- Alphabet's stock dip, despite beating earnings expectations, presents a potential buying opportunity.

- The recent decline is partly due to the failed acquisition of cybersecurity firm Wiz and mixed results from YouTube ads.

- Analysts remain optimistic, citing strong growth in AI investments and future revenue potential.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Alphabet's (NASDAQ:GOOGL) (NASDAQ:GOOG) stock dropped post earnings, presenting a potential buying opportunity as the tech giant exceeded analyst expectations across key financial metrics in the second quarter report.

The holding company behind Google reported strong earnings per share of $1.89, beating the consensus estimate of $1.84. Revenue also came in hot at $84.74 billion, surpassing forecasts of $84.19 billion and reflecting a 14% year-over-year increase.

Net income further impressed, reaching $23.6 billion and exceeding expectations of $22.9 billion, representing a 28% jump compared to the same period in 2023.

However, a note of caution emerges from YouTube advertising. While still experiencing a healthy 13% year-on-year growth, it fell short of analyst expectations, reaching $8.66 billion compared to the predicted $8.93 billion.

Can Alphabet maintain its momentum despite this YouTube hiccup? We delve deeper into the company's performance and explore the potential impact of YouTube's advertising miss.

What's Behind the Pre-Market Decline?

Alphabet's strong financial results have not been enough to prevent a pre-market decline of over 3%.

Source: InvestingPro

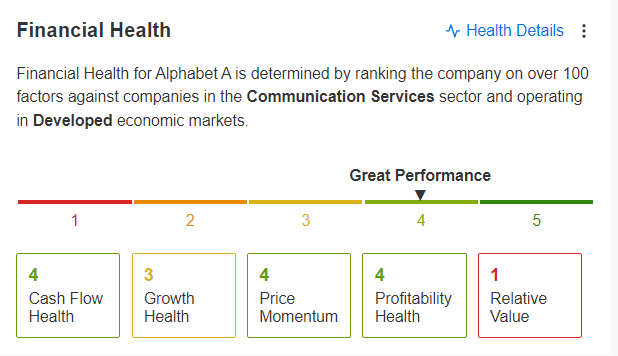

While the company's solid performance underscores its financial health, several factors contribute to the stock's current dip.

- Disappointment with Wiz Acquisition:

The sell-off may be linked to the collapse of Alphabet’s deal to acquire cybersecurity firm Wiz. The $23 billion acquisition, intended to bolster the company's cloud security, would have been its largest ever.

However, the failure to finalize this deal has dampened investor sentiment. Chief Financial Officer Ruth Porat reassured investors that Alphabet can still grow its Cloud business organically but is also exploring other ways to diversify its portfolio.

- AI Investments and Growth Strategy:

Despite the setback, Alphabet remains committed to growth, particularly in Artificial Intelligence (AI). Capital expenditures for the second quarter soared 91.4 percent year-on-year to $13.2 billion, reflecting significant investments in data centers and AI systems.

CEO Sundar Pichai emphasized that the risk of underinvestment is greater than the risk of overinvestment, with plans to invest at least $12 billion per quarter until the end of 2025, even if it affects profit margins.

- Market Reaction and Future Outlook:

The market’s reaction may be a brief pause in a stock that has risen over 30 percent since the beginning of the year. Investors are weighing whether this dip represents a temporary adjustment or a potential opportunity for continued gains.

Analysts Still Bullish on Alphabet

The current decline in the stock could be seen as an emotional reaction and a buying opportunity for investors, as analysts continue to remain bullish on the tech giant.

Thomas Monteiro, Chief Analyst at Investing.com, notes,

"While not as explosive as last quarter’s results, these numbers confirm that Alphabet continues to be a strong earnings growth machine."

He emphasizes that beyond the current figures, the company’s underperforming sectors are poised for recovery over the next year.

Monteiro attributes this potential rebound to several factors:

"We expect ad growth to bounce back as capital costs decrease and smaller companies gain additional cash and seek faster growth."

More importantly, he highlights that Alphabet is set to see substantial revenue growth as its artificial intelligence initiatives mature.

Most analysts covering Alphabet echo this positive sentiment, suggesting that the current dip offers a strategic entry point for investors.

The company’s ongoing investments in AI and its overall growth strategy position it well for future gains, reinforcing the bullish outlook.

Should You Buy This Dip?

Alphabet’s stock decline presents a potential buying opportunity, with a strong consensus among analysts that the company remains a solid investment despite recent setbacks.

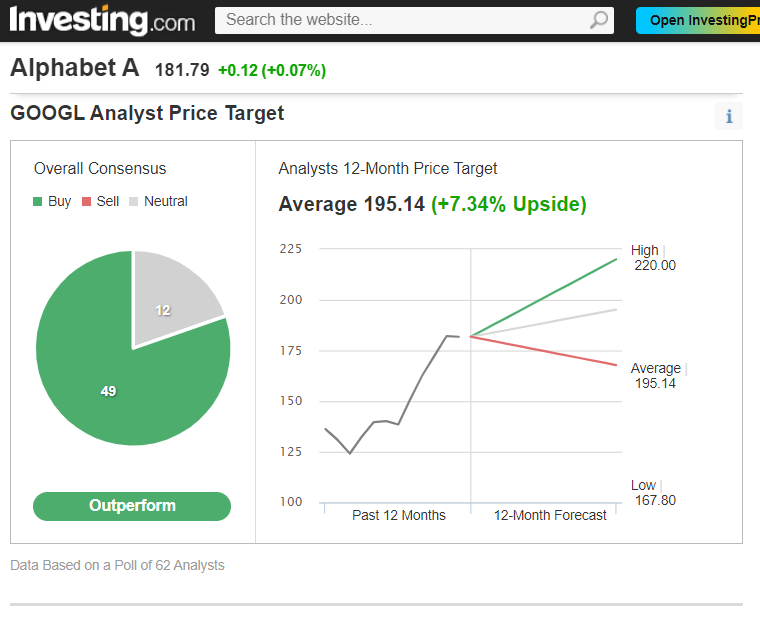

Alphabet holds 49 "Buy" ratings and 12 "Hold" ratings. According to Investing.com, the average target price from 62 analysts is $195.14, representing a 7.34 percent increase from the close on July 23.

This target could rise further if the current pre-market decline persists. Notably, RBC (TSX:RY) Capital and UBS have recently raised their price targets for the stock from $200 to $204 per share, citing Alphabet’s leadership in AI and its strong performance in key growth areas.

Despite a 30 percent increase in its stock price this year, experts continue to view Alphabet as a promising investment. The company’s cloud division remains robust, generating $10.3 billion in revenue for the second quarter, up 29 percent year-on-year, and achieving record operating profits of $1.2 billion.

Additionally, Waymo, Alphabet’s self-driving car unit, has seen revenue grow from $285 million to $365 million over the past year, positioning it ahead of Tesla (NASDAQ:TSLA) in the autonomous vehicle race.

Challenges and Risks Going Ahead

Alphabet faces several challenges, including controversies over its new AI-driven search features and concerns from publishers about potential impacts on web traffic and advertising revenues.

The company also contends with antitrust scrutiny in both Europe and the United States. These hurdles represent significant risks but are part of the broader challenges faced by innovative tech giants like Alphabet, which aim to not only generate profits but also drive societal change.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.