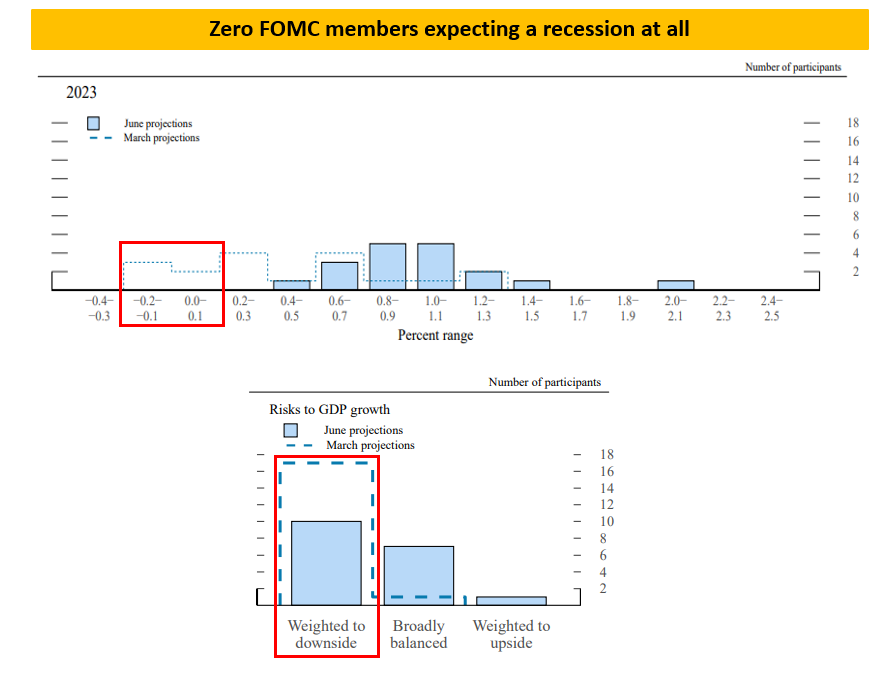

Contrary to March (red boxes), there are now a whopping zero FOMC members expecting a recession in 2023 (and 2024 too).

Also, fewer and fewer FOMC members see downside risks to their 1% GDP growth projection this year.

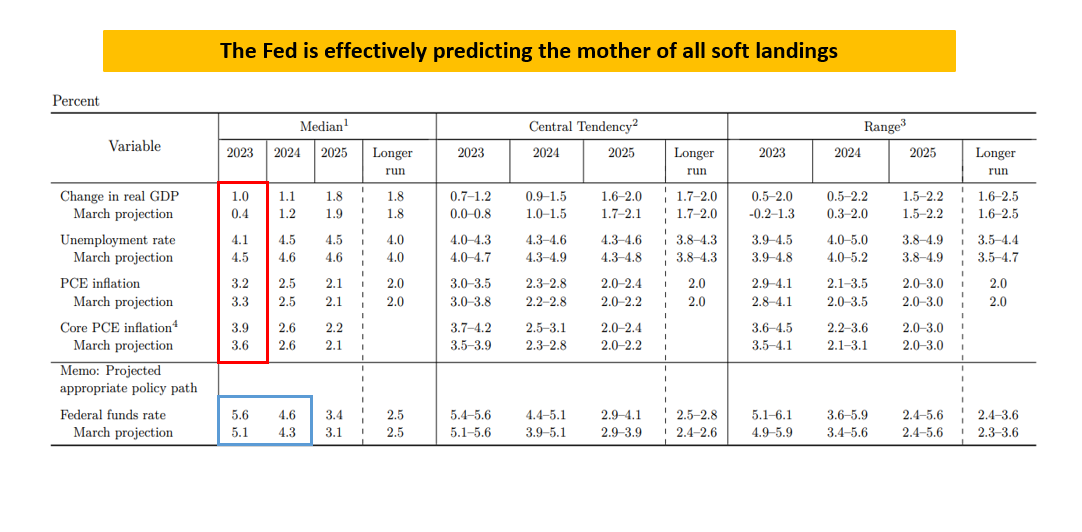

Not only the base case for GDP growth has been revised higher, but also the unemployment rate is expected to remain lower while core inflation will trend down but more slowly.

The two additional hikes in 2023 (blue box) are there as a posturing exercise: we think the economy is doing ok, and the labor market is still tight, and while inflation is moving in the right direction, we feel confident we can nudge rates a bit higher if needed to be – after all, the economy can handle it in case, right?

I think the Fed would highly prefer not to find out.

If you’d told Powell a year ago that jacking up rates to 5% and doing $95 billion/month in QT would have resulted in below-trend growth (no recession yet) and inflation convincingly moving towards the 3% area, he would have jumped out of joy.

At this point, you don’t want to risk ruining this apparent soft landing miracle.

Under the surface, though, overlooked but crucial corners of the markets are calling the Fed bluff…

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds - check out which subscription tier suits you the most using this link.