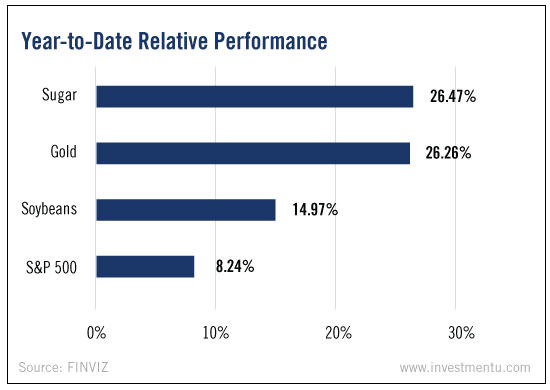

Gold has gotten a lot of attention this year - and for good reason. The yellow metal is up 26.26% year to date. But as this week’s chart shows, gold isn’t the only resource beating the stock market...

In fact, sugar is actually outperforming gold. It’s up 26.47% this year.

Soybeans aren’t far behind. They’re up 14.97% compared to the S&P 500's 8.24% gain.

And yet, most investors don’t trade - or know how to trade - these unsung commodities. Here’s the scoop on how they work...

To trade sugar, soybeans and other commodities, you could buy futures contracts, which in the simplest terms, allow you to buy or sell a commodity at a certain price in the future.

Investing in futures contracts is a lot like investing in a stock - an expensive one. A single contract can cost thousands of dollars. That’s why nearly all futures are bought on margin. That way, gains and losses are amplified.

Because of this, futures trading can be a risky proposition.

Fortunately, exchange traded funds are a much easier way to invest in sugar and soybeans.

Unlike futures, they don’t have an expiration date. Also, ETFs don’t require large amounts of leverage. And still, their returns mimic those of the futures contracts.

Most investors are familiar with the SPDR Gold Shares ETF (NSYE: NYSE:GLD). The fund tracks the price of gold. Shares are up 25.5% year to date.

Similarly, if you want to invest in sugar, you can buy the Teucrium Sugar (NYSE:CANE). It tracks the daily changes of three sugar futures contracts traded on the Intercontinental Exchange (ICE). So far this year, its investors have seen gains of more than 33%.

Soybean investors can trade shares of the Teucrium Soybean (NYSE:SOYB). Just like the previous ETF, it tracks contracts on the ICE. Its share price is up 8% since January. The fund just pulled back after hitting a 52-week high in June. It’s no surprise, since the movement of soybean futures is seasonal. Prices typically decline between June and August.

Investing in agricultural commodities can be a great hedge against rising food prices. It’s also a unique - and underutilized - way to diversify your portfolio.