Bostic says policy is “restrictive enough.” Vice Chair Philly Jefferson said that we are in a “position to proceed carefully.” Lorie Logan adds that higher yields may mean less need for the Fed to raise rates again. And Minneapolis Fed Pres Kashkari is perplexed on why Treasury rates are rising now, saying “it’s hard to know...but it’s possible that the government is issuing a lot of debt.” (Do you think?)

More supply puts downward pressure on prices and in the bond market, that means yields must go up. He offered another lesson, too – maybe it’s just that the US economy is strong and we can expect higher growth for the next 10 years so higher rates reflect that analysis.

Recall earlier this week I told you that Neely has been calling for a 6% terminal rate – along with Loretta Mester. If he changes his tune, then that would be a notable change and it kind of sounds like he is changing his tune. Fed Governor Chris Waller said that they will stay on the job to get inflation to 2%, but also did not commit to a move on November 1.

Fed Governor Mishy Bowman was a bit clearer. She thinks that the Fed needs to hike rates further, telling Bloomberg.com that “despite recent improvements, inflation remains well above the FOMC’s 2% target. Domestic spending remains strong, and the labor market remains tight.”

So, in the end, it sounds like three of them are committing to no hike and the other two are playing on both sides of the fence. This way they can point to their comments and say, “See, I told you.’ And one of them is firmly calling for higher rates.

Me? I still think that they need to hold rates higher for longer and I think they have made that clear. But I guess that narrative could change if the plot thickens – and the plot appears to be thickening. Not with economic issues as much as geopolitical issues. And while those issues don’t usually price stocks in the long run, they do provide chaos in the short run.

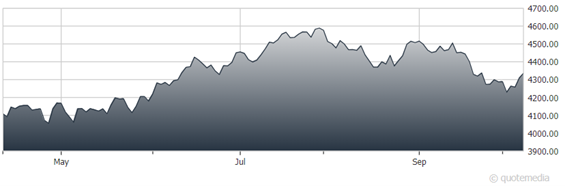

The S&P recently closed at 4,358 and there is a real possibility that we kiss and test trendline resistance at 4385. A quick look at the chart reveals that the intermediate resistance and short-term resistance are about to cross, with the short-term resistance slicing down through (not up through). That will cause some consternation for the markets as it struggles with what to do next.

If we push through, then we could see the S&P advance, testing levels seen in late August. Think 4,500-ish. Which, again, only supports my point as a long-term investor. Stick to your plan. Don’t try to pick tops and bottoms. Build a strong, diversified portfolio.