- The Bank of England maintained interest rates, with a 7-2 vote suggesting possible rate cuts as early as this summer.

- Upcoming UK inflation data is crucial, potentially increasing currency pair volatility today.

- GBP/USD breached the 1.27 supply zone, aiming for the next target near 1.28, but could drop below 1.25 if UK inflation data disappoints.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The recent Bank of England meeting made minimal changes to its monetary policy, notably maintaining the interest rates at their previous level. Of particular interest was the 7-2 vote in favor of maintaining the status quo, deviating from the anticipated 9-0 outcome. This hints at the potential for the first rate cuts as early as this summer.

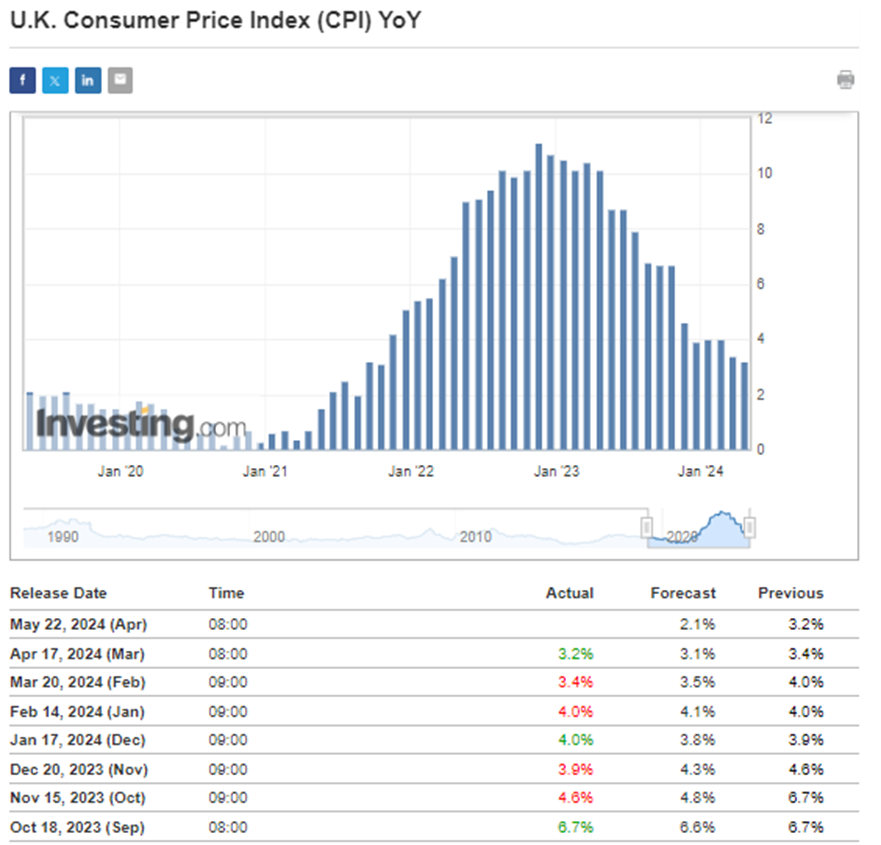

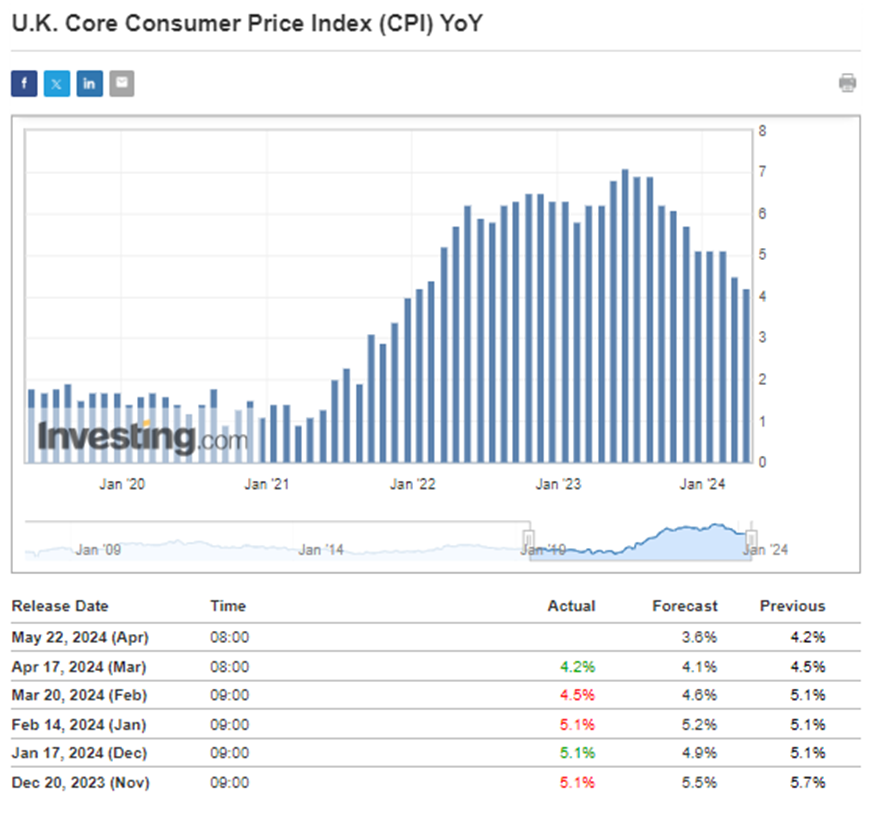

Consequently, the forthcoming data on the UK's inflation reading gains significance, potentially heightening currency pairs' volatility involving the British pound this week.

Meanwhile, the GBP/USD currency pair successfully breached a crucial supply zone around the 1.27 price level, paving the way for further upward movement.

When Will the Bank of England Cut Interest Rates?

Following interest rate cuts by the Central Banks of Sweden and Switzerland this year, there's anticipation in the market for the ECB to follow suit, possibly as soon as June, marking a shift in monetary policy.

Similarly, the BOE might tread a similar path, with market expectations leaning slightly towards rate cuts in the same month, just surpassing a 50% probability.

Tomorrow's CPI dynamics publication could present a compelling case, particularly if it aligns with the market consensus, showing the largest year-on-year decline since last October.

The situation is similar in terms of core inflation, where there is still a long way to go to the inflation target, but forecasts assume a continuation of the positive trend.

