- BoE is set to decide on monetary policy on Thursdaay.

- Consensus assumes the central bank will hold steady at least until UK general elections.

- But a dovish surprise is always in the cards and may create a trading opportunity in the GBP/USD pair.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

This week, the Bank of England (BOE) meeting on Thursday takes center stage. While the consensus expects no change in interest rates, a surprise cut remains a possibility.

However, the bigger story may be a dovish shift towards a potential rate cut in August, after the UK general election.

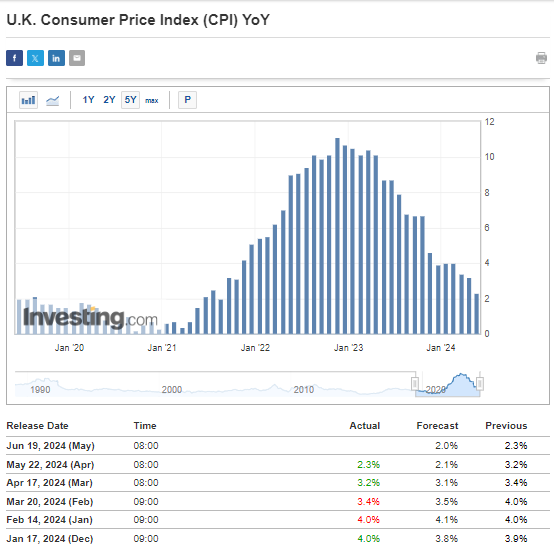

The primary driver for a potential rate cut is the UK's falling inflation. Forecasts suggest it may reach the Bank's 2% target as early as May's upcoming readings. This decline creates a strong argument for a dovish stance from the BOE.

With the upcoming general election, the BOE is likely to hold rates steady to avoid influencing its outcome.

However, investors should focus on the accompanying statement and voting outcome (expected 7-2 to hold). Any deviation from this could signal a dovish shift and potentially trigger volatility in GBP/USD.

Divergence With Fed May Spur GBP/USD Trading Opportunity

Central bank policies are a major force shaping currency pair trends. Take the example of USD/JPY. Its strong upward trajectory is fueled by the Bank of Japan's ultra-dovish stance compared to the Federal Reserve's aggressive rate hikes. Similarly, EUR/USD has seen a sharp decline since the European Central Bank's first rate cut earlier this month.

If the BOE adopts a dovish tone while the Federal Reserve remains hawkish, it could lead to a medium-term downward swing in GBP/USD. This potential divergence in monetary policy creates a trading opportunity for those who anticipate a weaker British pound.

GBP/USD: Bulls Falter at Resistance, Bears Eye Support Break

Last Wednesday, US inflation data triggered a brief surge in GBP/USD, suggesting a potential northward move. However, buyers ran out of steam near the 1.2850 resistance zone, leading to a reversal. Sellers have since pushed the pair down to test the key support cluster around 1.2650.

A break below this support could pave the way for a further decline towards the 1.2470 level. However, for a more significant downward trend, the BOE would not only need to cut rates but also signal a commitment to a more dovish monetary policy cycle.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.