Despite the Federal Reserve holding rates steady last week after a series of ten hikes to fight inflation, Jerome Powell maintained a hawkish slant on Wednesday while speaking to the House Financial Services Committee. He stated that more rate hikes are likely this year as “inflation pressures continue to run high, and the process of getting inflation back down to 2% has a long way to go.”

For gold investors, this is unlikely to be good news. With more rate hikes on the horizon safe, yield-earning investments, especially money market funds, are growing in appeal as an alternative to more traditional secure investments such as gold. Indeed, the yellow metal dropped by almost USD 37 to USD 1,921/Oz last week, a level not seen since mid-March. Other precious metals also took the hit with silver and platinum down -7.32% and -6.60% respectively for the week.

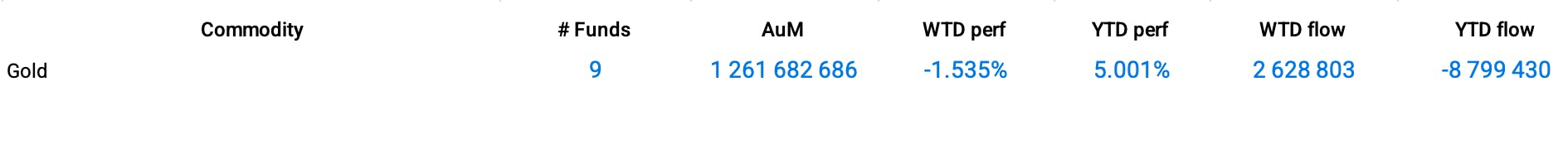

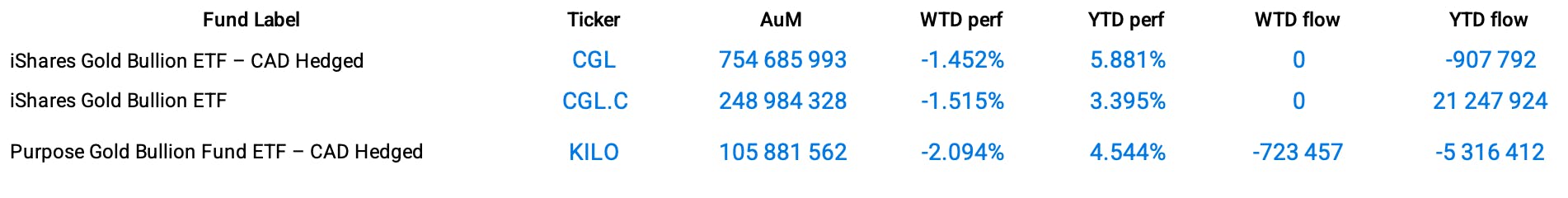

Against this backdrop, gold ETFs lost 1.54% week-over-week with net outflows of more than CAD 2.6 million. The iShares Gold Bullion ETF – CAD Hedged (CGL), the largest gold ETF in Canada with CAD 755 million under management, lost 1.45%.

Group Data CAD

Funds Specific Data CAD : CGL, CGL.C, KILO

This content was originally published by our partners at the Canadian ETF Marketplace.