- Trump’s tariff U-turn sparks huge risk rally.

- USD/JPY stuck in a volatile range with bearish bias.

- GBP/USD tight but watch for breakout setups.

- Silver prints key bullish reversal higher—$31 a key line in the sand.

There are plenty of ways to describe the price action across markets this week, but essentially, it was a wave of long liquidations across riskier asset classes followed by an epic short squeeze sparked by Donald Trump. His abrupt decision to pause reciprocal tariffs—introduced only hours earlier—for an additional three months triggered one of the largest risk rallies on record, even though the move excluded China, which was slapped with an even higher 125% tariff rate.

The rally decimated many technical levels and cleared out a lot of stale positions, creating something of a clean slate across many individual markets.

Now the dust has temporarily settled—and I suspect it will only be temporary—this post will look at potential setups involving USD/JPY, GBP/USD and Silver. While it’s unlikely to carry the same market-moving clout as in the recent past, I’d encourage you to read this U.S. inflation primer for guidance on what to expect from the March report released later Thursday.

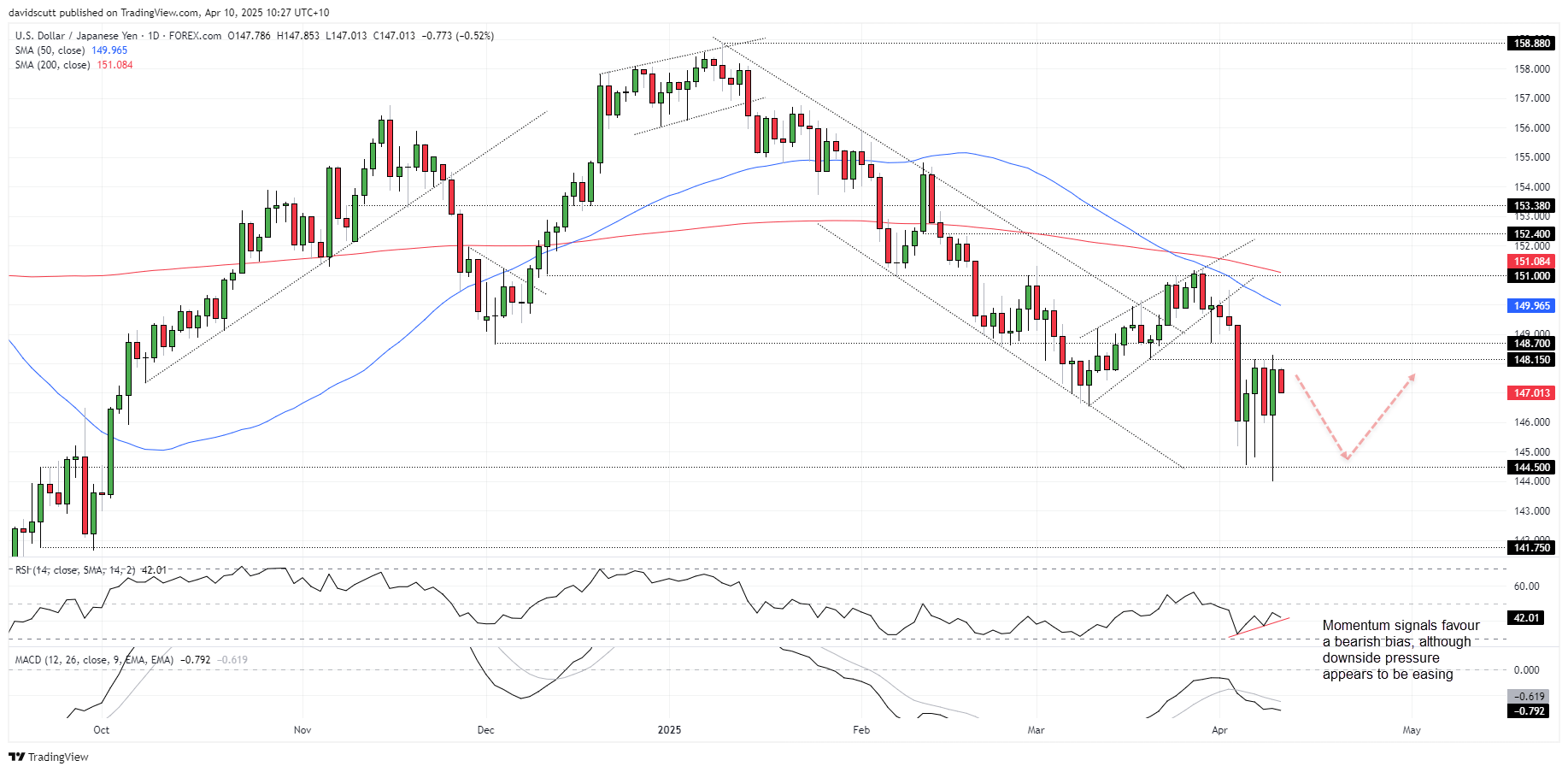

USD/JPY Whipsawed in Wide Range

Source: TradingView

USD/JPY has resembled a game of Pong over the past week, whipsawed between support beneath 144.50 and resistance at 148.15. Approaches to either side of the range present opportunities to fade given the uncertain environment, allowing for stops to be placed on the other side of each level for protection.

