Shares of prominent U.S. airline American Airlines Group Inc. (NASDAQ:AAL) have taken a monumental beating over the past year, shedding more than 20% in value year to date. Declining profitability, waning travel demand and the topsy-turvy economic climate dragged down its performance.

While recent momentum in the stock sparked hopes of a potential turnaround, fair value estimates based around realistic assumptions suggest otherwise. However, with the steep drop in value and gurus raising their stakes, along with positive technical indicators, there is growing optimism that the stock has hit rock bottom. The risks still linger, though, making the recovery uncertain but potentially promising for investors.

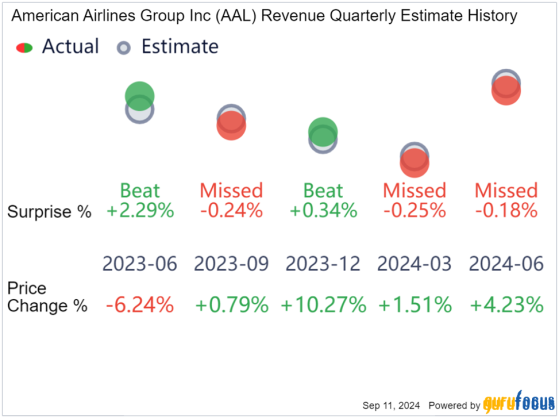

Recent results have been forgettable The past year, particularly the last two quarters, have been a bummer for the airline's investors, with both revenue and earnings per share falling short of estimates by substantial margins.

The charts highlights a mixed bag for American in terms of top-line beats over the past year. Despite occasional beats in the second and fourth quarters of 2023, the airline has missed estimates by a wide margin over the past couple of quarters.

A similar trend can be seen in its earnings per share performance in recent quarters. While the company posted a notable 23.85% beat in the second quarter of 2023, it followed it up with a steep miss in the third quarter. Additionally, in the past three quarters, estimates were missed by an average of 53%.

American proudly touted its highest-ever quarterly revenue of $14.30 billion in the second quarter, but a deeper dive uncovers the more troubling reality behind the numbers. Despite a modest 2% sales bump, profits nosedived by a whopping 46% to $717 million, or $1.01 per share. Moreover, key metrics such as passenger revenue per available seat mile and total revenue available per seat mile dropped by 5.90% and 4.90% year over year. Hence, with all the talk about its record revenue numbers, the year-over-year drop shows that revenue struggles continue to outpace the company's cost-cutting efforts.

Moreover, the company slashed its earnings per share forecast to a rage of 70 cents to $1.30 per share, well below the previous projections at $2.25 to $3.25 and market estimates at $1.10 to $2.60. Additionally, American will be looking to cut capacity growth in the second half to 3.50%, down substantially from 8% in the first half, pointing to a rocky road ahead.

Additionally, the sentiment is supported by analyst estimates for the upcoming quarters. The charts reveal a sharp downtrend in both earnings per share and revenue estimates for the airline over the past 90 days, with steep drops compared to more recent timeframes like 30 and seven days. This trend underscores the growing pessimism around the airline's near-term financial performance, reflecting major challenges amidst worrying projections.

A look at guru tradesThe chart below shows a consistent bearish trend for American, with the number of guru sells often outweighing the number of buys. Notably, in early 2024, we can see a major spike in sell transactions compared to buys, reflecting a more negative approach when the stock neared the $20 mark.

Moreover, throughout the better part of last year, we saw multiple sell transactions versus only one or two buys, indicating that major investors will continue reducing their exposure. Moreover, we see significant selling activity even when prices hovered between the $10 and $20 range. As the stock dipped near the $10 mark, buying activity surpassed selling, signaling that the market's finest are being increasingly drawn to the potential upside at these lower levels.

Moreover, the chart below shows how several institutional investors have added to their positions following the stock's recent drop in price.

PRIMECAP Management (Trades, Portfolio), for instance, boosted its stake by 34.37%, while Jefferies Group (Trades, Portfolio) and Paul Tudor Jones (Trades, Portfolio) increased theirs by 146.1% and 339.16%. Moreover, billionaire Lee Ainslie (Trades, Portfolio) increased his stake in the company by a sizeable 95.26%.

