The Currency War Continues

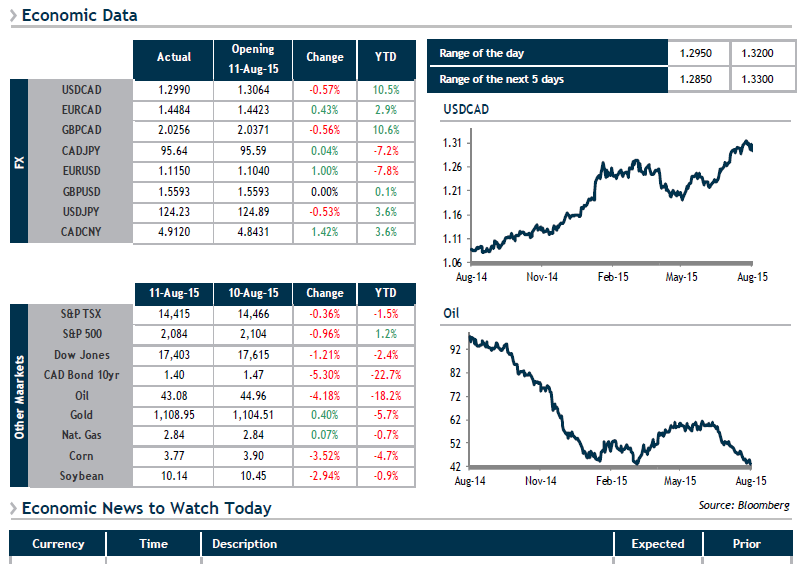

The devaluation of the yuan, triggered by disappointing economic data, shook up markets yesterday, resulting in a generalized decrease in risk tolerance. The loonie, main markets and crude oil prices all posted major losses on Tuesday. Crude oil, which fell to $42—its lowest level since March—was also hampered by a negative report released by OPEC regarding overproduction and inventory levels that are too high.

This currency war is intensifying at the time when the Fed is potentially getting ready to increase its key rate in September. With the Chinese economy that is showing signs of slowing down and the greenback that continues to rise, will the Fed be once again forced to postpone its key rate hike?

In the short term, the CAD will be vulnerable to a global economic slowdown and weak crude oil and commodity prices. As for the markets, corporate earnings season is in full swing, with 75% of companies on the S&P/TSX Composite Index that have reported their Q2 results beating earnings forecasts from analysts by 2.5%.