Thus, if we do not see any negative surprises, then, according to a recent statement by Bank of England Deputy Governor Ben Broadbent, rate cuts can be expected in the coming months, with June not being excluded.

US Federal Reserve's Wait-And-See' Approach

Despite the latest US inflation data aligning closely with market expectations, it triggered another upward wave in US stock indexes and a weakening of the US dollar. However, for the Federal Reserve, this might not suffice as a catalyst for a swifter policy pivot, given that consumer inflation dynamics persist above the 3% threshold, showing no signs of returning to target levels.

What does this mean for the dollar? It appears that the market has largely factored in the momentum generated by the inflation figures through recent declines. With no significant data releases expected in the coming days, the dollar's valuation may remain steady. This, in turn, creates space for the British pound to take the lead in the short term on the GBPUSD pair.

Prospects for Extending the Upward Movement on GBP/USD

Will the upward momentum on GBP/USD continue?

Following a local rebound prompted by a test of the supply zone around the 1.27 level, buyer interest is gradually and steadily pushing prices higher. Presently, the next target for buyers is another supply zone near 1.28, offering approximately 100 points of upward potential.

Bottom Line

If tomorrow's inflation data falls harder than expected, the British pound could weaken. From a technical perspective, a drop below the 1.2640 support level would signal a reversal of the local uptrend, potentially leading to levels below 1.25.

***

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $9 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

-

Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

-

Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

-

And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - claim your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.