- The Federal Reserve is all but certain to leave rates unchanged at its January FOMC meeting.

- Fed Chair Powell could strike a more hawkish tone than expected in the post-meeting press conference.

- As such, investors should brace for sharp swings in the aftermath of the Fed’s policy announcement and Powell commentary.

- Navigate this earnings season at a glance with ProTips - now on sale for up to 50% off!

The Federal Reserve will announce its policy decision at its first meeting of the year on Wednesday. No action by the central bank is seen as the most likely outcome, as investors believe the Fed is all done tightening.

However, commentary from Fed Chair Jerome Powell could help sway market sentiment as monetary policy adjustments hang in the balance.

As such, there will be a lot on the line when the U.S. central bank announces its latest rate decision at 2:00PM ET on Wednesday.

What To Expect: Hawkish Pause

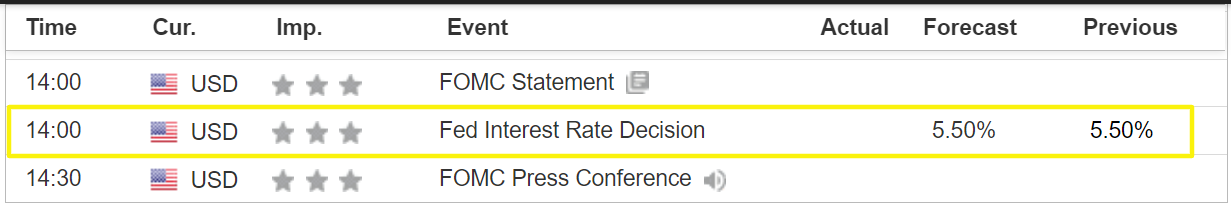

The Fed is widely expected to keep interest rates unchanged at the conclusion of its FOMC policy meeting, as officials continue to assess signs of a resilient economy and slowing inflation. That would leave the benchmark Fed funds target range between 5.25% and 5.50%, where it has been since July.

Source: Investing.com

Fed Chair Jerome Powell will hold what will be a closely watched press conference half an hour after the conclusion of the FOMC meeting at 2:30PM ET, as investors look for fresh clues on when the Fed might start cutting rates.

After raising borrowing costs by 525 basis points since March 2022, many market participants are growing more confident that the Fed’s policy tightening campaign is all but over and that rate cuts are now on the horizon.

With that being said, investor bets are still mixed on when the first Fed rate cut might happen.

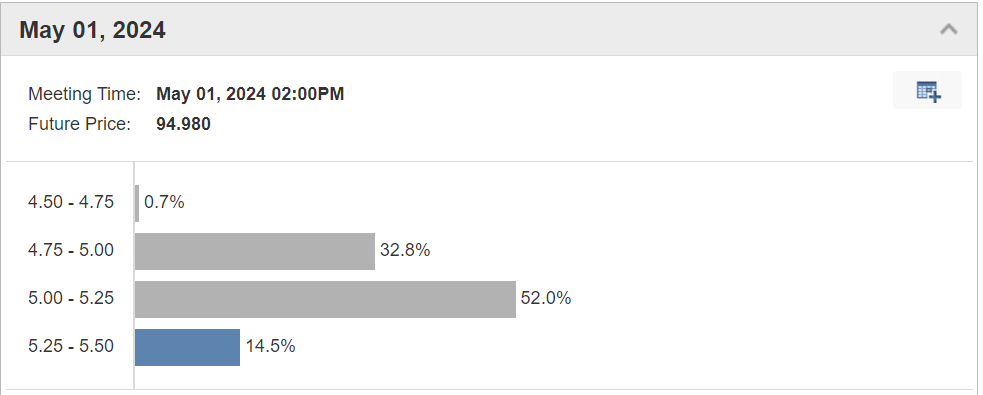

For a while, financial markets were betting that the U.S. central bank will start lowering rates in March. But more recently, those bets have been pushed back to May following a recent batch of upbeat economic data.

As of Wednesday morning, financial markets see about a 55% chance of the Fed leaving rates at current levels in March, compared to a 45% probability of 0.25% rate cut.

Looking out to May, investors believe there is a roughly 85% chance rates are lower by the end of that meeting, as per the Investing.com Fed Rate Monitor Tool, down from around 100% just a few weeks ago.

Source: Investing.com

At the previous Fed meeting in late December 2023, Powell acknowledged that more rate hikes are unlikely and the time for rate cuts is drawing closer.

In addition, new dot-plot forecasts showed three quarter-point rate cuts in 2024, assuming that economic growth slows considerably during the year and inflation takes another leg lower.

But since the last FOMC meeting, U.S. economic data and comments by several Fed officials have not supported that view.

