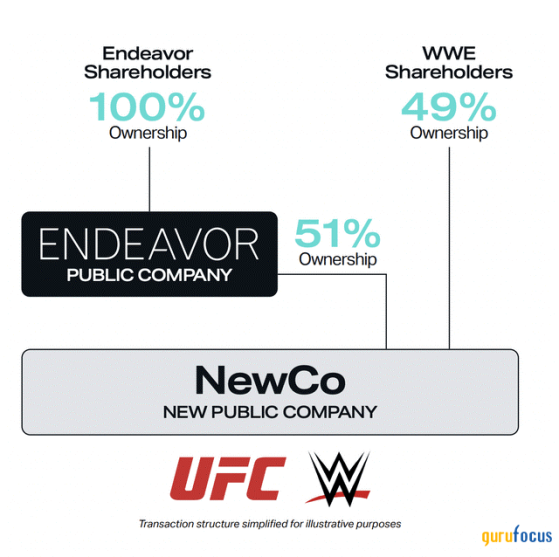

Out of all the companies available on the market, TKO Group Holdings Inc. (NYSE:TKO) can be considered a truly unique and thrilling stock. To those unfamiliar with the company, it was born out of a merger between Endeavor-owned (NYSE:EDR) UFC and WWE. Together, this combined force has access to over 1 billion households through television in around 170 countries and is responsible for over 350 live events per year.

WWE, or World Wrestling Entertainment, is a leading media and entertainment organization recognized globally for sports entertainment. WWE offers family-friendly entertainment through its television shows, live events and digital media. The organization's content reaches a staggering 1 billion households globally and comes in 25 languages.

UFC, or Ultimate Fighting Championship, is the biggest mixed martial arts promotion company in the world. Based in Las Vegas, it has more than 900 million fans and around 260 million followers on social media. The UFC has more than 40 live events conducted each year in some of the most prestigious arenas in the world, which is broadcasted to over 170 countries featuring athletes from over 80 countries.

What makes me passionate about TKO is the fact I understand its products and overall business model through following its brands growing up. This makes TKO all the more appealing as an investment since it combines stock knowledge with enthusiasm.

Performance and growthTKO Group's standing within the entertainment industry is quite compelling. Live events, especially in sports and combat, have a universal appeal that captivates audiences worldwide. The merger of UFC and WWE under the TKO banner perfectly exemplifies this trend. On a year-to-date basis, the stock has done extremely well and has even outperformed the S&P 500 Index.

TKO Data by GuruFocus

Just look at the rising growth rates in this sector, which clearly indicate the growth trends should continue.

The strength of TKO lies in its unique position at the junction of the two global phenomena. The UFC, which enjoys universal appeal, features fighters from every country in the world. In 2023, UFC events established records for highest gross revenues at different arenas in different parts of the world, proving beyond a doubt there is huge following for the sport around the globe.

At the same time, WWE is also showing strong potential. At the start of 2024, the company announced a deal to broadcast and move its top brand, Monday Night Raw, exclusively to the streaming giant Netflix (NASDAQ:NFLX) starting in 2025 in a 10-year deal worth $5 billion. WWE's last deal with the linear network NBC universal was priced at approximately half of the new deal at around $250 million to $260 million per year. This will immediately double the licensing fee revenue for WWE, increasing it by around $250 million.

Similarly, WWE signed its first-ever canvas branding deal with Prime Hydration, which will make Prime to be the first ever brand to have its logo featured at the center of the WWE ring. While the length and financial terms of the deal were not disclosed, it is said to be the largest sponsorship deal in WWE history, directly improving the company's bottom line. This is WWE taking a cue from UFC's playbook, recognizing the tremendous success it has had over the years with lucrative sponsorships. UFC earns approximately three times the advertisement and sponsorship income of WWE. With deals like Netflix and Amazon (NASDAQ:AMZN), it is evident that under TKO's leadership, both the WWE and the UFC have started to leverage their combined strengths and best practices to create a profitable synergy. By doing so, they are poised to drive profitability to new heights.

Both divisions dominate the media and sports entertainment market in 2024, with no significant competitors, essentially creating a monopoly. TKO draws on people's affinity for live entertainment and the international love for combat sports. By utilizing these forces and strategy of using a broad fighter pool, international expansion and the increasing legal online gambling market, the company has positioned itself for continued growth and exceptional investment potential.

Financial resilienceBoth segments are on par with each other in terms of revenue. WWE recorded $1.32 billion and UFC saw $1.30 billion in 2023. TKO's financial performance has shown consistent improvement.

