- An upbeat Fed meeting has dashed hopes of any imminent interest rate hikes.

- Federal Reserve's dovish tone yesterday has ignited a rebound in gold and silver prices.

- Gold has resurged above $2,000, while silver now eyes a retest of the $26 resistance.

After an unexpected surge to new all-time highs above $2,100 per ounce at the beginning of the month, gold underwent an equally dynamic correction.

A parallel scenario unfolded for silver, which once again fell short of breaking through the crucial resistance around the $26 per ounce mark.

However, the dynamics shifted with the Fed's final meeting of the year yesterday, marked by a decidedly dovish stance by Powell and his peers. This development brings us closer to a potential interest rate cut cycle, already starting in FOMC's March meeting.

On top of this, several macroeconomic conditions are aligning favorably with technical indicators for the precious metals market, setting the stage for another long-term bull, particularly for gold, which tends to thrive in a declining interest rate environment.

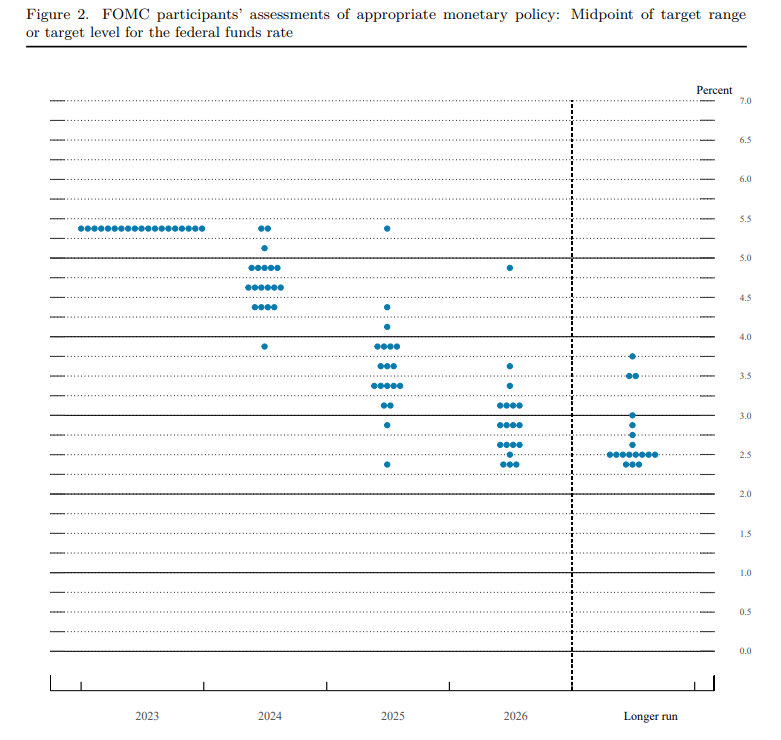

Fed Dot Plots Clearly Point to Pivot

Even though it hasn't been officially declared, the end of the interest rate hike cycle seems imminent. This is evident from Jerome Powell's statements, stating:

"Committee members no longer see further interest rate hikes as appropriate, but they are also not ruling out such a possibility."

While there's still a slightly open door for a return to increases, the likelihood is minimal and contingent upon a black swan event.

This sentiment is supported by the Fed's dot plots which indicate a strong inclination towards interest rate cuts in the upcoming years.

Source: The Fed

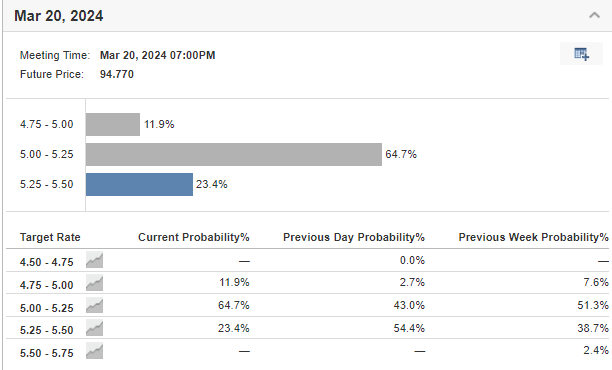

Currently, the median forecast for the future assumes a level of 4.6%, which implies at least four cuts of 25 bps each in 2024. The probability has also skewed sharply when it comes to the first interest rate cut, which points to 60% for March.

As a result, we are seeing declines in the valuation of the US dollar against most currencies along with declining bond yields, which seems to be an ideal environment for rising commodity prices including gold and silver.

All of this is happening against a backdrop of relatively strong GDP growth and a strong labor market, which, however, with falling inflation, should no longer have a major impact on decisions to cut interest rates.

Gold Technical View: Strong Momentum Could Erase Declines

The last few days have been marked by the continuation of the dynamic corrective movement, which led to the royal metal's valuation going slightly below the psychological barrier of $2,000 per ounce.

The current demand impulse clearly indicates the possible end of the corrective movement and the continuation of the northward movement in the following days.

The key test of the bulls' strength will be the local supply zone falling around $2040 per ounce. If buyers manage to knock out this zone then the next natural target will be the historical maxima located near $2150 per ounce.

Silver Technical View: Another Resistance Test Likely?

Silver, like gold, in recent days moved within the framework of a dynamic downward impulse, which, from a technical point of view, represented a renewed defense of the key resistance area, which is located in the price area of $26 per ounce.

If the upward scenario, which became the primary option after yesterday's Fed meeting and the market reaction, is realized, a retest of the indicated level is the main target for buyers.

If this obstacle can be overcome then the attention of the bulls will be focused on the 2021 maxima falling at $30 per ounce.

***

You can easily determine whether a company is suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 60%), by taking advantage of our extended Cyber Monday deal.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky therefore, any investment decision and the associated risk remains with the investor.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI