It was a strange day; it started strong, was weak mid-day, and snapped back in the final hour.

On top of that, strange things are happening underneath the surface that have marked the tops of the past, such as rising implied correlations, implied volatility, and rising prices.

This could be a function of a very big week coming, which features mega-cap tech earnings, the Fed, the quarterly refunding announcement, and the jobs report.

Or is the market just wearing itself out as it nears the end of the road?

Generally speaking, when implied volatility starts to rise with price, it is a sign of a market reaching an exhaustion level, and that could very well be the case.

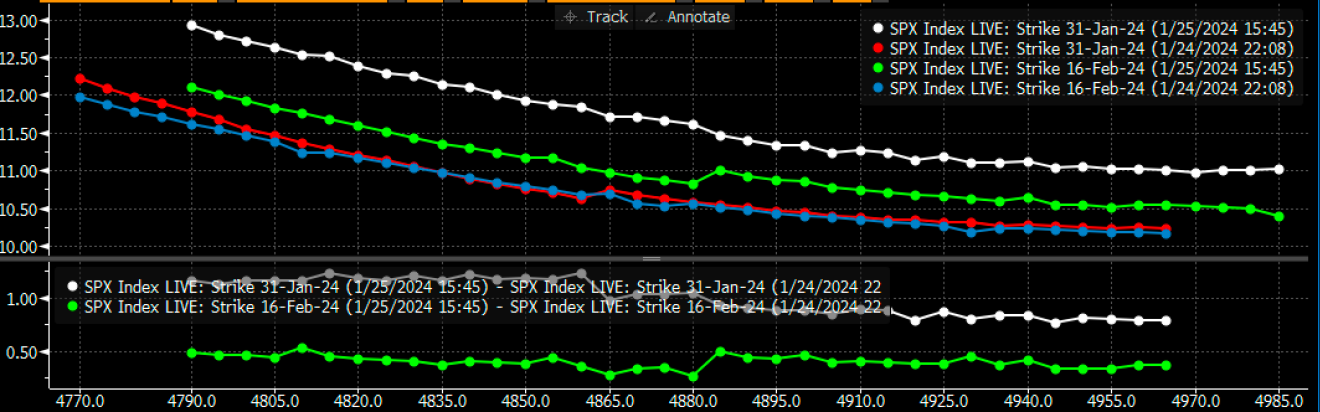

To see if the IV increase was due to nervousness heading into next week or something else, I compared the IV for the January 31 OPEX and the February 16 OPEX.

I found that yesterday, the implied volatility for both dates was about the same, marked by the red and blue lines.

yesterday, the white line, the January 31 OPEX, and the green line for February 16 OPEX were noticeably higher than yesterday’s value.

Additionally, the skew of the IV was rising to the left and falling to the right, suggesting that the IV for lower prices is rising faster than for rising prices but that overall, the IV was up across strike prices.

So, the rise in the IV is not solely based on event risk.

Source: Bloomberg

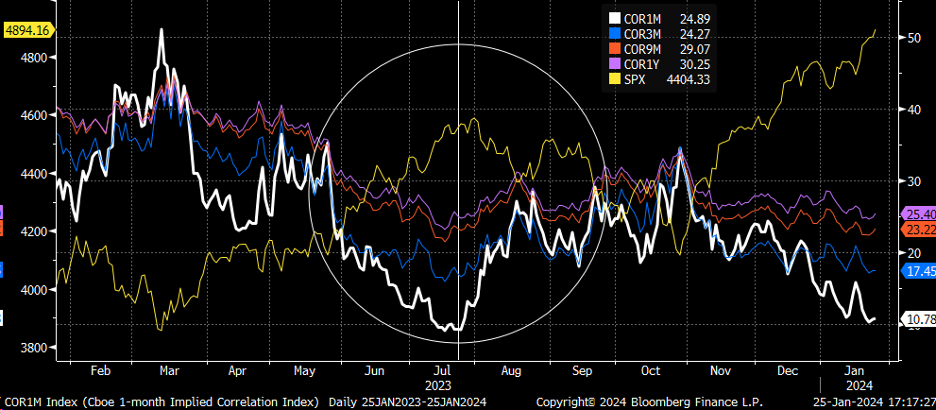

Additionally, the implied correlation index for 1,3,9, and 12 months was higher yesterday.

