The race to the lowest cost Canadian bank ETF is on, as Hamilton ETFs launch the Hamilton Canadian Bank Equal-Weight Index ETF, or ticker HEB. This low cost vehicle allows investors to gain access to the Canadian banks.

HEB ETF spotlight

HEB is Hamilton’s newest addition to its offering of ETFs which now total 12 enhanced income and financial sector ETFs. The ETF was launched on April 3, 2023 and marks the lowest cost Canadian bank ETF currently in existence within Canada, costing investors a mere 0.19% management fee.

As ETFs proliferate through the financial market, we expect to continue to see fees come down and more innovative products come to market as issuers battle for market share. A “plain-vanilla” equal-weight, passive ETF without any active strategy or element of active layering should be cheap and widely available to investors. We see the launch of HEB as an example of this low-cost battle rearing its head in the bank ETF space.

There’s no shortage of investors who want to dabble in the Canadian banks, and there is no surprise why—just pull up a stock chart for any of the “Big Six” Canadian banks and take a look at their dividend yield to see for yourself. These stocks consistently grow earnings and distribute a handsome dividend to investors, meanwhile providing the safety of never having cut a dividend once in their histories.

HEB ETF: Fund facts & constituents

HEB has launched about a month ago and it has garnered significant growth in its assets under management (AUM) in this short period of time. Here is a rundown of its fund facts:

- AUM: $519 million

- Management Fee: 0.25%

- Strategy: Passive

- Number of Holdings: 6

- Income Yield: 5.18%

HEB is highly attractive for investors seeking a monthly income distribution, with a solid annual distribution yield of around 5% at its current trading level. The ETF provides almost equal-weighted exposure to the “Big Six” Canadian banks, including:

- Bank of Nova Scotia (TSX:BNS) (17.3% weight)

- Canadian Imperial Bank of Commerce (16.8% weight)

- Bank of Montreal (TSX:BMO) (16.7% weight)

- Royal Bank of Canada (TSX:RY) (16.5% weight)

- Toronto-Dominion Bank (TSX:TD) (16.4% weight)

- National Bank of Canada (TSX:NA) (16.3% weight)

HEB stacked up against other Bank ETFs

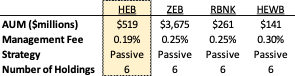

To evaluate how attractive HEB is for Canadian investors, we thought it would be worth taking some time to see how it stacks up against comparable ETFs that also hold Canadian bank ETFs.

We’ve compared HEB to three other very similar ETFs, which also hold the Big Six Canadian banks. The three ETFs are:

- BMO Equal Weight Banks Index ETF (ZEB)

- RBC Canadian Bank Yield Index ETF (RBNK)

- Horizons Equal Weight Canada Banks Index ETF (TSX:HEWB)

The first thing that stands out is HEB’s sizable cost advantage as compared to the other ETFs. HEB screens as much more cost effective which is reflected in the rapid growth of its AUM. For example, RBNK has been trading since 2017, however HEB has already almost doubled its AUM in a matter of weeks.

Both ZEB and HEWB hold the Big Six banks at relatively equal weights, while RBNK holds them in accordance to their index weights (this has resulted in a tilt towards the Scotiabank and CIBC (TSX:CM)). This makes ZEB and HEWB the most comparable. While ZEB has clearly been the leader and most dominant equal-weight Big Six bank ETF, we would not be surprised to see HEB continue to take share.

Hamilton’s pricing strategy may aim to gain brand awareness from ETF investors to garner more attention for some of their other more interesting ETFs that offer unique strategies. For example, the Hamilton Enhanced Canadian Bank ETF (HCAL), which utilizes leverage to provide an enhanced yield.

Data as of April 29, 2023.

This content was originally published by our partners at the Canadian ETF Marketplace.