Down Trend

Gold and silver is probably one of the most hyperactive commodity in trading, as so many traders & investors have attempted to pick "bottoms" and "tops" to make a fortune on it's fast moves.

Unfortunately it is the hardest endeavor and most difficult way to trade (picking tops and bottoms), and it could make your life miserable if your trading/investing is solely based on calling major tops & bottoms (watch my video here).

Rather than calling 'tops' & 'bottoms', it will probably give you more of an edge, if you understand the primary-term trends and follow (hence not going against the trend).

Here is why.

Gold and silver buyers have been calling the bottom since the late-2013, though we did see strong move early-2016, those bottom callers really suffered for about 2-3 years.

But even with recent bullish-move since the early-2016, it's hard to believe, just yet, that the gold and silver has completely bottomed.

Trend is most overlooked and undermined item in trading & investing; because the most do not respect it.

Stocks move in a trend (in minor, intermediate, and primary), as long as it is in a trend, we must assume that it could continue in the direction of that trend.

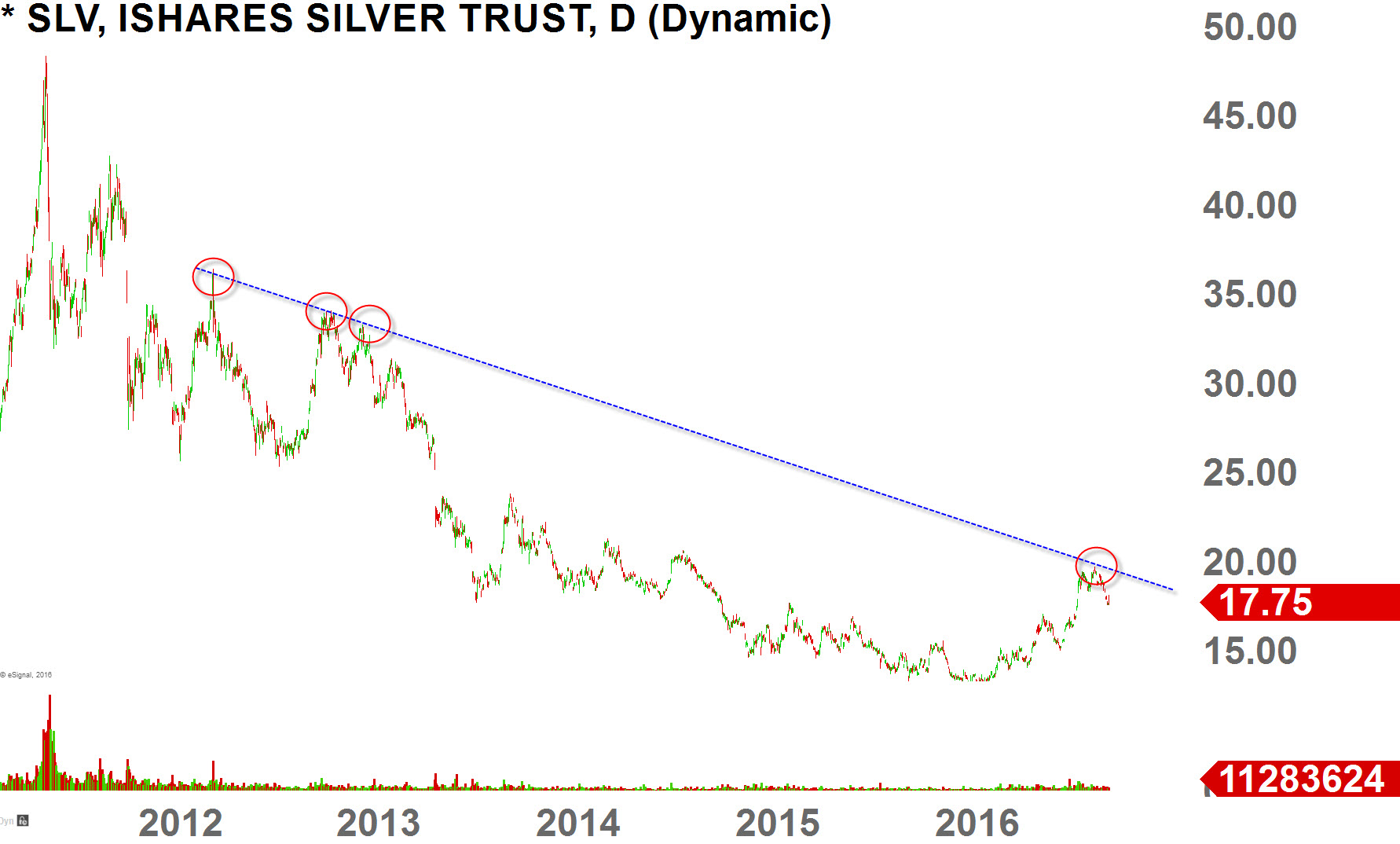

Of course, we may & should ascertain to all possibilities especially if there are signals for a reversal of that trend. But as of today, I do not see any tangible signals that would support the idea that the gold and silver has completely bottomed (though it may have bottomed for short-term, but I am talking about the long-term for the primary-term uptrend) and ready for a strong uptrend (at least not just yet); in fact, we are still in a primary-term downtrend as you can see in the charts below.

I would say we have cautionary signals in the minor to intermediate term in gold and silver as of today, as I have depicted two charts for this article below.

Buyers would, at least, want to see the price-action staying well above this downtrend-resistance otherwise we may see more deterioration in this market.