Grab Holdings (NASDAQ:GRAB) has been a central player in Southeast Asia’s digital economy, evolving from a ride-hailing service into a full-fledged super app. In my previous analysis, I highlighted how Grab’s network effects, financial growth, and strategic positioning set it apart from competitors. Now, with Q4 2024 results in hand, it’s time to reassess the thesis. With a strong Q4 performance and key strategic initiatives, the company is demonstrating its ability to scale profitably while deepening user engagement.

Following the latest earnings release, I’m revisiting my investment thesis to assess how Grab’s ecosystem-driven approach, cross-user engagement, and strategic partnerships are shaping its long-term trajectory.

Strengthening Retention & MonetizationGrab’s Q4 2024 results reinforce my view that the company is successfully balancing growth and profitability while deepening its ecosystem in a way that strengthens its competitive moat. The company’s ability to integrate mobility, food, grocery, financial services, and enterprise solutions into a single platform continues to drive user engagement and spending, setting it apart from vertical competitors that struggle to build the same level of cross-functionality.

Users engaging across multiple services in Grab’s ecosystem spend significantly more than those using just one vertical, with cross-users spending four times more and showing a higher transaction frequency. This underscores the power of Grab’s ecosystem, where each additional service enhances stickiness, increases retention, and lowers customer acquisition costs. This makes it harder for competitors to lure away its customers. Grab’s ecosystem impact is clear in grocery delivery, which has now outpaced food delivery growth for two consecutive quarters. This trend highlights the company’s successful expansion beyond its core mobility and food delivery segments.

The introduction of family accounts and group orders represents another important evolution of this ecosystem. Family accounts enable multiple users to link their Grab usage, share rides and meals, and streamline transactions, increasing engagement opportunities. Group orders tap into social consumption behaviors, making it easier for users to consolidate multiple transactions into a single platform experience. Both features are designed to maximize lifetime value while lowering acquisition costs, reinforcing the network effect that keeps users locked into Grab’s services.

Beyond deliveries, Grab’s financial services division is also benefiting from ecosystem synergies. In Malaysia, 90% of GXBank customers were acquired through the Grab platform, significantly lowering customer acquisition costs and demonstrating the power of leveraging its super app to drive financial adoption. While this is a small segment of its revenue, it has minimal customer acquisition costs, strengthening retention through its financial offerings.

As users adopt more financial products within the platform, their reliance on Grab increases. The ability to cross-sell financial products within the app offers significant monetization potential, particularly as digital banking scales across Southeast Asia.

Beyond financials, management’s commentary during the earnings call shed light on Grab’s strategic investments in electric vehicles (EV) and autonomous vehicles (AVs) that will benefit its cost structure and long-term sustainability. The company has partnered with BYD to roll out 50,000 EVs in the coming years, a move expected to lower driver operating costs, reduce fuel dependency, and enhance cost efficiency. As EV adoption scales, the potential for lower operational costs and improved driver retention will likely translate into stronger unit economics over time. Singapore has already shown promising signs as an early adopter of EVs, and as infrastructure improves across Southeast Asia, Grab’s early push into electrification could provide it with a lasting competitive edge.

Additionally, Grab is actively exploring the future of autonomous ride-hailing, with management highlighting that AV adoption in Southeast Asia will likely follow a hybrid model, integrating both AVs and human-driven fleets.

FinancialsGrab’s reported $764 million in revenue for Q4 2024, up 17% year-over-year (YoY), while on-demand Gross Merchandise Value (GMV) grew 20% YoY. The company maintained expense discipline, leading to adjusted EBITDA of $97 million, a 173% YoY increase, and free cash flow of $192 million for the quarter.

Source: Grab Investor Presentation

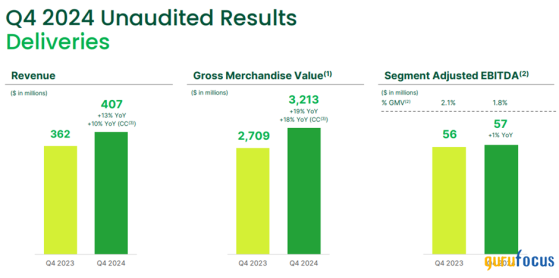

However, digging into the deliveries segment, revenue grew 13% YoY, but GMV growth outpaced it at 19%. This signals that Grab is taking a lower percentage of each transaction, indicating a lower take rate. If a company has a true moat, it should capture more value over time, not less. Adjusted EBITDA for this segment barely improved, up just 1% YoY, with its GMV-to-EBITDA contribution shrinking from 2.1% to 1.8%. While management maintains that long-term steady-state delivery margins should reach 4%, the current trajectory suggests some near-term challenges in reaching that target.