As with most companies, management changed its objectives from growth to earnings starting in 2022 just to meet market expectations due to high debts. As of the first quarter of 2024, TKO has seen a 63% year-over-year increase in adjusted Ebitda. However, free cash flow decreased by $37.30 million from the previous quarter due to a one-time expense related to the WWE headquarters. This still translated to a FCF margin of 19.14%, ranking better than 88% of companies in the media industry, along with a gross margin of 68%, which also outperforms 88% of its peers. As such, TKO appears to be a huge cash cow.

WWE's insider trading stood at about 10% in the last quarter, though it should not be seen as a concern. This is attributed to the resignation of WWE Chairman Vince McMahon and his connections to the company amid workplace misconduct allegations, which will be discussed later on.

TKO's price-earnings ratio of 308 and forward price-earnings ratio of 45 might sound so high that one cannot consider investing in it, but some stocks, especially industry leaders, require evaluation beyond pricing ratios. The company maintains a solid 4:1 asset-to-liability ratio, with most of the liabilities being long-term debt, which are slowly but surely on a downward trend.

Despite the fact intangible assets and goodwill constitute a noticeable share of TKO's total assets, its cash flow appears sufficient to support them. This strategic positioning of constant cash flow will enable the company to bring down its debt level and also seek buybacks and reduce the share count, increasing earnings per share. The number of outstanding shares has already declined by 1.50% since November 2023.

Speaking of financial performance, just take a look at these margins: the gross margin is at 70%, Ebitda at over 17% and net income in positive all above sector medians. These healthy margins relate well to TKO's sound operations and financial performance within the nervy entertainment industry.

Furthermore, the emergence of online gambling adds another avenue of growth for TKO. Online sports betting, which is hugely popular in the U.S, complements live combat events like UFC matches, where the excitement of the contest is fueled by the opportunity to wager on outcomes. This enhances fans' experience and advertising revenue, making the growth of the online gambling industry crucial to TKO's success.

In essence, TKO capitalizes on two powerful trends: the constant demand for live performances and the people's love for fighting disciplines around the world. Combining such forces under one roof and effectively managing a diverse fighter pool, global presence and the rising size of the online gambling market, the comapny is set up for future rapid growth and extraordinarily attractive investment potential.

With regard to the risks related to TKO, one significant concern is the heavy reliance on intangible assets and goodwill. Trying to maintain a positive sentiment among a diverse global consumer base is challenging to say the least. For instance, McMahon, the former TKO and WWE executive chairman, was accused in January of offering a woman a job contract on the condition she would engage in a sexual relationship with him, then tried to cover it up through signing an NDA. This incident negatively impacted the company's reputation, which is not only WWE but TKO as a whole. However, the company acted quickly to rectify the problem as McMahon resigned and sold his shares in the company, ending any connection . Likewise, UFC CEO Dana White was accused of domestic violence in 2023 when he was caught on camera assaulting his wife at a club. White apologized and blamed much of it on the alcohol. Such controversies can harmful for a company that relies heavily on public perception and consumer enthusiasm.

There were also concerns with working conditions in WWE and UFC. In March, TKO made a $335 million settlement with former UFC fighters concerning a class-action lawsuit for alleged antitrust violations. This settlement still needs to be approved by a federal judge, which could be tricky. However, this lawsuit arose from occurrences that happened when the company was under previous ownership about a decade prior, and no such cases have been reported since the new ownership came into power. Further, both White and the WWE over the years have implemented health and wellness policies as a way of safeguarding their talent from future such incidents.

Is TKO Group ready to rumble into the future?A 48% year-over-year increase in adjusted Ebitda in the first quarter is no small feat. UFC and WWE operate on a relatively fixed schedule when it comes to their events, making year-over-year comparisons accurate. With TKO settling all its claims in the UFC antitrust lawsuit and addressing workplace misconduct, the legal challenges seem to be behind it. On the other side, future negotiations for UFC rights with Disney (NYSE:DIS) and WWE Premium Live Events rights are reportedly in their final stages. Additionally, the new Netflix deal will leverage the streaming giant's global reach to expand WWE's already massive audience.

TKO's innovative approach in the entertainment industry, particularly in combining conventional sports and new-age media showcases its understanding of the evolving market. The company's ability to leverage its extensive media presence combined with its new strategic partnerships and a robust financial position sets it apart from competitors.

As the company continues to capitalize on the growing trend of live entertainment, its strategic initiatives are starting to bear fruit in the form of consistent growth and profitability. Having the combined ownership of WWE and UFC, we are starting to see each brand take strategies from each other to enhance their profitability. Their established brand loyalty, growth prospects and margin expansion objectives make TKO an attractive investment currently. However, income-focused investors may want to look elsewhere as TKO does not currently pay dividends.

This content was originally published on Gurufocus.com