We are not alone in pointing to the large increase in Treasury issuance coinciding with a lack of demand from traditional buyers (the Fed, China, Japan, and Russia, as well as US banks). Treasury issuance is increasing not only because of the widening deficit and the backlog of Treasuries from the debt-ceiling related pause earlier in the year, but also because nearly 30% of all outstanding Treasury debt will mature in the next 12 months and have to be rolled over.

These events perhaps show that the Fed has lost control of the narrative. Many commentators think that the Fed will be forced back into the Treasury market as buyers. And at any rate, the probability of a rate hike next month has dropped to just 7%, down from 30% a few days ago and over 50% in mid-September.

Indeed, a weakening economy and widening budget deficit will prevent the Fed from raising rates more in an election year, even as inflation remains stubborn. The acknowledgement of that confluence will spark the next bull market in gold.

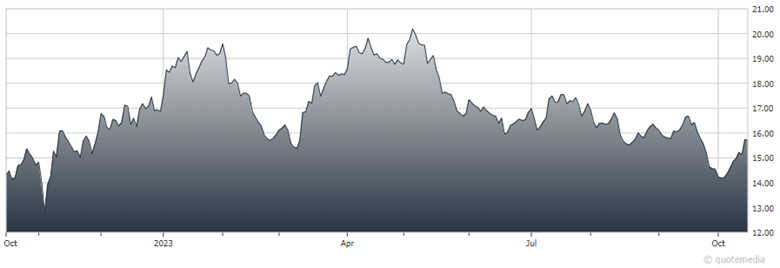

Barrick Gold (NYSE:GOLD)

As for Barrick, it reported mixed operational results. Pueblo Viejo had expansion ramp-up difficulties while the Carlin mine reported lower grades.

Although both gold and copper production showed increases on the prior quarter, and the company has indicated higher production in the fourth quarter, it is unlikely it will be sufficient for it to reach its annual guidance. Similarly, though cash costs are expected to have fallen from the second quarter, they remain above the company’s annual guidance.

Barrick will release its full quarterly financials at the beginning of next month. Separately Barrick has been granted a mining lease for its Porgera mine in Papua New Guinea, clearing the way for a restart of the mine that has been suspended for three years. This follows arduous negotiations between the company and various other parties, including landowners.

Once compensation is agreed with landowners, the mine can restart, probably before the end of the year. Under the revised agreements, Barrick and its partner partner Zijin will own 49% of the mine and be the operator. Barrick’s share of production could be as much as 250,000 ounces per year, making it the company’s 10th largest mine.

At present, Barrick has excluded Porgera from its 2023 and five-year guidance. Barrick, up 15% in a recent 10-day period, remains a buy.

Recommended Action: Buy GOLD