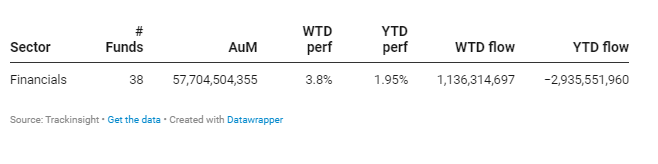

The S&P financial sector experienced a notable rebound over the week, up 3.26%, in the wake of regional banks transitioning into positive territory since the beginning of the year (+2.03%). Financial funds appreciated by +3.80% - bringing their collective year-to-date performance to +1.95% - while attracting an exceptional $1.13 billion in positive inflows over a single week.

Such investment flows could indicate renewed investor confidence in a sector that has been hindered by numerous challenges this year, including the monumental collapse of SVB, First Republic, and Credit Suisse (SIX:CSGN). The downfall of these institutions posed significant obstacles to growth within the sector, contributing to a period of negative performance.

One of the reasons for the recent rebound could be attributed to a decrease in government bond yields as falling treasury yields reduce default risk, thus leading to conditions more conducive to recovery. A spike in yields will have certainly added pressure to regional banks holding bonds that have fallen in value - one of the key factors in the failures of Silicon Valley Bank and First Republic.

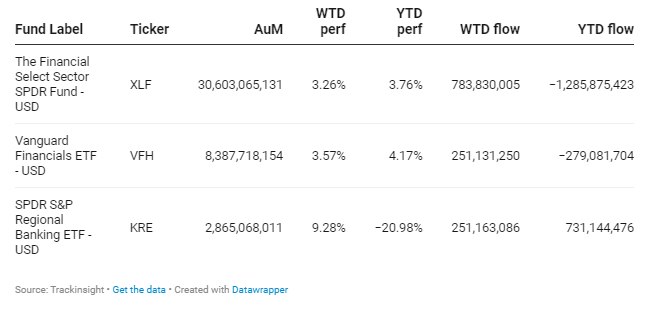

The likely end of rate hikes amid lower inflation and slowing economic activity should bring more stability to the sector. Reflecting the week’s trend, the Financial Select Sector SPDR Fund (NYSE:XLF) rose by +3.26% over the week with inflows of $784 million. Meanwhile, SPDR S&P Regional Banking ETF (KRE) gained +9.28% and collected inflows of $251 million, although remains down -20.98% since the beginning of the year.

Group Data

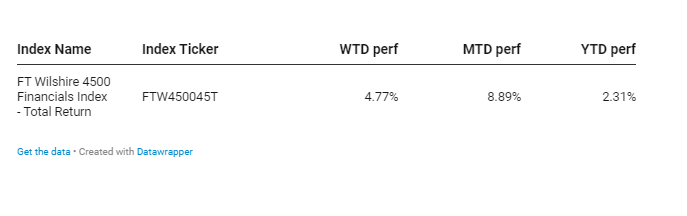

Index Data

Funds Specific Data: