Gold has long been the go-to safe-haven asset for times of economic uncertainty, offering a reassuring grip on value in turbulent times. Yet in an intriguing departure from convention, the yellow metal has displayed a surprising indifference to growing concerns over an economic slowdown in China. The allure of a strengthening dollar and soaring Treasury yields have turned heads away from gold's traditionally comforting gleam.

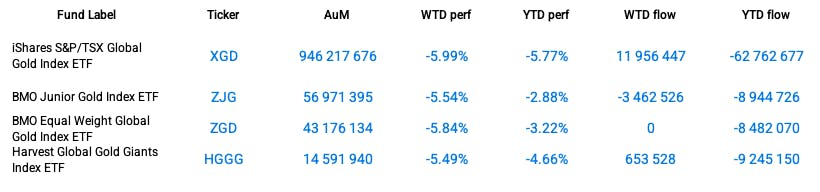

As expected, gold miners' ETFs mirror this trend with corresponding losses registering a significant 5.5% for the week. This wave of selloffs further suggests growing anticipation of a robust American currency, underpinned by hawkish signals from the Federal Reserve.

What we’re witnessing is less a fall from grace for gold, and more a rise in credibility for other financial instruments. The seemingly insuperable bond between market instability fears and burgeoning gold demand has faltered momentarily in the face of more attractive alternatives.

At the same time, we’re seeing Dollar Index Bullish ETFs step into the limelight - reaffirming faith in hard currency with an advance of 0.7% on average this week alone. This faith is vindicated by rises in US Government bond yields - an indicator commonly used to gauge indications related to monetary policy shifts which can trigger significant market realignment.

For now, it remains essential to monitor the continued interplay between these markets closely. As ever with global finance, today's underperformer could swiftly reshape itself into tomorrow's hot ticket - reminding us that change is not just inevitable but forms part of any mature investment terrain's anatomy.

In conclusion, though there's a bleak outlook painted within some quarters regarding gold prices' short-term future, one thing looks certain: investors are increasingly considering stepping out from beneath gold’s shadow and embracing an invigorating spectrum of other asset opportunities driven by wider global uncertainties.

Group Data: Gold

Funds Specific Data: XGD, ZJG, ZGD, HGG

This content was originally published by our partners at the Canadian ETF Marketplace.