Elon Musk has long been synonymous with Tesla (NASDAQ:TSLA), but that connection is increasingly looking like a liability rather than an asset. For over a decade, Tesla was the crown jewel of innovation, a status symbol for early adopters and climate-conscious consumers alike. Its brand equity was unrivaled, propped up by a first-mover advantage in electric vehicles, flawless product design, and a cult-like following around its CEO. But that aura is fading.

The sharp rise in the share price following Trump’s victory seemed disconnected from fundamentals. Nothing had changed operationally to warrant the move. And now the fundamentals are catching up with the company. Tesla is increasingly falling out of favor with consumers and investors, not just because of competition, but because of reputational damage driven from within. In addition, CEO Elon Musk’s current focus on the Department of Government Efficiency (DOGE) has generated public backlash.

This article examines how Tesla’s core business is losing momentum, how brand deterioration is affecting demand, and why the company’s valuation no longer aligns with its current fundamentals.

Tesla’s Sales Are SlowingAfter years of exponential growth, Tesla’s global vehicle deliveries have flattened across 20232024. For the first time in over a decade, Tesla’s global sales have declined. The company delivered 1.79 million vehicles in 2024, down 1% from 1.81 million in 2023, a modest decline, but signs suggest it’s worsening. Q1 2025 didn’t start on the right foot either. Tesla’s global deliveries dropped 12.9% to 336,681 vehicles, falling well short of analyst expectations of approximately 377,592. Sales fell sharply in Europe and remained soft in China, despite a late-quarter pickup in registrations.

Europe

In January, the sales declined 45% across Europe year-over-year (YoY), followed by a 44% drop in February. The market share has fallen to its lowest level in 5 years (9.6%) while EV sales are up 31% for the year in this market.Looking more closely at specific markets, Elon Musk has involved himself in European politics abroad, particularly in the UK and Germany, seemingly without anticipating consumer reaction whether direct or indirect. Whether connected or not, Tesla’s car sales in Germany fell by 76% in February, even as overall EV sales rose 30.8%. Tesla sales were also down 24% in the Netherlands, 42% in Sweden, 48% in both Norway and Denmark, 45% in France, 55% in Italy, 10% in Spain and 53% in Portugal. This could mark the beginning of a domino effect with the worst potentially still to come.

China

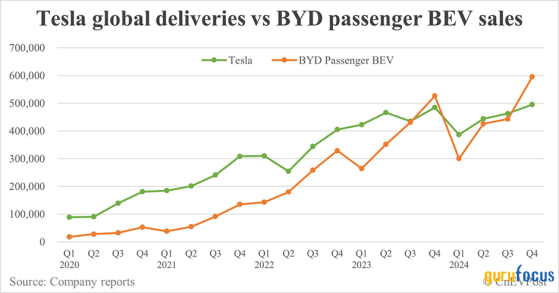

Looking at another market, China, Tesla’s second-largest market, vehicle deliveries hit a record high in FY2024. However, we’re beginning to see the same pattern emerge in 2025, with sales in China in January down 15%. I acknowledge that other automakers also reported sharp declines, likely tied to the Chinese New Year.In my view, China could become more complicated for two main reasons. First, there’s uncertainty about tariffs on China and the possibility of retaliation. More importantly, there’s the question of how Chinese consumers will feel toward the U.S. and how that sentiment could impact Tesla. Second, China is arguably the most competitive EV market, led by domestic players like BYD (BYDDY), which has already surpassed Tesla in quarterly global EV sales in late 2023 and again in Q4 2024, delivering about 595,000 battery-electric cars in Q4 2024 compared to Tesla’s 495,000.

Source: CnEVPost

Technologically, BYD is also challenging Tesla’s edge. In March 2025, BYD unveiled a new 1,000 kW super charging platform that can add 400 km (250 miles) of range in just 5 minutes. This ultra-fast charger is twice as powerful as Tesla’s latest Superchargers (which peak around 250500 kW). At such speeds, the time difference compared to refueling a combustion vehicle is negligible, practically solving one of EVs’ longest-standing drawbacks. Naturally, this level of charging performance demands specialized infrastructure, and BYD is already planning to deliver it. The company aims to build 4,000 of these ultra-fast charging stations across China, with the first 500 expected to be completed in the coming months, alongside vehicles equipped to support the technology. At the same time, BYD is rolling out advanced driver assistance features like its new God’s Eye ADAS suite at no additional cost, undercutting Tesla’s strategy of charging substantial fees for Full Self-Driving capabilities.

