Energy prices and energy stocks were one of the market’s few bright spots in Q3. The more-recent pullback in crude oil and gasoline has given bargain-hunting investors a chance to get on board. In this article, three of our top MoneyShow contributors weigh in on their favorite investments in the sector – and how they could deliver solid portfolio performance in the rest of 2023 and beyond!

Has the the Oil Buying Frenzy Eased?

By Phil Flynn

The dollar went up like a rocket after the US government avoided a shutdown and at least one Fed official, Patrick T. Harker, had to take elevated oil prices into account when it came to raising interest rates. It’s too bad that the Fed can’t produce oil because the only other way they have to bring down prices is to crush the economy. The Fed’s Loretta Mester said one more hike is probably needed this year before it stands pat for some time. Federal Reserve Chairman Jerome Powell also said that the Fed will keep rates higher until inflation is down to its target.

This comes as OPEC Secretary-General Haitham Al-Ghais is warning anyone who will listen that the world needs at least $12 trillion to be invested in oil and gas production by 2045 and if we do not, “we are endangering energy security.”

Yet other analysts are predicting a potential oversupply that may come down to the future of the Chinese economy. There has been a lot of concern about Chinese oil demand. Still, despite some doom and gloom predictions, Chinese oil demand has stayed close to records.

Many still believe that moving forward China’s demand could be the make-or-break point for oil. Goldman Sachs (NYSE:GS) reports that China’s demand for many major commodities has been growing at “robust rates”. They say that China’s demand for copper has risen 8% year on year, while the appetite for iron ore and oil is up by 7% and 6% respectively, all beating Goldman’s full-year expectations.

Noted oil bear Ed Morse of Citi Group told Bloomberg that he is betting, “The oil market will move between supply shortages and oversupply, said Morse. But ‘oversupply’ won’t be big enough to get us down to $20, or let alone negative prices, and the undersupply won’t be big enough to get us over $100, but it will mean volatility in the oil market.”

The author of the book The Prize, Daniel Yergin, says the market is not talking about the incredible rise in non-OPEC production, especially in the US and Canada. That could be because some are predicting that oil production in the US might level out due to falling rig counts and the plunging rates of drilled but uncompleted wells.

Still, Bloomberg reported that “US crude oil production reached the second-highest level on record in July as output from Texas’s Permian basin soared to an all-time high.”

Now before California Gavin Newsome tries to take credit for it, let’s point out that most of the Permian Basin is on private, not Federal land. Bloomberg wrote, “The nation’s production rose to 12.991 MMbpd, the highest since a peak of 13 MMbpd in November 2019, according to data from the Energy Information Administration. Most of the gain came from Texas, where oil drillers produced a record 5.63 MMbpd.” Go Texas! Bloomberg points out, “The output growth comes even as operators dial back activity.

Now back to the supply-side realities. We will likely get another draw at the Cushing, Oklahoma delivery point. We expect to see draws across the board.

Part of that is continued record oil product exports.

The Energy Information Administration (EIA) reports that US petroleum product exports totaled nearly 6.0 million barrels per day (b/d) in the first half of 2023, 2% more than during the same period in 2022. The first half of 2023 saw the most US petroleum product exports during the first six months of any year in our Petroleum Supply Monthly data, which date back to 1981.

Product exports grew more slowly in the first half of 2023 than in the first half of 2022, when they quickly rose to meet increased demand in Europe after the region took measures to reduce petroleum product imports from Russia.

Oil retreat from the key monthly resistance of $95 means that the buying frenzy has eased. While the market is soft, we think that the big-picture downside is limited. Search for option play bargains. Oil also saw some pressure from the reports that Turkey’s energy minister said the country will restart operations this week on a pipeline from Iraq that has been suspended for about six months.