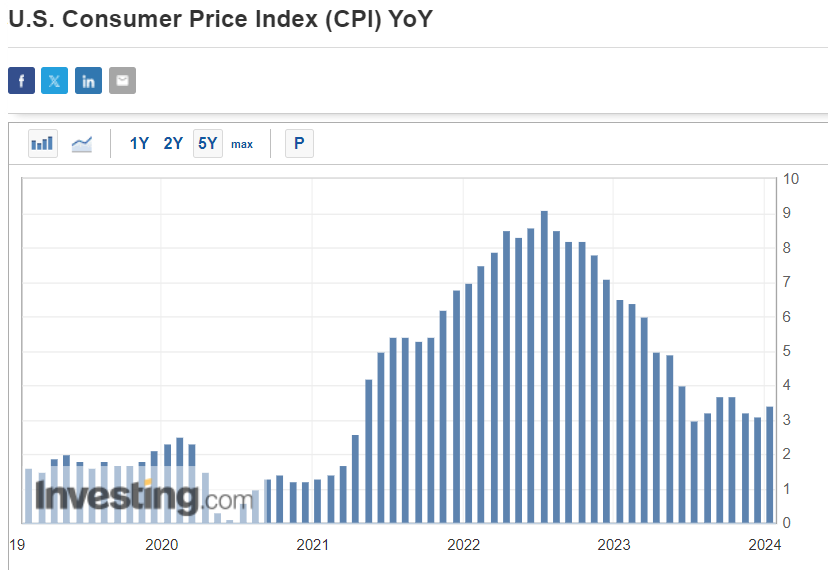

Indeed, consumer price inflation (CPI) rose 3.4% from a year ago in December, accelerating from 3.1% in November. Excluding the more volatile food and energy items, core prices rose 3.9%, faster than the 3.8% rate most economists projected.

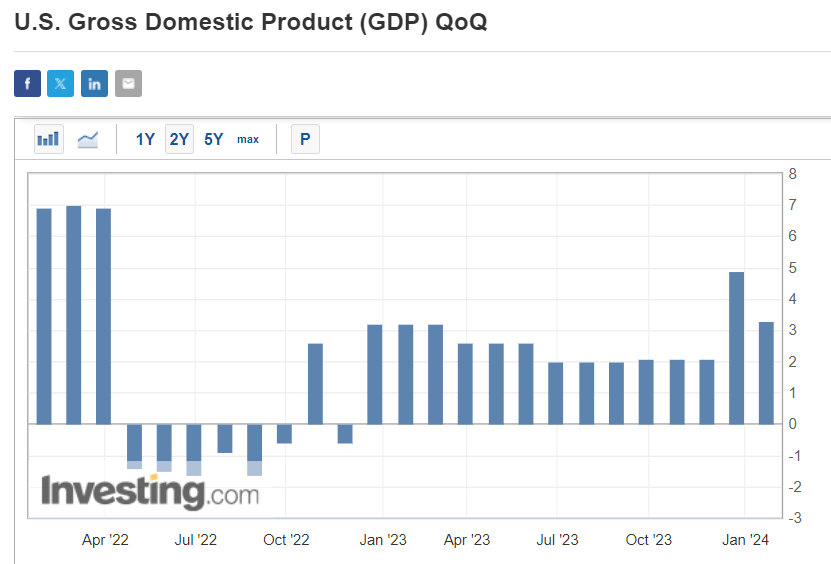

Furthermore, the economy continues to hold up much better than expected in the face of higher rates, with GDP rising 3.3% in the fourth quarter, trouncing estimates for growth of 2.0%.

Despite widespread forecasts of a potential U.S. recession, the economy has proven considerably more resilient than anticipated amid a strong labor market and robust consumer spending.

Prediction: Powell to Signal The Fed In No Rush to Cut Rates

While the Fed is all but certain to leave rates unchanged, I believe there is a substantial risk that Powell could strike a more hawkish tone than expected in his post-meeting news conference given that the economy continues to grow at a robust pace.

In addition, while inflation is cooling, it is not slowing fast enough to allow the Fed to declare mission accomplished and pivot to a dovish policy stance.

As such, Powell is likely to push back against market expectations for an imminent rate cut and reiterate that policymakers will remain dependent on incoming economic data in determining their next move.

Additionally, watch Powell to stress that he only sees cuts happening when the Fed is confident inflation is sustainably moving back to its 2% goal.

I am of the opinion that the Fed will be on hold for at least the first half of 2024 and a rate cut would likely only come in September as the economy holds up better than expected, the labor market remains strong, and inflation takes longer to return to the Fed's 2% target than many had hoped.

That being the case, the U.S. central bank could keep policy rates higher for longer than markets currently anticipate.

Any indications or shifts in the Fed's tone during the meeting could trigger significant market movements and investor sentiments. Taking that into consideration, market participants are advised to remain vigilant, exercise caution, and diversify portfolios to hedge against potential market fluctuations.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.