- Labour Party secures majority in UK election with 412 seats, calming market expectations.

- GBP/USD remains stable amid anticipation of steady fiscal policies and potential BoE rate cuts.

- US inflation data crucial; weaker figures could extend USD depreciation, influencing near-term trading dynamics.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Last week, Labour secured victory in the UK's general election by winning 412 out of 650 seats in the House of Commons, as widely anticipated. The outcome, achieved with just 34% of the total vote due to the single-member constituency system, was met with a calm market reaction, having been largely anticipated beforehand.

In the coming months, the new government is expected to maintain fiscal discipline and limit significant fiscal policy changes, as previously indicated during the election campaign.

This stance leaves the Bank of England poised to potentially initiate its interest rate cut cycle, possibly as soon as in the upcoming meeting.

Against this backdrop, let's examine the current outlook for the GBP/USD to gain insight into the current trading opportunities.

Will the Bank of England and the Fed Cut Rates Simultaneously?

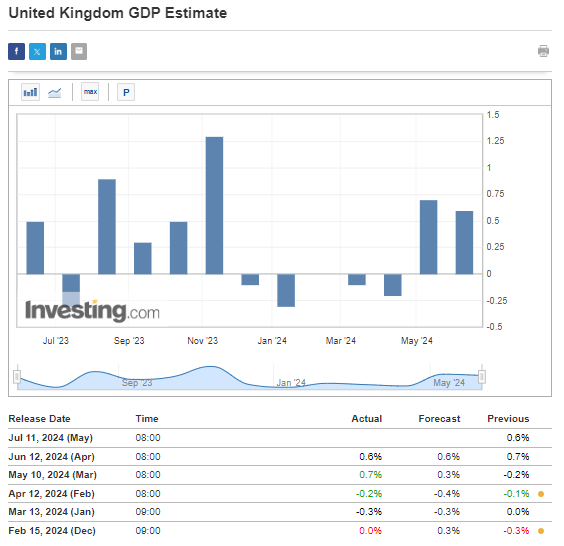

Market expectations suggest a likelihood of dovish action at the next BoE meeting, driven by subdued inflation in the UK and a desire to bolster economic growth, which has recently dipped below 1% year-on-year.

This anticipated move is already factored into current market sentiments. Any additional strengthening of the British pound could prompt the Bank of England to signal readiness for a comprehensive rate adjustment cycle.

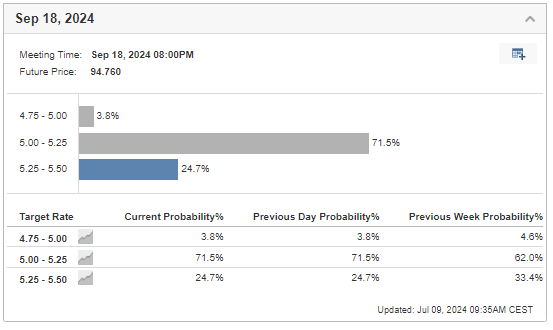

Meanwhile, recent data from the US labor market increased the probability of the first interest rate to 70% in September which is the main factor prompting the US dollar downtrend since.

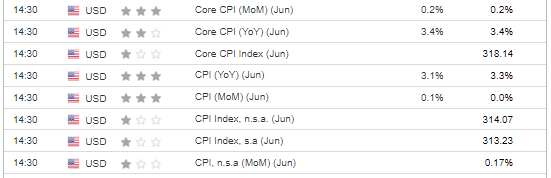

Of utmost importance in this context will be the US inflation data scheduled for release this Thursday. Preliminary forecasts anticipate headline consumer inflation to decrease to 3.1% year-on-year, while core inflation is expected to remain unchanged at 3.4% year-on-year.

If the final data come in below current forecasts, it is likely that the depreciation of the US dollar will persist, with actual rate cuts in September becoming the baseline scenario.

The week will conclude with US PPI inflation data, complementing Thursday's figures and providing further direction for dollar pairs in the short term.

Technical View - 1.284 Level Crucial

The demand momentum observed since the beginning of the month has faced resistance from the supply side near the local peak around the price level of 1.2840.

The direction of correction will heavily hinge on Thursday's US inflation data; any disappointing figures could bolster selling pressure, with the initial target near the local support zone around 1.2740.

If growth continues and breaks through the current tested peaks, bulls may face challenges around 1.29, where the highest levels of the year are situated.

However, it's important to note that medium and long-term movements will be shaped by upcoming actions of Central Banks, which will become clearer in the coming weeks.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level! Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.