This article was written exclusively for Investing.com

- Bitcoin, Ethereum: leading the cryptocurrency asset class lower since April and May

- Stablecoins are cryptos, but there is a difference

- Yellen and company are looking at stablecoins

- Regulation is on the horizon

- The real reason for governmental concerns: Expect bifurcation sooner rather than later

Last week, we heard from several market luminaries via the B-Word virtual conference, an event hosted by the Crypto Council for Innovation whose stated aim is to, "demystify and destigmatize mainstream narratives about Bitcoin," as well as "explain how institutions can embrace it." Market-focused celebrity speakers at the virtual event included ARK Invest founder Cathy Wood, Twitter (NYSE:TWTR) and Square (NYSE:SQ) co-founder Jack Dorsey, and Tesla (NASDAQ:TSLA) founder Elon Musk.

Ms. Wood, who is also the CEO and CIO of her investment company, used the platform to continue expressing her bullish expectations for Bitcoin and other cryptocurrencies. Mr. Musk, Tesla’s TechnoKing, admitted to guilt for pumping cryptos but denied dumping them. Jack Dorsey, who is also the CEO of Twitter and payments company Square said, cryptos are the currency of the internet.

Musk and Dorsey are poster boys for disruptive technology forces. On the other side of the spectrum, governments worldwide rely on the status quo for power. Control of the money supply is crucial to maintaining power.

If Mr. Dorsey is correct, the cryptocurrency asset class poses a substantial threat to government control. The ability to expand and contract the money supply is critical for monetary and fiscal policies. Cryptocurrencies are a libertarian force that presents a direct threat.

Cryptos, stablecoins and the coming onslaught of government-issued digital currencies comprise the asset class. I expect a division between the three, as well as increasing regulation of the asset class.

After their parabolic rallies ended in April and May, Bitcoin and Ethereum, the crypto class leaders, are sitting a lot closer to their lows than their highs. Government leaders are signaling that they may be ready to kick the cryptocurrency asset class when it is down to prevent it from exploding to new highs.

Bitcoin, Ethereum: leading the asset class lower since April and May

Bitcoin hit its high on Apr. 14, the day of Coinbase’s (NASDAQ:COIN) listing on NASDAQ.

Source: CQG

The weekly Bitcoin futures chart highlights the decline from $65,520 per token on Apr. 14 to a low of $28,800 in late June.

At the $32,480 level at the end of last week, Bitcoin was still near the lows and less than one-half the price at the high, though at time of publishing it's trading at the $38,000 level. Ethereum, the second-leading cryptocurrency, waited until May to peak.

Source: CQG

Ethereum rose to a high of $4,406.50 on May 12 and dropped to a low of $1,697.75 in late June. At the $2,040 level on July 23, Ethereum was also under half the price at the high. At time of publishing it's also higher, at $2,333.

The parabolic rises ended, and after falling like knives, Bitcoin and Ethereum have been digesting the correction and consolidating not far from the recent lows.

Stablecoins are also cryptos, but there's a difference

Bitcoin and Ethereum are pure cryptocurrencies that reflect a libertarian philosophy, rejecting the government’s control of the money supply.

A stablecoin is a blockchain-based currency where the price reflects the level of another cryptocurrency, fiat money, or an exchange-traded commodity. The four leading stablecoins floating around in cyberspace are Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and Multi-Collateral Dai (DAI).

![]()

Source, all images: Investing.com

As of the end of last week, Tether was trading at $0.9994, and was the third-leading crypto behind Ethereum, with a market cap of over $61.76 billion. At time of publication USDT remains in third place, is at $1.0006, with a market cap of $61.83B.

![]()

During the same period, USD Coin was at the $0.9989 level, and was the seventh leading cryptocurrency, with a market cap of $27.025 billion. As we publish, it's in eighth place, trading at $0.09995 with a market cap of $27.13B.

At $0.9989 per token, Binance USD’s market cap was $11.775 billion, ranking tenth on the cryptocurrency hierarchy. At time of publication it remains in tenth position, now trading at $0.9996 with a market cap of $11.85B.

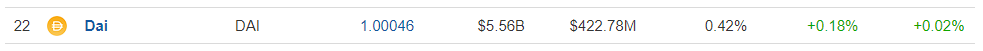

And finally, as of last week, DAI was at $1, with a market cap of $5.42 billion, ranking in twenty-second place out of over 11,000 tokens. As of publication it remains in twenty-second place, continues to trade at $1 with a current market cap of $5.56B.

Yellen and company are looking at stablecoins

Janet Yellen, the Secretary of the US Treasury, has been working with regulators to discuss stablecoins, which have been under policy maker’s microscope. The Secretary said:

“In light of the rapid growth in digital assets, it is important for the agencies to collaborate on the regulation of this sector and the development of any recommendations for new authorities.” The Secretary noted the potential benefits of stablecoins while also cautioning that regulators need a framework for “mitigating risks they could pose to users, markets, or the financial system.”

With the total market cap of all cryptocurrencies at $1.395 trillion at the end of last week, it does not pose any systemic risks to the financial system. Apple (NASDAQ:AAPL) alone had a market cap of above $2.479 trillion on July 23. Meanwhile, cryptocurrencies’ market cap rose to over $2.4 trillion at the recent high. The Treasury Secretary and many legislators feel this is the perfect time to put a regulatory framework in place before the crypto class swells to a level where they are chasing a speculative beast.

Progressive US Senator Elizabeth Warren, who has long had financial institutions and markets in her crosshairs, sent a letter to SEC Chair Gary Gensler asking him to address the risks the cryptocurrency market poses to consumers and financial markets. Chair Gensler has a history in the fintech sector as he was the CFTC Chairman when Bitcoin futures were emerging. He also taught a fintech course at MIT during his hiatus from government service.

Regulation is on the horizon

Fed Chair Jerome Powell has told the markets the central bank is evaluating the possibility of issuing a digital dollar. At a press conference following the June FOMC meeting, he told reporters that the central bank needs to “get it right” when it comes to a digital dollar.

Last week, Chair Powell commented that one of the strongest arguments in favor of a central bank digital currency is it would lessen the need for multiple stablecoins or cryptocurrencies.

It's clear regulation is on the horizon in the US and Europe. Given the Biden administration’s embrace of a more global approach, a coordinated regulatory framework is the most likely route.

China recently cracked down on cryptocurrency mining, trading, and other market aspects as Beijing prepared to roll out its digital yuan. The US and Europe will take the prolonged regulatory route while China regulates with a sledgehammer.

The real reason for governmental concerns: Expect bifurcation sooner rather than later

The underlying concern for all governments remains the control of the money supply. The purse strings are a crucial ingredient in maintaining power.

Conducting monetary and financial policies includes the ability to expand or contract the money supply. Cryptocurrencies are libertarian as they remove the control from central banks and governments and return them to individuals. The ideological divide creates a wide underlying philosophical gap.

I expect the market to bifurcate with two levels of regulation. Government-issued digital currencies and some stablecoins will carry different risk weightings and regulatory rules than cryptocurrencies and stablecoins that reflect values of more esoteric underlying products.

Meanwhile, it seems that the US government is getting serious about regulation when Bitcoin, Ethereum, and many other cryptos have experienced substantial declines. Fans of the asset class may see it as regulatorys kicking the dog while it’s down, but government initiatives are long overdue.

While we will hear a lot about nefarious uses and ransomware attacks that require payment in cryptos, the real issue is the systematic risk that the asset class shifts control of the money supply from the status quo to individuals.