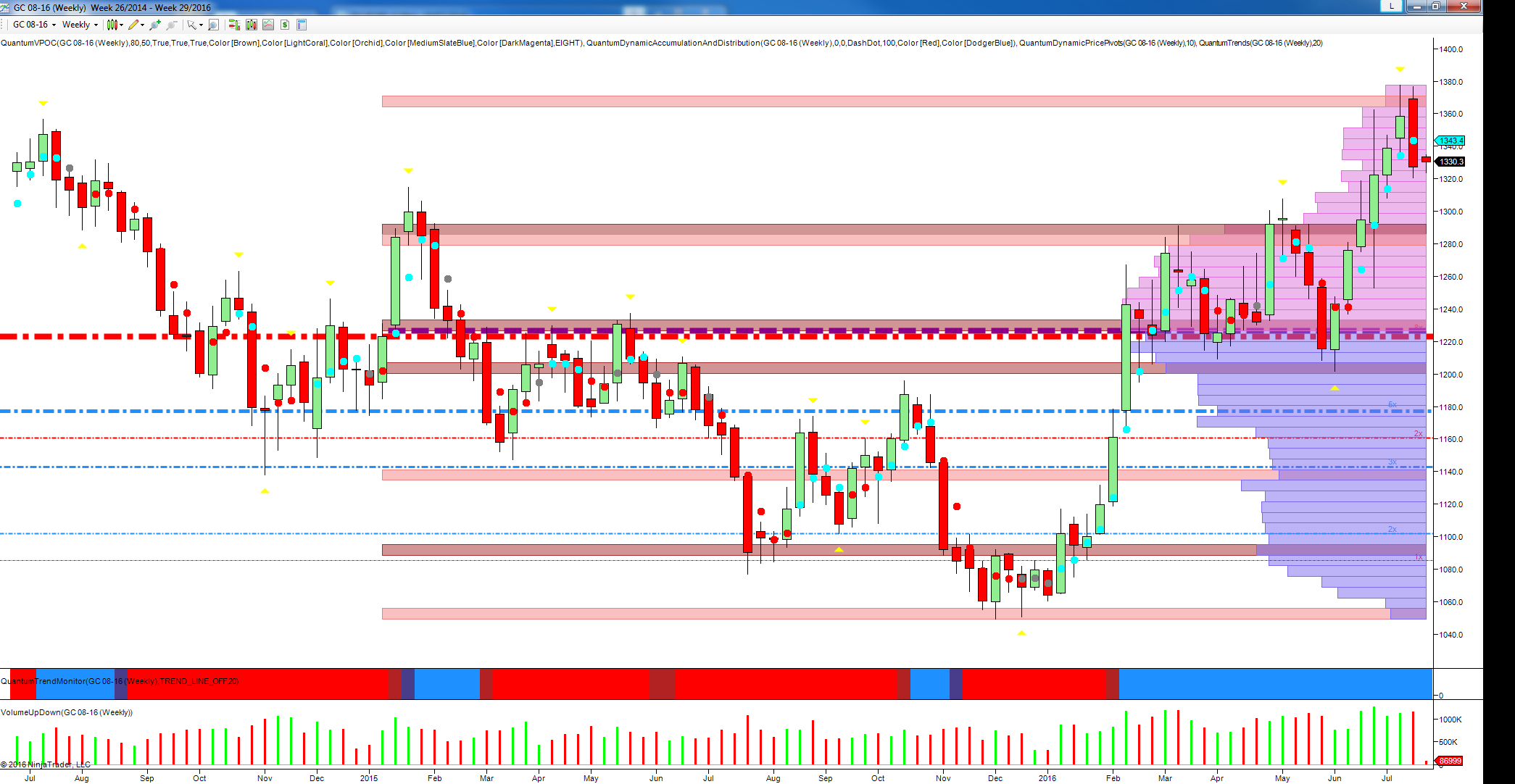

Last week’s bearish engulfing candle for gold on the weekly chart appears to have had some follow through at the start of the new trading week as the precious metal fell victim to a renewal of risk appetite as most global equity markets made fresh monthly highs and the S&P 500 and Dow soared into new high ground.

The key downside level for gold is now the $1320-per-ounce price point, where we only have very minor support, and a failure here will see gold approach a low-volume node on the daily chart, which would then open the way to a rapid move to the next significant support platform in the $1290 region. What’s also interesting on the daily gold chart is the volume point of control currently sitting at the $1280-per-ounce region.

To the upside, this morning’s price action has seen the precious metal attempt to base around $1325 in an attempt to regain the $1330 price point; but with a number of failures, this is proving to be a bit of a challenge.

Meantime, the USD is playing its part in gold’s struggle, with the USD index pulling higher and looking to move through the 97 area of resistance.

From a fundamental perspective, the longer-term prospects will depend on a number of factors. First, the likelihood of further shocks to global markets. One that is currently hiding in ‘plain sight’ is the fragility of not only the Italian banking system, but also a potential problem with Germany’s largest bank, Deutsche Bank (DE:DBKGn). This was highlighted in a recent report from the IMF that stated: “Deutsche Bank appears to be the most important net contributor to systemic risks in the global banking system". Then we have the US presidential election, which although some months away, will soon add its own brand of volatility to the markets. Finally we have the Brexit instability, which although absorbed in the short term, is likely to continue to impact markets as negotiations for decoupling begin in earnest.

Which of these canaries in the gold mine will sing the loudest remains to be seen.