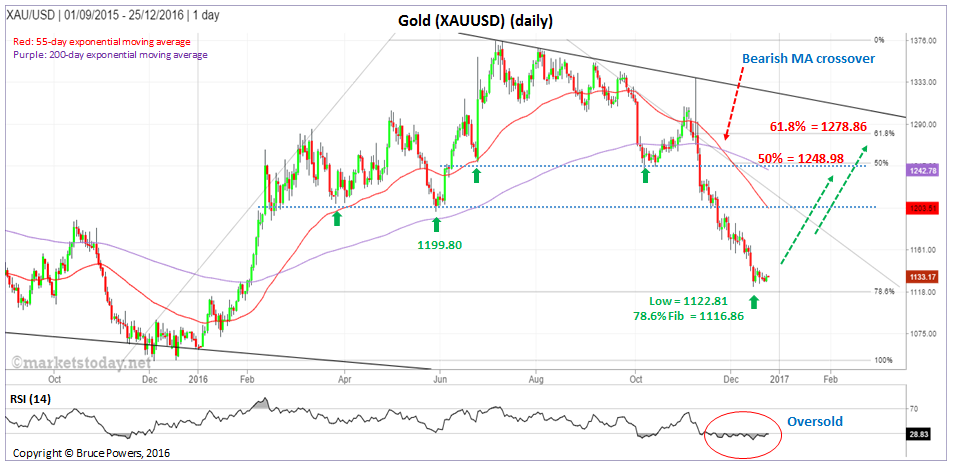

Spot gold (XAU/USD) remains in a long-term downtrend following a test of resistance at the long-term downtrend line over multiple weeks from July to September, and then again in November. A swing high of $1,375.15 was reached during that time, which was also a 2016 high and the highest price since March 2014.

Eventually, buyers capitulated and the precious metal fell decisively for six weeks until hitting a low of $1,122.81two weeks ago. Essentially, that decline completes a 78.6% Fibonacci retracement ($1,116.86) of the uptrend begun from the 2015 low. Although there is no real bullish divergence on the 14-day RSI so far, it has been oversold for the past month.

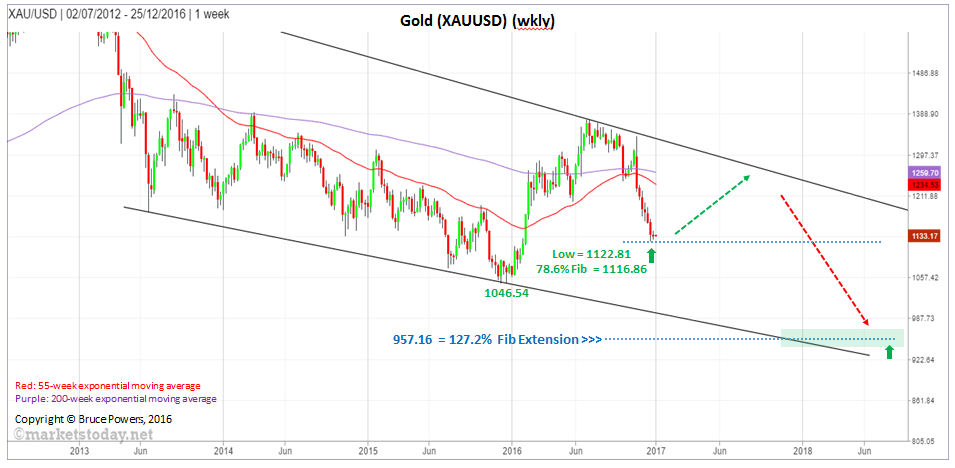

Until proven otherwise the long-term downtrend can be anticipated to continue- eventually.

Price remains below the long-term downtrend line. 55-week exponential moving average (ema) was unable to cross back above the 200-week ema. It has remained below the 200-week ema since December 2013. Price got above the 200-week ema for much of 2016 after falling below it in 1Q 2013, but is now decisively back below the 200-week ema.

Near-term positive

Regardless, given the analysis in the first paragraph above, in the near-term there is a reasonable chance for a decent bounce, and possibly another test of resistance of the long-term downtrend line.Fibonacci retracements of the current short-term decline can be used as potential targets and to correlate with the downtrend line once it is approached. The 50% retracement level is at $1,248.98, and the 61.8% price level is at $1,278.86, and can be seen on the following chart.

Long-term lower target at 127.2% Fibonacci extension

If the long-term downtrend remains intact going forward and the 2015 low of $1,046.54 is eventually exceeded to the downside gold could easily reach the 127.2% Fibonacci extension of the uptrend off the 2015 low. That extension is at $957.16 and is a minimum lower target.