Gold, silver hit fresh record highs amid geopolitical tensions, weak dollar

As hard as I try, I still can't see how GameStop (NYSE:GME) is a value stock, as some seem to think.

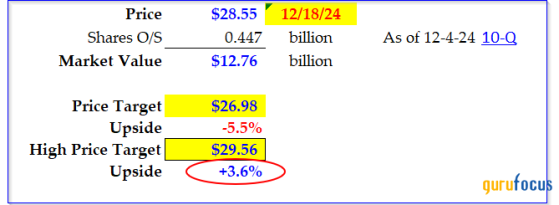

This was the same problem I had six months ago on June 12, 2024, when I wrote the GuruFocus article, A Realistic Look at GameStop's Value.The stock at the time was about $23.00 per share. Today it's over $28.50. This article will discuss why I still can't see much value left in the GME stock valuation.

Valuing GME and Setting a Price Target (NYSE:TGT)

The table above shows that my price target is just under $27.00 per share, and the high end of my target range is $29.56, or just under 4% higher.That's not much upside.

This valuation is based on two methods: (1) net asset value (NAV), and (2) its free cash flow (FCF) and FCF margins.

Net Asset Value

One way to value GME stock is to use a net asset value (NAV) method.Add up the easily-determined assets and subtract the real liabilities. Then divide by this result by the shares outstanding to determine its NAV per share.

Comparing that NAV to the stock price will show if there is any potential upside for value investors.

Net Liquidity For example, as of the end of Sept. 30, 2024, GameStop had over $10 per share in net liquid assets (NLA):

The table above does not include the net working capital liabilities (i.e. current liabilities less current assets):

Let's assume that the company's GameStop stores in the U.S., and the rest of the world (Europe, Canada, and Australia) include this working capital in their valuation.

Stores Next (LON:NXT), let's value those stores. This is hard to do based on profits.

On an operating basis, GameStop is still losing money. For example, in Q3 GameStop lost over $33 million from its stores and e-commerce. That was twice as worse as last year.

GameStop has only just become profitable in the last two quarters (i.e., on a net income basis). This was after including interest income from its huge cash pile.

For example, in Q3 GameStop made $54.2 million in interest income.

That interest income more than covered the $33.4 million operating losses from stores and e-commerce. So, after $3.4 million in taxes, its net income for Q3 was $17.4 million or 4 cents per share.

How to Value the Stores Therefore, if management were to sell the GameStop stores and e-commerce business, it would likely use a sales multiple valuation.

For example, let's assume for argument's sake that GameStop could sell all its stores for 2x sales (including all the leases and net working capital).

Analysts project sales this year ending January 31 will be $4.023 billion and next year $3.75 billion. That means over the next 12 months (NTM) sales will average $3.85 billion.

That implies that its stores' valuation will be $7.7 billion or $17.24 per share:

Total (EPA:TTEF) NAVSo, the total NAV is the sum of both the NLA and Store Valuation, as seen in the table below:

This analysis shows that an investor in GME stock could potentially lose money.

Moreover, the distance between its NAV and the stock is not only negative, but there is no margin of safety. That is what value investors typically look for.

Free Cash Flow Valuation

Another way to value the stock is based on its free cash flow.That is the net cash flow (after all cash expenses, including working capital and capex spending) that a company generates each quarter from its sales and marketing efforts.

For example, this year GameStop is expected to reach positive free cash flow (FCF). Over the next 12 months (NTM) and next year that positive FCF should grow.

This assumes that its free cash flow margins continue to improve and that its stores eventually produce positive free cash flow.

For example, by the end of 2024 (i.e., the year ending Jan. 31, 2025) its FCF will be positive at 0.4% of sales.

But in Q3 2024 its operating cash flow (OCF) margin was much higher at 2.9% of sales. The table below shows that even after capex spending (0.53% of sales) it still generated a 2.3% free cash flow margin. And that should continue to grow:

For example, based on the analysts' forecasts of over $4.02 billion in sales for the year, its Q4 sales will be at least $1.48 billion.

That implies its Q4 operating cash flow could reach $48.8 million, using a 3.3% margin. And after $5 million in capex spending, its Q4 FCF could work out to $43.8 million, or 3.0% of sales.

That also implies that over the next 12 months (NTM) its FCF margin could be 2.8% and by next year it could rise to 3.1%.

How to Value FCF Estimates Using FCF Yield

As a result, we can value GME stock using an FCF yield method.For example, look at the table below.

It shows that if we assume that once the market anticipates that GameStop will stay FCF positive, it will give GME stock a 1.0% FCF yield.

That is the same as implying that if GameStop were to pay out 100% of its free cash flow as dividends, its dividend yield would be 1.0%.

The table shows that even using NTM FCF estimates, the valuation is only $10.9 billion, or $24.39 per share. That is 14.6% below today's price.

So, the only way to find a higher valuation is using the 2026 year (i.e., ending Jan. 31, 2027) numbers. There it works out to $29.56, or +3.6% higher.

Summary and Conclusion

Based on an NAV method, GME is worth $27.52 per share, and using liberal 2year out FCF estimates and a 1.0% FCF yield method, it's worth $29.56 per share.On average that works out to $28.54 per share.

Today, Dec. 18, the stock is at $28.55. This shows that GME stock is fairly valued.

That does not mean, by the way, that the stock won't keep rising. It just means that value investors can't find much of a margin of safety in today's price.

That may present a dilemma to some investors. For example, they may hope that GameStop can eventually start producing operating profits in its stores.

My projections imply a good deal of that already with the higher FCF margin estimates. Nevertheless, if this happens it could push GME stock's value even higher.

Moreover, GameStop could use its $4.6 billion in net cash to make a huge acquisition of a profitable company. That could also potentially push its value higher.

The problem for value investors is that this is specualtive. For defensive investors there is simply no margin of safety in the easily determined value for GME stock right now.

For example, value investors typcially want to see at least a 25% margin of safety. That way, in case the worst happens, at least there is some downside risk protection. I have shown that there is little to no margin of safety between the value of GameStop stock and its stock price.

The bottom line for value investors: despite its large cash balance, GameStop is still not a value stock.

This is not meant to be a stock recommendation (either to buy or sell) or to give anyone financial advice concerning owning or not owning this stock.

This content was originally published on Gurufocus.com