The momentum picture remains bearish, favouring selling rallies over buying dips. However, downside momentum is showing signs of waning, meaning more emphasis should be placed on price action in the near term.

The yen is likely to remain more of a play on risk appetite than yield differentials in the current environment, so keep an eye on volatility measures such as VIX futures and the performance of global equities.

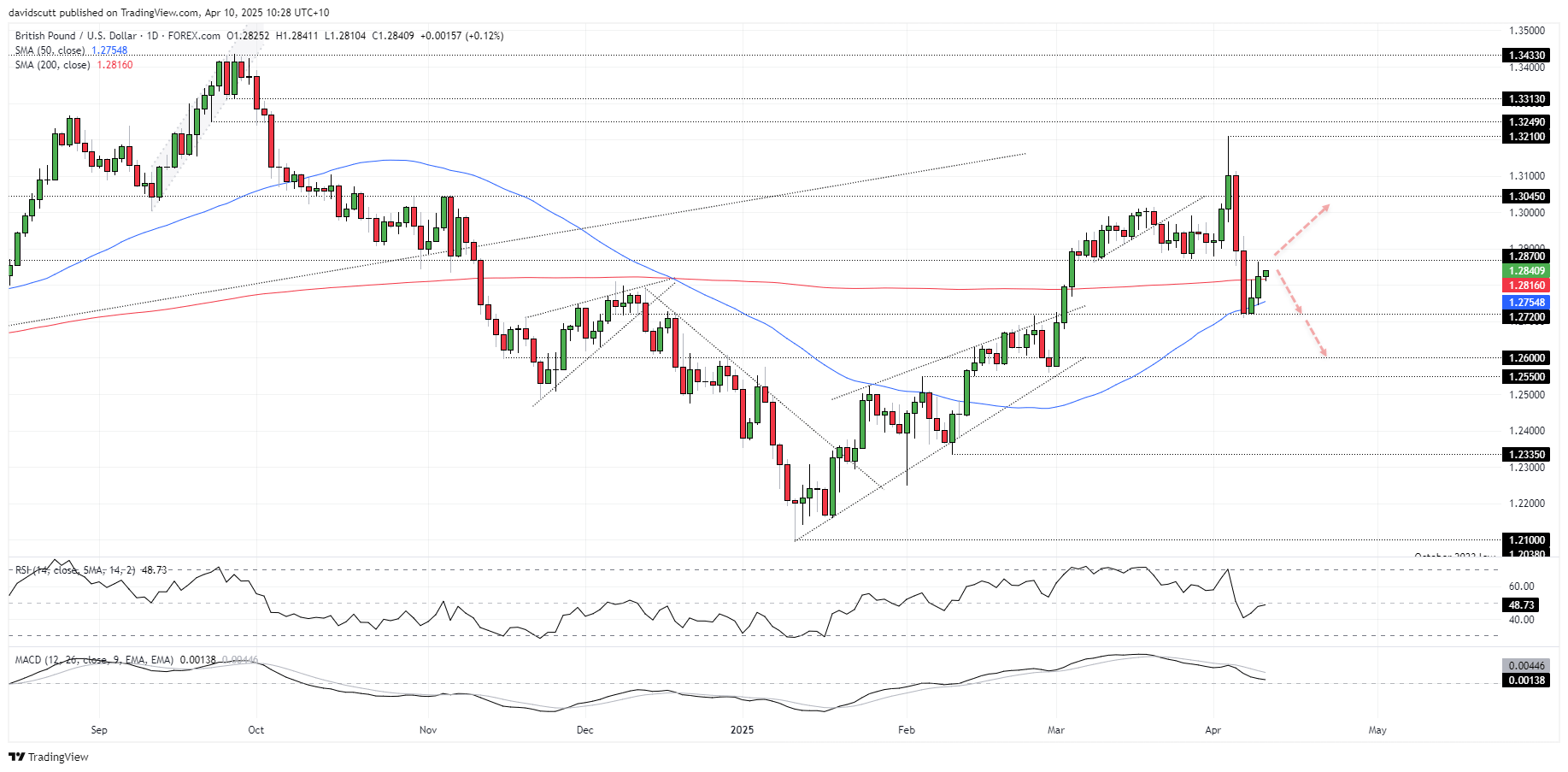

GBP/USD: Cable Eyes Bullish Break

Source: TradingView

GBP/USD moves have been relatively restrained compared to high-beta currencies tied to the economic cycle, trading in a tight range between 1.2720 on the downside and 1.2870 on the topside over the past week. That’s the initial range for traders to focus on.

If the price breaks above 1.2870, it could encourage bulls to initiate longs, targeting a move back to 1.3045—a long-standing level that previously offered support and resistance until being obliterated late last week. A stop beneath 1.2870 would offer protection.

