Investment Thesis

The Global Banking and Markets segment (constitutes 65.3% of net revenues as of Dec. 31, 2024) generates revenues from IB fees, including advisory, and equity and debt underwriting fees, Fixed Income, Currency and Commodities (FICC) intermediation and financing activities, and Equities intermediation and financing activities. The segment also includes relationship lending and acquisition financing (and related hedges) and investing activities related to its Global Banking & Markets activities.The Asset and Wealth Management segment (30.2%) generates revenues from management and other fees, incentive fees, equity investments, and debt investments, as well as private banking and lending.The Platform Solutions segment (4.5%) generates revenues from consumer platforms, transaction banking, and other platform businesses.Investment Upsides:

Goldman decided to refocus on its core strengths of IB and trading operations while scaling back its consumer banking footprint and hence undertook a major business restructuring initiative. In October 2024, Goldman finalized a deal to transfer its GM credit card business to Barclays (LON:BARC). Barclays will obtain the card program’s receivables from Goldman this year. In 2024, Goldman completed the sale of GreenSky, its home-improvement lending platform, to a consortium of investors. In the fourth quarter of 2023, Goldman sold its Personal Financial Management unit to Creative Planning. Goldman aims to cease unsecured loan offerings to consumers through its digital consumer banking platform Marcus. In 2023, it sold substantially all of Marcus’s loan portfolio. These moves are in line with GS’s decision to focus on and grow core businesses, wherein it has showcased encouraging results, given its strong leadership position, wide scale of operations and exceptional talent. In global banking and markets, Goldman maintained its long-standing top position in announced and completed Merger & Acquisition in 2024. This is likely to give it an edge over its peers. Although IB revenues declined in 2022 and 2023 due to muted global M&A deal value and volumes, it rebounded in 2024 as global M&A bounced back, with deal value and volume witnessing remarkable growth. Management expects the IB business to continue to improve, driven by higher net revenues in equity underwriting and debt underwriting. We believe improved client engagement, backed by digital disruption and transformation trends, signs of growing M&A and underwriting pipelines, and the company’s decent IB backlog will support IB revenues in the upcoming period.Goldman has a solid balance sheet position. As of Dec. 31, 2024, cash and cash equivalents were $182 billion. As of the same date, total unsecured debt (comprising long-term and short-term borrowings) was $313 billion. Out of this, only $70 billion were near-term borrowings. Moreover, the company maintains investment-grade long-term debt ratings of A/A2/BBB+ and a stable outlook from Fitch Ratings, Moody’s Investors Service and Standard & Poor’s, respectively. Thus, the company’s decent cash levels and solid credit profile indicate that it will likely be able to continue to meet debt obligations even during economic slowdowns.Goldman’s capital distribution activities have been impressive over the years. In February 2023, it announced a share repurchase program, authorizing repurchases of up to $30 billion of common stock with no expiration date. In 2024, Goldman repurchased approximately $8 billion worth of its common shares. At the end of 2024, GS had the remaining $10 billion worth of shares available under authorization. In August 2024, the Federal Reserve approved a 20-basis-point reduction in Goldman’s stress capital buffer requirement, lowering it to 6.2% from 6.4%. This reduction enhanced the bank’s flexibility in capital deployment. In July 2024, the company’s board of directors approved a 9.1% increase in common stock dividend to $3 per share. Given its decent liquidity, such capital distribution activities seem sustainable. This is likely to stoke investors’ confidence in the stock. Goldman plans to ramp up its lending services to private equity and asset managers, and aims to expand internationally, which will likely support its growth over the long run. Goldman Asset Management a unit of GS intends to expand its private credit portfolio to $300 billion in five years. Once the company strengthens its operations in the United States, it plans to expand its lending business in Europe, the U.K. and Asia. In sync with this, in January 2025, in order to expand its business in private credit, private equity and other asset classes, and better serve its corporate and investor clients, Goldman unveiled several initiatives. The company is establishing the Capital Solutions Group to expand and integrate its full range of financing, origination, structuring and risk management solution operations in the Global Banking & Markets business. To ensure the finest comprehension and implementation of investment sourcing and investing capability, the company will also grow its Asset & Wealth Management unit alternatives investment team.

