In a shift of fortunes, exchange-traded funds (ETFs) that track gold miners have made headway in the recent financial market moves. Following a challenging week previously, gold miner ETFs bounced back impressively, gaining an estimated 3.96%.

The momentum was not limited to the yellow metal alone. Other precious metals took the cue and rallied in tandem. Notably, silver and silver miners ETFs found themselves among the week's top performers.

Yet, despite the upbeat trend observed this week, disconcerting realities persist within the gold mining industry. According to Adam Hamilton, mining equity analyst, rising costs at an annual rate of 7.7% and falling production volumes are elements that place immense pressure on an already challenging operating environment.

Underperforming stocks like Newmont (-17.24% YTD), one of the biggest gold miners in the world, have been impacted by a unique dichotomy in the market. While there has been a modest growth in gold bullion this year (+4.65% YTD), the performance disparity between the yellow metal and miners’ equities amplifies specific risks inherent to companies such as Newmont navigating this particular industry.

One market watcher noted: “Higher outputs bolster operating cash flows which facilitate expansion of mines and drive virtuous circles of growth. Increased gold mining boosts profitability by spreading substantial fixed operational expenses across more ounces produced." However, for significant players such as Newmont, Barrick Gold (NYSE:GOLD), and Kinross Gold (TSX:K) among others making up almost three eighths of GDX (NYSE:GDX)'s total weighting — fall in output doesn’t bode well.

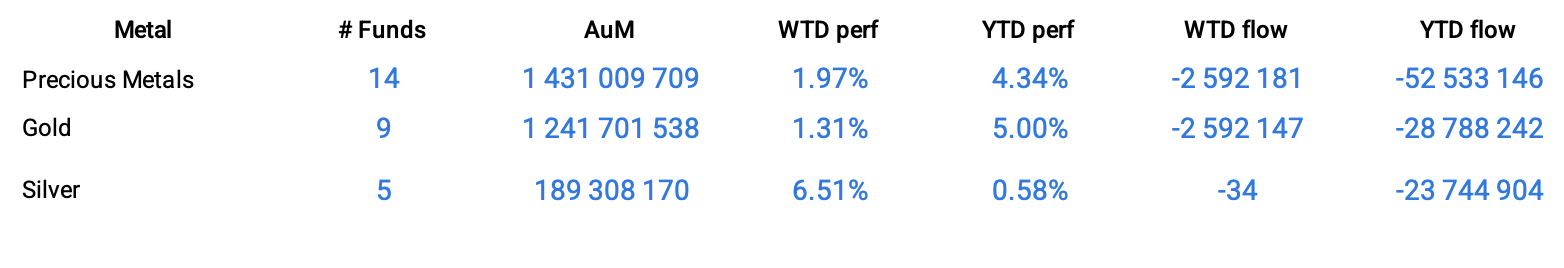

Group Data

Funds Specific Data: XGD, SVR, ZJG, SBT.B, ZGD

This content was originally published by our partners at the Canadian ETF Marketplace.