Source: Grab Investor Presentation

A similar trend is visible in Mobility, where revenue increased 19%, but GMV grew 23%, indicating a similar take-rate compression. Management reaffirmed its 9%+ long-term steady-state margin target, yet mobility margins declined from 8.7% to 8.4% YoY, suggesting pricing pressure or increased competition. If competition is forcing Grab to adjust pricing to maintain volume, that could be a headwind to future profitability.

Source: Grab Investor Presentation

Incentives continue to be a key lever for growth, with total incentives reaching $512 million in Q4, up 29% YoY. Consumer incentives, at $308 million, surged 37% YoY, while partner incentives grew 18%. Partner incentives tend to be stickier as once a driver or merchant is onboarded, churn is much lower. However, consumer incentives remain a slight concern, as churn is higher in this segment, making long-term retention more challenging. That said, management must prove its competitive advantage by gradually reducing consumer incentives over time.

Despite this, I recognize incentives are being used strategically to drive adoption of Saver transport rides and re-engage inactive users, which explains why Grab’s monthly transacting users (MTUs) continue to rise. A third of new MTUs this quarter were either new or reactivated users, showing that Grab’s incentives are working, but Grab must ensure these users continue transacting post-incentive period.

Another key profitability driver is Grab’s expanding advertising segment, which is becoming an increasingly valuable monetization lever. GrabAds penetration as a percentage of GMV has now reached 1.7%, up from 1.4% YoY, signaling growing merchant adoption. More importantly, the retention rate for merchants using advertising tools is around 75%, underscoring strong demand for visibility within Grab’s marketplace. As businesses recognize the value of advertising within the ecosystem, this segment is positioned to become a meaningful contributor to Grab’s long-term revenue growth.

As competition for advertising slots increases, higher ad pricing and improved margins should follow. Merchants are always seeking ways to stand out in a crowded marketplace, and as Grab’s user base expands, the competition for visibility will only grow more intense. Gradually, I expect merchants to bid more aggressively for top placements, mirroring trends seen in other platform-driven advertising models. This dynamic should drive a steady increase in ad pricing and margins, reinforcing advertising as a high-margin revenue stream for Grab.

Beyond being a strong incremental revenue stream, advertising enhances Grab’s ability to deepen user monetization and platform engagement. The company is actively investing in self-serve tools to make advertising more accessible, particularly for SMEs, which could accelerate adoption and long-term revenue expansion. As more businesses recognize the importance of targeted visibility within Grab’s platform, advertising is likely to evolve into a core pillar of Grab’s profitability strategy.

Grab’s balance sheet remains strong. The company holds $5.7 billion in net cash liquidity, with $364 million in debt. The company also showed better dilution control, with share-based compensation declining to $49 million, down from $66 million YoY, and shares outstanding decreasing by 0.3%.

Looking ahead, Grab’s 2025 guidance reflects some conservatism forecasting revenue between $3.33 billion and $3.40 billion, representing 19% to 22% YoY growth, while adjusted EBITDA is expected to land between $440 million and $470 million, reflecting a 41% to 50% YoY increase. Management is known for being conservative in guidance, often under-promising and over-delivering, so it wouldn’t be surprising to see an upward revision as the year progresses.

An Attractive ValuationGrab’s valuation remains one of the most compelling aspects of my investment thesis, with the stock trading at levels that suggest significant upside potential relative to its financial trajectory.

At current prices below $4.75 per share, Grab holds $1.32 per share in net cash, providing a margin of safety. This effectively means that a large portion of the business is being valued at a fraction of its potential. If we exclude the cash position, the market is effectively valuing Grab’s entire operating business at just approximately $3.43 per share, which appears extremely low, in my opinion, given its strong GMV growth, adjusted EBITDA trajectory, and competitive advantages.

From a discounted cash flow analysis, incorporating projected cash flow growth and using a WACC of 10.4%, I estimate a fair value of $7.51 per share, suggesting a potential upside of approximately 60% from current levels. This valuation is supported by Grab’s improving operating leverage, continued expansion of financial services, and higher monetization of its ecosystem. If Grab continues executing on its profitability roadmap, I expect the stock price to reflect this progress, unlocking further upside.

Source: Author

Why My Investment Thesis Remains IntactGrab’s Q4 2024 results reaffirm that my thesis remains intact. The company continues to scale profitably, leveraging cross-user engagement, financial services, and advertising monetization to deepen its ecosystem while keeping customer acquisition costs in check.

That said, incentives remain something I’m watching closely. Management is using them strategically to reactivate users and bring them back onto the platform, but retention beyond the incentive period will be key. If these users stick around and become long-term customers, it strengthens the model. If not, it could signal more work to be done.

The continued growth in cross-user adoption across services reinforces Grab’s ability to drive engagement while reducing acquisition costs, which is a strong competitive advantage. With a solid balance sheet, improving free cash flow, and growing high-margin revenue streams, I continue to see Grab as a compelling long-term opportunity in Southeast Asia’s digital economy.

This content was originally published on Gurufocus.com