The Greenback Continues to Climb

On Monday, the loonie pulled back slightly because of weak crude oil prices and disappointing Chinese economic data. Chinese manufacturing activity figures, as measured by the Caixin China PMI, fell in October but at a slower pace, a sign that central government efforts to stimulate the economy are starting to pay off. In addition, China’s Prime Minister also announced on Monday that the country’s economy is forecasted to grow by at least 6.5% per year for the next five years. This is the first time that China has publicly admitted that its growth rate may fall below 7%.

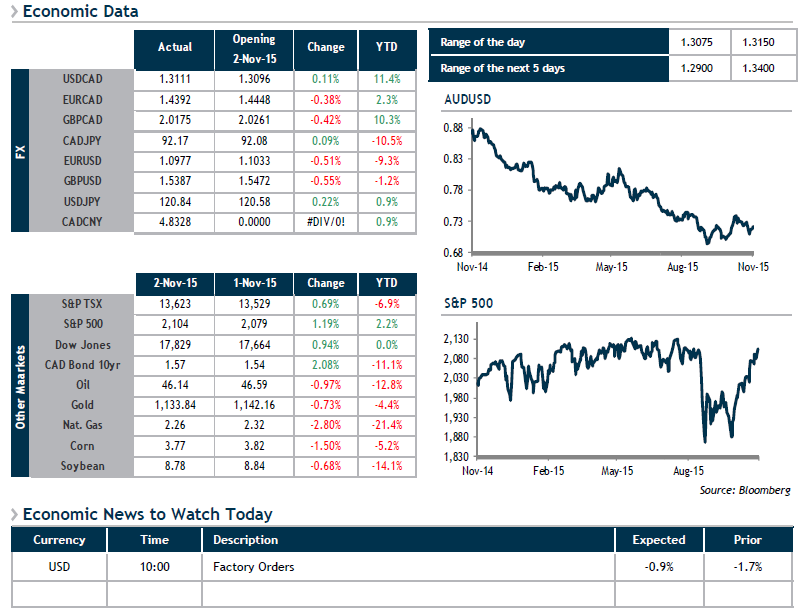

The Australian dollar, which is a good comparable for the loonie, is rising strongly this morning following the decision from the Reserve Bank of Australia to maintain its key rate unchanged. The Australian economy is showing signs of improvement and a key rate cut will probably pushed off until 2016. Has the Australian dollar, which is trading at around 0.72 cents, finally reached its lowest levels? The greenback seems like it will continue its ascent today. We will be monitoring Factory Orders (September) in the United Stated, which are expected to decrease for the second time in a row.