WES: An Attractive Energy Name in the MLP Sector

By Martin Fridson, CFA

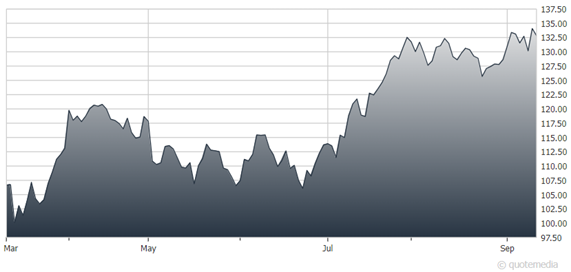

The S&P 500 posted a total return of -4.76% in September and -3.26% in the third quarter. What rained on the stock market’s parade was a continued rise in interest rates. The Fed funds effective rate increased by a quarter-point to 5.33% during the quarter, while the 10-year Treasury yield jumped from 3.81% to 4.57%.

That trend produced negative returns in most income categories, including both investment grade and below investment grade bonds, closed-end funds, convertible bonds, preferreds, and REITs. Only MLPs bucked the trend. They were buoyed by an 8.6% gain in the Generic First Crude Oil, West Texas Intermediate contract in September—and a 28.5% advance for the quarter.

As for WES, it is an MLP and a 50.8% owned subsidiary of Occidental Petroleum (NYSE:OXY), a major energy exploration company. Public unitholders own 49.2% of WES’s outstanding common units. WES owns, directly and indirectly, a 98% limited partner interest in Western Midstream Operating, LP (Midstream Operating). Although WES is not rated, Midstream Operating has senior debt ratings from Moody’s (Ba2), S&P (BBB-), and Fitch (BB+).

The partnership is engaged in the business of gathering, processing, and transporting natural gas, as well as the gathering, stabilizing, and transporting of condensate natural gas liquids and crude oil. WES’s core assets provide midstream services from two of the most active and productive basins in the United States – the Delaware Basin in West Texas and New Mexico and the DJ Basin in northeastern Colorado.

WES reported 2Q 2023 net income attributed to limited partners of $247.1 million or $0.64 per common unit, with 2Q 2023 adjusted EDITDA of $488.3 million and free cash flow of $340.1 million. Net income per common unit missed analysts’ estimates by a penny. Year-over-year revenue was down 17.9% on lower energy prices.

Distribution coverage remains solid. We recommend WES’s common units for medium- to high-risk taxable portfolios. Distributions are taxed on a variable, cost-effective basis. WES issues a K-1 to unitholders.

Recommended Action: Buy WES.

EOG: A Highly Rated, Inflation-Busting Stock in the Energy Sector

By Nilus Mattive

You’ve probably heard the old apologue about frogs in a boiling pot of water — the one where the poor amphibians don’t notice the ever-rising temperature of the liquid around them until it’s too late. Well, inflation works a lot like that, too.

Inside the government’s alphabet soup of flawed inflation measures is a basic truth: We almost never experience true deflation where prices for goods and services actually drop. Instead, we have ever-increasing amounts of inflation affecting what we buy day in and day out.

So, when the mainstream media says inflation is cooling, they simply mean the rate of inflation isn’t going up as fast as it was before. In other words, even when the Fed is “succeeding,” the temperature is rising 2% a year! And right now, it’s going up far faster than that.

EOG Resources (NYSE:EOG)

What’s more, the effects compound over time. Thus, even a short string of above-average inflation leads to substantially higher prices in a hurry. You need only look at the past several years to see how devastating all this is. Even using the government’s own flawed CPI data, something that cost $100 in 2018 now costs $121 today.

That’s a huge loss of your purchasing power over the past five years. And I don’t believe the current inflation beast has been truly tamed yet…which means it’s absolutely critical that we continue to protect our wealth through investments that produce solid, growing income streams as well as other alternative assets that can continue to outpace the actual price rises taking place in our economy.

EOG is one example. It was recently upgraded by our Weiss stock ratings to a “B-“ rating. One of the major factors was an increase in the company’s total capital. As noted recently, the company has been beating estimates and growing its bottom line. Shares are starting to respond to these great results too, with surging prices recently.

Recommended Action: Buy EOG.