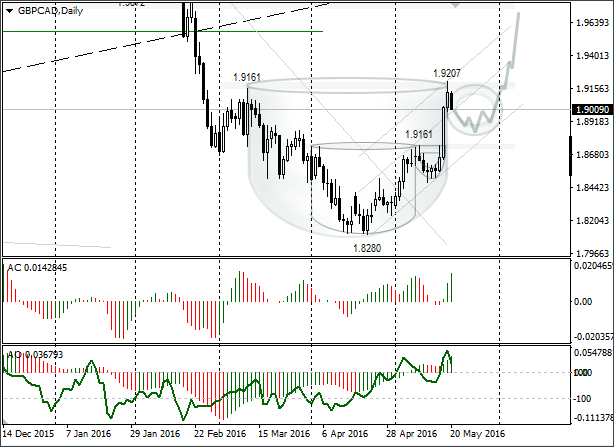

Trading opportunities for currency pair: the GBP/CAD has an inverted cup with handle pattern forming on it. After a fall in the rate to 1.8855, a strengthening of the pound to 1.9640 is expected. Growth of the GBP/CAD will be stamped out by a break in the trend line.

Background

The last GBP/CAD idea I had came out on 8th February. When it was published, the pound was trading at around 2.0178 Canadian dollars. After two pinbars and a double bottom formed, a growth to 2.0325 and 2.0550 was expected. The idea didn’t come off. Even when Brent dropped to $29.89, the GBP/CAD rose only to 2.0289. Another 36 points remained ‘til the first target. By not breaking the 2.0325 resistance, the GBP/CAD dropped to 1.8280 by 21/04/16 due to Brent rising to $46.16 per barrel.

Current Situation

This week I have chosen a currency pair which is dependent on oil prices. Bear in mind that the GBP/CAD has restored from a 1.8280 minimum by 927 points during the phases when oil was falling. On Wednesday the GBP broke the 1.9161 resistance after the publication of new survey data regarding the Brexit. The number of Brits who want to remain is 55%. On Thursday the pound continued to strengthen due to UK stats. Retail sales in April were up 1.3% MoM after a March fall of 0.5% and this was 0.5% higher than forecasted. The previous value was reassessed from -1.3%. Sales were up 4.3% YoY and March’s data was reassessed upwards from 2.7% to 3.0%. I’ve highlighted two cups with handles on the daily graph. Since the small one has already formed, you should see what I expect from the bigger one. As soon as the handle is formed, expect the rate to break 1.92.

The GBP/CAD corrected to 1.9009 on Friday. The weakening of the pound was caused by a technical correction after its rally on Wednesday and Thursday. Friday’s candle’s body closed off that of Thursday. This is a bearish signal. During the formation of the handle we can expect to see a fall of the rate to 1.8855 with a subsequent growth to 1.9640. Growth of the GBP/CAD will be stamped out by a break in the trend line. Between the GBP/CAD and NZD/CAD there is no constant daily correlation, so don’t pay attention to how the NZD/CAD could depart upwards first.