Gold prices witnessed their first decline in four weeks, down 3.5% over the week, as it appears that investors have capitalized on gold’s all-time high as an opportunity to secure profits.

The week's poor performance marked a significant shift for the precious metal, which had previously reached an unprecedented peak at $2,135.40 per ounce on Monday. This surge was largely driven by robust central bank demand, a weakening dollar and increased expectations for future rate cuts by the US Federal Reserve. That said, the uncertainty surrounding the timing of the Federal Reserve's rate cuts could keep pressure on gold prices and sustain the current bearish correction.

In addition to profit-taking strategies, changes in currency dynamics may also play a role in influencing gold prices. The dollar index was up 0.7% for the week, steadying around the 104 threshold on Friday, and making the yellow metal priced in dollars more costly for holders of other currencies.

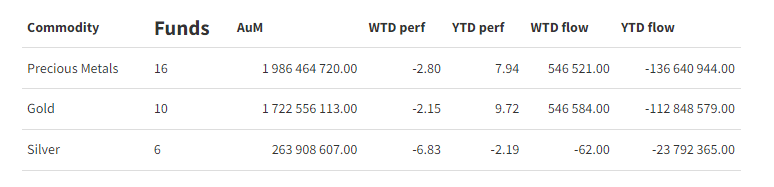

Gold funds lost 2.15% over the week, though they saw inflows of just over half a million dollars.

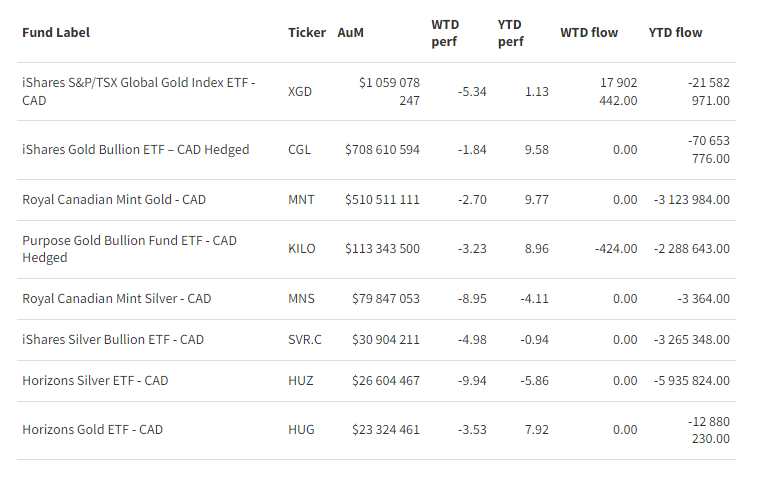

The iShares S&P/TSX Global Gold Index ETF (XGD) and Purpose Gold Bullion Fund ETF (KILO) fell by 5.34% and 3.23% respectively, but XGD attracted $18 million net subscriptions over the period, demonstrating continued investor interest in the yellow metal.

Group Data

Funds Specific Data