On the flipside, Renaissance Technologies (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio) reduced their stakes by 12.94% and 74.77%. Nonetheless, the overall surge in buying activity suggests at this point that gurus are buying-the-dip, potentially betting on a recovery.

Analyzing debt positioningDebt levels have probably been the biggest talking points for American Airlines in recent years. Its high leverage and significant borrowing, especially during the pandemic, made it one of the most indebted airlines, weighing down its profitability and financial flexibility. However, with the post-pandemic pent-up demand in play, the company has done a relatively good job of reducing its debt load. During the second quarter, it paid down roughly $680 million of its debt and management believes it is on track to reduce debt by $15 billion by the end of 2025.

From 2019 onwards, American shows a negative net issuance of debt. In 2019, the net issuance was at -$230 million, but that scenario changed quickly during the pandemic, where it surged upwards of $8.20 billion in 2020 and $4.80 billion in 2021. However, in 2022, the airline bounced back, reducing its debt with -$2.60 billion in net issuance, continuing the trend with -$2.8 billion in the most recent trailing 12 months.

Nonetheless, despite these efforts, American is still left with a massive debtload of upwards of $34 billion. Additionally, its financial metrics indicate that it is faring poorly compared to historical and industry averages. Its cash-to-debt ratio of 0.21 is remarkably below the industry norm, underscoring significantly weak liquidity, and a negative debt-to-equity ratio of 8.31 points to excessive liabilities compared to equity. Moreover, its Altman Z-Score of 0.66 points to financial distress, while its Piotroski F-Score of 4 out of 9 highlighting its precarious financial footing.

Naturally, the company's financial position has everything to do with its lackluster profitability metrics. The net margin of -0.23% and free cash flow margin of -1.52% not only lag the industry norms, but also its historical performance. Additionally, return on assets is at a dismal -0.19%, reflecting ineffective asset utilization and is significantly behind industry benchmarks. Moreover, its return on invested capital fares better at 12.18%, but is overshadowed by other weak bottom-line metrics.

Valuation suggests the stock has bottomed outAmerican Airlines' stock has burned investors over the past year, but is up by double-digit margins in the past month. According to Citibank, as the broader airline sector picks up the pace, the current oversold conditions present an excellent opportunity for value seekers.

Following the prolonged period of decline, analysts assign an average price target for the stock at $11.58, projecting a 5.36% rise from current price levels. Analysts project a high of $18, reflecting a healthy upside if fundamentals and operating conditions improve. Also, its GF Value of $16.70 suggests the intrinsic value of the stock is significantly undervalued based on its average price target of $11.58.

Moreover, the trend is supported by the Peter Lynch chart below. It reveals a stark disconnect between the stock price and its valuation based on Lynch's price-earnings model.

Over time, we have seen the stock has moved below its median price-earnings ratio of 7.1, suggesting it is remarkably undervalued based on its historical earnings. Additionally, it suggests American's current price may offer value if earnings stabilize. However, its tough to discount the sharp volatility in the stock, particularly post-2020, which casts doubt on whether this valuation gap can be corrected in the near term.

However, the discounted cash flow model assigns a fair value of $9.92, suggesting the stock is overvalued by 10.79% and still has not bottomed out. The DCF calculation uses a discount rate of 10%, a growth rate of 5% for the next five years and a terminal growth rate of 4%.

Naturally, there's a fair bit of discrepancy in the DCF calculation, with it being based solely on earnings and cash flow projections. Moreover, the DCF method's reliability is also comprised due to the airline's cyclical nature and volatility, reducing the accuracy of estimates.

TakeawayAmerican Airlines appears to have hit a bottom after a prolonged dip in value, offering potential upside for value investors. Guru investors have been raising their stakes, while technical indicators signal a continuation in the current uptrend. Moreover, analyst targets assign a price target of $11.58, projecting a considerable 5.36% rise from current levels. Its GF Value points to an even greater upside at $16.70. It is important to consider the lingering risks, though, including major debt and profitability challenges, but the broader airline sector's recovery could act as a catalyst.

This content was originally published on Gurufocus.com