Goldman’s efforts to diversify its business mix towards more recurring revenues and durable earnings have led to various strategic acquisitions over the years. In 2022, the company acquired NN Investment and robo-advisor NextCapital. These moves are aimed at bolstering international presence as well as wealth and asset management capabilities. These and other past acquisitions continue to help diversify the fee-revenue base and offer top-line stability for the company. Shares of Goldman have outperformed the industry in the past year. The company’s earnings estimate for 2025 has revised upward over the past month. Given this, the stock has decent upside potential in the near term.

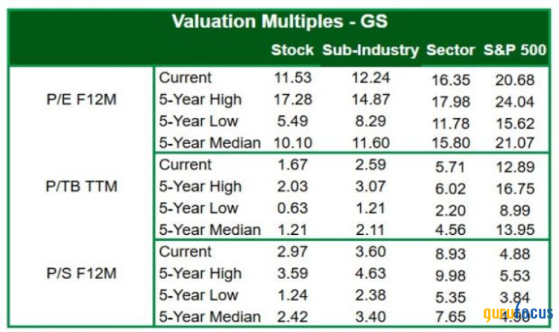

Valuation

Goldman’s shares are up 10.4% in the past six-month period and 45% over the trailing 12-month period. Stocks in the sub-industry and those in the Finance sector are up 12.2% and 4% over the past six months, respectively. Over the past year, the sub-industry is up 25.1% while the sector is up 18.2%. The S&P 500 Index is down 0.4% in the past six months and 10.9% in the past year. The stock is currently trading at 11.53X forward 12-months earnings, which compares to 12.24X for the sub-industry, 16.35X for the sector, and 20.68X for the S&P 500 Index.

Investment Risks

Given the current market volatility driven by an evolving macroeconomic backdrop, geopolitical concerns, and inflation, Goldman might see limited market-making opportunities in the Global Banking and Markets division. The segment’s revenues witnessed a decline in 2022 and 2023 due to an increasingly challenging market-making backdrop. The segment’s revenues increased in 2024, driven by record net revenues in Equities and strong performances in Investment banking fees and FICC. However, the future performance of this volatility-driven division depends on market developments and client volumes, which remain uncertain. Goldman’s bottom-line growth has been affected in the past few years by its escalating cost base. Expenses saw a three-year (2020-2024) compound annual growth rate (CAGR) of 3.1% due to higher technology costs. Goldman’s ongoing investments in technology and market development for business expansion are expected to keep costs elevated in the near term. Additionally, a rise in transaction-based expenses during periods of higher client activity will likely contribute to further expansion of its cost base.Goldman is a geographically diversified company with a presence in almost all the major markets in the world. The company has high dependence on overseas revenues as reflected in the last few years. Several risks stemming from the regulatory and political environment, foreign exchange fluctuations, and the performance of regional economies may hurt its top line. Amid escalating geopolitical concerns and to meet its legal and regulatory obligations, the company has significantly reduced exposure to Russia. Goldman’s trailing 12-month return on equity (ROE) undercuts its growth potential. The company’s ROE of 13.30% compares unfavorably with 17.10% of the S&P 500. This reflects that the company is less efficient in using shareholders’ funds.

Guru Activity

Over the past few months, Gurus have offloaded GS stock from their portfolios. Each Guru has their respective investment objective based on the overall status quo of their portfolio. However, it seems like Gurus had better opportunities elsewhere after the US Presidential Election, which they didn’t want to miss out. And this argument is further vouched by the largest shareholders of Goldman Sachs (NYSE:GS). 8 of the 10 largest institutional shareholders of the investment bank have amped up their positions as per their latest 13F filing. The largest shareholders of the company are perceiving the tightening spreads as an indication of the opportunities in the refinancing space Goldman can take leverage of. And this is why it is no surprise that the asset management arm of JP Morgan (NYSE:JPM) itself was the biggest buyer of Goldman in the last quarter.

Recommendation

In 2023, Goldman completed the divestiture of its Personal Financial Management unit to Creative Planning, resulting in a gain of $349 million. In 2022, the company acquired robo-advisor, NextCapital and Dutch asset manager, NN Investment Partners from NN Group (AS:NN) N.V. The company also closed the acquisition of GreenSky in an all-stock transaction. In 2020 and 2019, Goldman completed its purchase of Folio Financial and United Capital, respectively. Over the past five years, the stock has traded as high as 17.28X and as low as 5.49X, with a 5-year median of 10.10X. My neutral recommendation indicates that the stock will perform in line with the broader market. My $579 price target reflects 12.11X forward earnings.This content was originally published on Gurufocus.com