Alternatively, a break of 1.2720 would generate a bearish setup, allowing for shorts to be established beneath the level with a stop above for protection. 1.2550 screens as an initial target.

Momentum indicators are neutral, placing increased emphasis on price signals to guide direction.

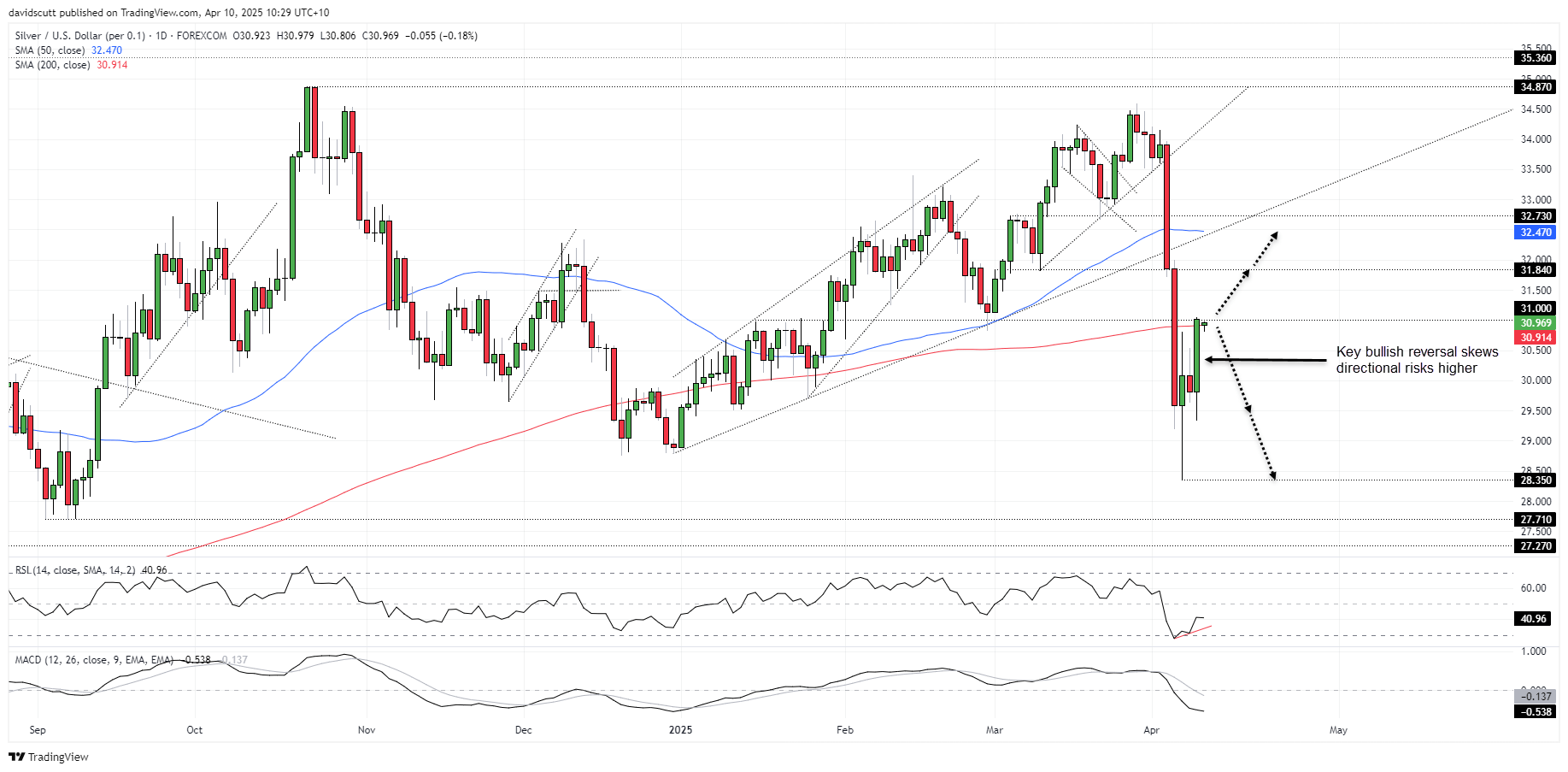

Silver Squeezed, $31 Key

Source: TradingView

Silver printed a key bullish reversal candle on Wednesday, surging from below $29.50 before the move stalled at resistance at $31. The level can now be used to build setups around, depending on how near-term price action evolves.

A break above $31 allows for longs to be established with a stop beneath for protection. $31.84 screens as a potential target, with the intersection of former uptrend support and the 50-day moving average at $32.44 another after that.

Alternatively, if the bullish key reversal proves a false signal, the setup could be flipped with shorts established below $31 with a stop above for protection. $28.35 screens as a potential target, although $29.50 may suit those with a little less ambition.

While momentum signals remain bearish, there are early signs that downside pressure is easing. In these headline-driven markets, more emphasis should be put on price signals rather than momentum shifts.