My real concern is that even Tesla’s already-declining 2024 numbers may prove too optimistic. Musk’s political alignment only began gaining visibility in mid-2024, meaning the full impact on demand may not yet be reflected in the data. Given the current trajectory, from reputational headwinds to intensifying competition, it seems likely that 2025 will bring another leg down in sales, and potentially a meaningful one.

Has Elon Musk become Tesla’s biggest business risk?I want to be clear: Musk’s brilliance and risk tolerance built Tesla, and I’ve long admired him. However, his political controversies and erratic public image are weighing on Tesla’s brand and demand. Musk’s attention is stretched across too many ventures, including DOGE, Tesla, SpaceX, X, and more, leaving Tesla without the focused leadership it needs at this critical juncture.

Even Dan Ives, longtime Tesla bull and one of its most vocal Wall Street supporters, has shifted his tone. He recently stated that Musk needs to stop "treating Tesla like a sideshow". After the Q1 2025 delivery miss, he doubled down We knew 1Q Tesla deliveries would be soft, but these numbers were bad... a disaster on every metric... the time has come for Musk fork in the road moment for Tesla. That kind of language signals a meaningful shift in sentiment from the bullish camp.

And he’s not alone. Cathie Wood and Ron Baron (Trades, Portfolio), two of Tesla’s most high-profile long-term backers, began trimming their positions in the second half of 2024 (Although Baron, still holds an unusually large allocation).

Moreover, in the U.S. and now globally, many protestors are protesting and boycotting Tesla. In extreme cases, some individuals have even vandalized Tesla vehicles in public, a response to the growing backlash surrounding Musk’s controversial behavior.

There is currently a significant increase in listings of used Teslas. This suggests that even existing owners are turning away, not just because of reputational damage, but in some cases, safety concerns.

What is performing?And that, right now, is the question. While many argue that Tesla is all about its future vision, from robotaxis and humanoid robots to a future built on AI infrastructure. But so far, these ambitions haven’t translated into meaningful financial returns. That vision might eventually materialize, but today’s valuation already assumes it will. Meanwhile, the fundamentals are beginning to resemble those of a traditional automaker. Musk, who was once the driving force behind Tesla’s technological edge, now seems increasingly distracted and as his attention drifts, the competition is catching up, if not pulling ahead.

That said, not everything is broken. Although Energy accounted for just 10% of revenue in FY2024, it grew 67% YoY, reaching record levels and the company’s margins in that segment are improving. Energy storage deployment exceeded 31 GWh, growing 114% YoY.

The Supercharger network continues to grow and has become a lucrative licensing opportunity, with Supercharging stalls being accessible to other electric vehicle drivers in North America through the Tesla app and adapters provided by your vehicle manufacturer. New vehicles outside of Tesla have started coming equipped with NACS charge ports.

Why I Trimmed My PositionOverall, the negative developments have accumulated in recent months, and Tesla is facing significant challenges. Although the share price has fallen significantly recently, the valuation remains far from cheap. As a pure car company, Tesla would likely be trading at a much lower price, especially given the numerous negative sales trends (While Tesla is still framed by many as a tech company, the reality is that nearly 90% of its revenue stems from selling cars).

Source: Author

Tesla is currently trading at an 8x forward price to sales (P/S) and 102x forward price to earnings (P/E), even after a 30% pullback year-to-date. For context, its peers trade at less than 1x forward P/S and 20x forward P/E.

Tesla earned its premium valuation by delivering high growth up to FY2023, supported by strong execution and a dominant position in the EV space. But that momentum began to fade in FY2024 and deteriorated further in Q1 2025. With sales growth decelerating and margins under pressure, the justification for such a premium multiple is increasingly difficult to defend. Unless performance stabilizes, the next few quarters could bring further declines, both operationally and in the stock price.

Despite this, I have no doubt Tesla is one of the most ambitious companies in the world. Tesla might be the least impacted by tariffs compared to its peers and even managed to get a free infomercial from Trump himself.

Musk has the power and vision to get Tesla back on track, but unfortunately, his attention remains diverted elsewhere.

This content was originally published on Gurufocus.com