I will note that in July, these indexes also started rising a few days before the peak in the S&P 500 a couple of days later. While one or two up days isn’t a trend, it must be closely monitored.

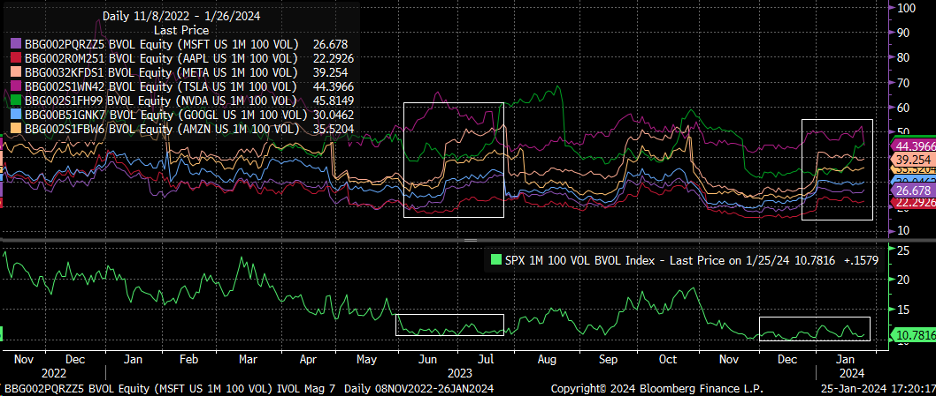

Additionally, in July, a similar thing happened with the IV of the MAG7, with IVs rising well before earnings, and then after earnings, the IV dropped quickly, like Tesla (NASDAQ:TSLA) did yesterday.

This IV drop in the individual stocks kills the dispersion trade because, to short vol in the S&P 500, there needs to be a long vol hedge, which is the stocks in the index. So, if the IV drops following earnings, the trade doesn’t work.

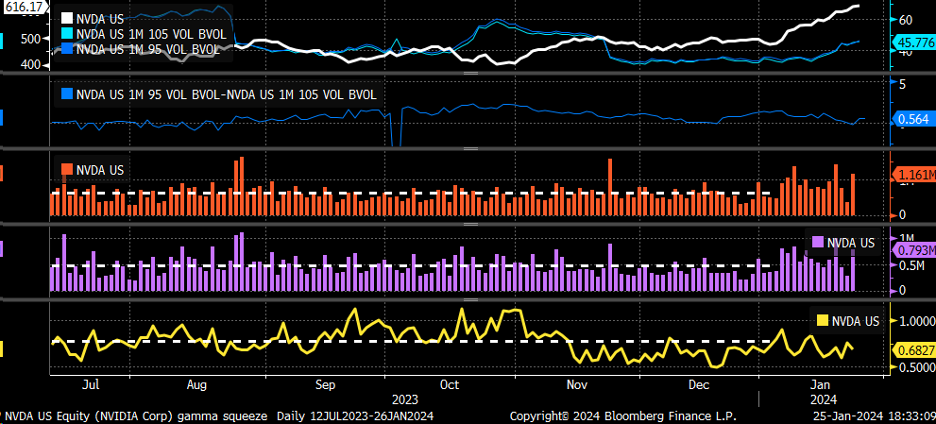

Meanwhile, the same movie is repeated daily, with Nvidia (NASDAQ:NVDA) helping keep the entire S&P 500 afloat with a daily gamma squeeze, as noted by rising implied volatility and call volumes.