This article was written exclusively for Investing.com

The PHLX Housing Index has stalled out in recent months, up just over 1% since Sept. 1. However, the past couple of months have been volatile, with the index rising and falling by as much as 10% in both directions. But more recently, the index has struggled since peaking on Oct. 16.

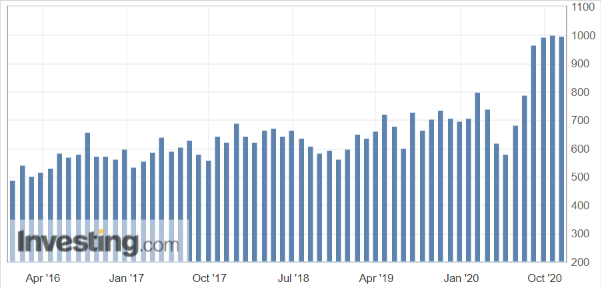

The heightened volatility might come as a surprise, given how hot the housing market has been. Mortgage rates have plunged due to the easy monetary policy the Federal Reserve has implemented. Additionally, the sector has been aided by the pandemic as families have left big urban centers to move to the suburbs and purchase homes. It means that the latest vaccine news may prove to be a headwind}} for the sector, as investors begin to rotate out of groups that benefitted from the pandemic.

Perhaps adding to this move lower in the Housing Index is also that the month over month rate of change for new homes has started to slow, and is possibly plateauing. The slowing may be forcing investors to begin looking further down the road and view the slowing monthly trends as a sign the rapid expansion is fading. Additionally, with a vaccine potentially around the corner, it seems possible that families may also opt to stay in the cities or even relocate back to cities, once deemed to be safe.

Home Improvement Struggles Too

The struggling sector extends to the home improvement names, like Home Depot (NYSE:HD) and Loews (NYSE:L). Home Depot's stock has fallen by almost 8% from its highs on Aug. 26. Still, the stock is trading around 22.2 times next year's earnings estimates, above its 5-year average of roughly 19.6.

Home Depot's stock may even continue to struggle based on the technical chart. It shows that the stock has been in a trading range of $265 to $290 since July. Meanwhile, the relative strength index has been trending lower since peaking at overbought levels in mid-July. It would suggest that the stock is currently in a consolidation phase and may still have a further drop ahead. A break of support could trigger that decline sending the stock lower to $245, a decline of around 10% from $273.96 on Nov. 25.

Technical Troubles

The Housing Index will need to continue advancing to avoid forming a potentially bearish head and shoulder pattern. This is a reversal pattern and would indicate that the index has further downside risk. Should the index fall below support at $360, it could result in a drop to $325, a decline of about 17%.

Like Home Depot, the Housing Index also has a bearish trend in the relative strength index, suggesting momentum is leaving. The index is likely to continue to consolidate.

Analysts Still Bullish

Still, some analysts are bullish on the group. On Nov. 25, Trust Financial upgraded DR Horton (NYSE:DHI), Pulte Group (NYSE:PHM), and Toll Brothers (NYSE:{{32520|TOL) to buy ratings from hold ratings. The analysts also gave the stocks significant price target increases. The analysts raised D.R. Horton's price target to $100 from $58. Meanwhile, Pulte was increased to $60 from $32, and Toll was increased to $60 from $45.

While the housing market is hot, investors appear to be getting nervous about the groups' outlook based on the indices' movements and some stocks within it. It could suggest that the market sees a potential slowing of the recently booming sector.