This will certainly be an interesting week, especially with the Federal Reserve meeting scheduled for Wednesday. I anticipate that Jay Powell will raise interest rates on Wednesday, indicating that more rate hikes are on the horizon.

The silence from the Fed over the past week has been quite noticeable, with no significant commentary following the release of the higher core CPI data, even from sources such as The Wall Street Journal. While the Fed is in a blackout period leading up to the meeting on Wednesday, there is usually some media speculation about its next move, but there has been next to nothing this week.

This lack of communication leads to questions about the Fed’s likely action. However, by analyzing the commentary from Fed officials over the past year, it seems reasonable to assume that the Fed will continue raising rates, as the banking issues are likely, not new. For months, the Fed must have known that banks were sitting on significant losses in their held-to-maturity assets; in retrospect, this should have been apparent.

Anyone who bought a 10-year note at 1.5% is now losing money if marked to market. Investors who should have known the potential risks were not, as evidenced by the 25% increase in the KBW Bank Index from the October lows to the February high.

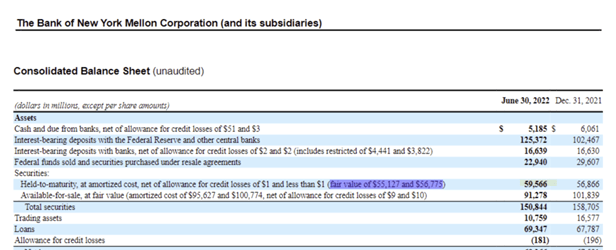

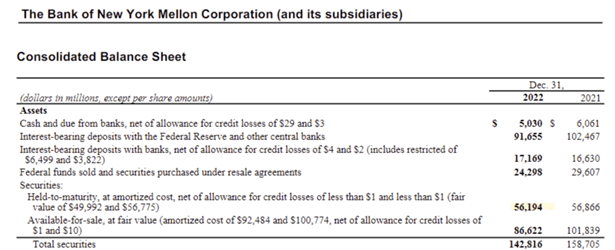

Even by the end of the second quarter of 2022, banks such as Bank of New York Mellon (NYSE:BK) experienced losses on their held-to-maturity and available-for-sale assets. During that period, the Fed raised rates at 75 basis point increments. These losses grew larger after the fourth quarter, and the Fed continued raising rates in February.

The Fed is faced with the choice of either not raising rates or continuing to press ahead. If the Fed stays true to its statements over the past year, then these challenges were to be expected. After all, Jay Powell informed us at Jackson Hole that there would be some pain and that this was the cost of reducing inflation. If the Fed genuinely believes that price stability is necessary for financial stability, it must continue to raise rates. Otherwise, its past statements and guidance will lose credibility, and the markets may never trust this Fed again.

With the new Bank Term Lending Facility, it seems that any bank needing funds can access the facility, take a loan based on the par value of its bonds, and shore up its balance sheet. This should mean that even if the Fed continues to raise rates, all banks should be able to weather the storm.

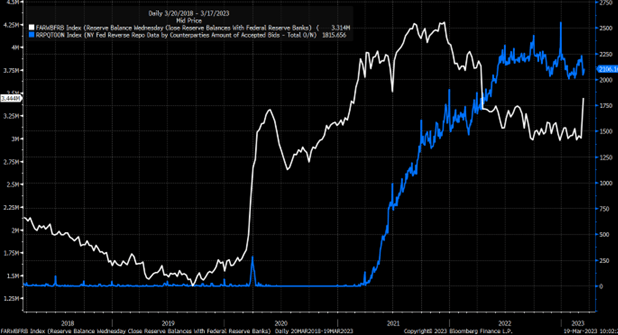

There is also $2 trillion per day entering the Reverse Repo facility. If that money were redirected, bank reserves would increase significantly, providing even more liquidity for banks. However, the Reverse Repo facility is being utilized daily, resulting in reserves remaining at the lower end of the range.

S&P 500

Meanwhile, the S&P 500 finished lower on Friday, with the March options expiration now complete. This development should free the major indexes and enable them to trade more freely.

The S&P 500 appears to have formed a bear flag over the last few trading sessions, and if this is the case, we can expect the futures and cash index to test the 3,800 support level again this week. A rally to the upper end of the channel would allow the S&P 500 to approach 4,040. However, I do not think that is the likely path.

Dow Jones Industrial Average

The Dow Jones Industrial Average also appears rather weak and is likely to revisit its October lows, having completed a diamond reversal top a couple of weeks ago. Some support has been observed around the 32,000 area on the chart, but a decline below 31,400 could pave the way for a drop back to 30,000.

Goldman Sachs

It is still unclear to me why Goldman Sachs (NYSE:GS) rallied as much as it did in October, but that surge seems to have run its course. Now, the stock is giving back those gains, with the next major level of support at $286.

Honeywell

A similar situation can be observed in other parts of the DJIA, such as Honeywell (NASDAQ:HON). This stock experienced a significant rally off the October lows, but now those gains are being wiped out. Support levels for Honeywell are at $182 and then $174.

UnitedHealth

UnitedHealth (NYSE:UNH), another major Dow component, experienced a significant upward move and has been consolidating for months since. The stock has fallen below its long-term uptrend and is now trading at the lower end of the channel.

A break of the trading channel would be a negative signal and could set the stage for a decline to fill the gap at $404.