Amazon (NASDAQ:AMZN) Web Services (NASDAQ:AMZN), or AWS, recorded very strong growth in Q2 2024, bolstered by robust demand for AI services and sustained migration away from traditional infrastructure to the cloud.

While companies are modernizing their operations, AWS continues to reap the benefit accruing from this trend, thus finding its place in one of the leading positions among cloud providers.

With growing AI capabilities and strategic partnerships, AWS is in a position to drive the overall growth of Amazon and reinforce its competitive edge in the market.

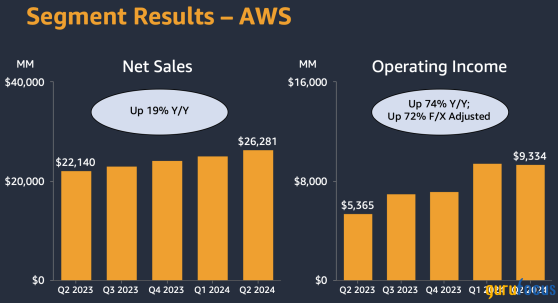

AWS's Growth Soars to 18.8% in Q2, Powered by AI Demand and Cloud MigrationAWS continues to derive high top-line growth for Amazon. In Q2 2024, AWS top-line growth accelerated to 18.8%, up from 17.2% in Q1. This acceleration in growth emerged from several macro trends. Companies are increasingly moving from on-premises infrastructure to the cloud.

Additionally, this shift will continue, with AWS benefiting from the increasing IT spending transitioning to cloud solutions. Many companies have completed their initial cost optimization efforts and are now focusing on modernizing their infrastructure. Hence, this modernization will derive more vital cloud adoption, contributing to AWS's growth.

Moreover, AWS's AI and machine learning (ML) services are seeing dramatic growth. The demand for AI capabilities is driving a multi-billion dollar revenue run rate. This is reflecting strong client interest and adoption of AWS's AI services. AWS's ability to leverage its broad functionality, strong security features, and extensive partner ecosystem positions it as the preferred cloud provider.

AWS Strengthens Lead as AI Investments Propel Cloud Market GrowthIn Q2 2024, AWS showcased robust growth in the global cloud infrastructure services market. Global spending in this sector increased by 19% year over year, reaching $78.2 billion. AWS, along with Microsoft (NASDAQ:MSFT) Azure and Google (NASDAQ:GOOG) Cloudthe top three vendorscollectively grew by 24%, now accounting for 63% of total market spending. Specifically, AWS's sales rose by 19%, marking a notable acceleration compared to the previous quarter.

Source: Amazon

This is highly driven by enterprises boosting their IT budgets in areas related to AI. Of course, other providers own over a third of the global cloud market. Still, the trend shows movement to these big hyperscalers, including AWS, with market share increasingly captured due to their advanced capability and wide service offerings.

Another important highlight is that the historical estimates of Canalys from cloud infrastructure services revenue have been revised thanks to an extensive review. Thus, this revision affected the market shares from Q1 2022 to Q1 2024 and did not alter the overall rankings and growth rates from the previous reports that confirmed AWS's solid and consistent position in the market.

Source: Canalys

Fueling the Future: How AWS's AI Innovations Drive Amazon's Ad Revenue SurgeAdding AI to AWS's offerings has helped build up Amazon's advertising capability, which testified to its substantial growth in ad revenue that neared major key milestones each year by increasing.

Amazon increased the value of its advertising platform by using AI to promptly improve ad targeting, personalization, and analytics. This drew a more diverse set of advertisers into its fold, who began to invest more in the platform. The interaction of AWS's AI innovations and advertising strengthened the top-line growth and Amazon's position in the digital advertising market.

Moreover, AWS's AI capabilities capture new channels to advertise through support for video and voice ads by Amazon Prime Video and Alexa devices. This expansion gives Amazon greater reach and consumer engagement, but it also unlocks new revenue sources because more advertisers want to take advantage of its advanced advertising capabilities.

It's important to note that AWS's AI innovations extend beyond advertising, impacting other areas of Amazon's business. In e-commerce, for instance, AI will enhance inventory management and supply chain logistics, leading to improved customer service and cost reduction.

Looking ahead, AWS's AI is set to play a disproportionately critical role in driving future ad revenue growth. With its rich AI algorithms, the platform will enable the creation of highly personalized and effective advertising strategies, further enhancing Amazon's advertising capabilities.

Currently, AWS accounts for 16% of Amazon's net sales. With AWS already well-positioned in AI services through products such as Amazon Bedrock and SageMaker, it is further positioned to see a great leap in revenues due to exponential growth in global AI demand. For instance, if AI-related revenue grows at a much faster rate compared to Amazon's North American and International segments, we could see AWS's share rise closer to 20% or higher in the coming years.

Source: Amazon

AWS has a set of advanced AI services that strengthen the AWS cloud computing platform and solidify AWS's market leadership by attracting enterprises with a high demand for sophisticated AI and ML solutions. This is supposed to drive long-term contracts and revenue stability.

Moreover, its AI technologies can be adapted for various industries such as healthcare, finance, and transportation, expanding Amazon's market reach and fostering innovation across multiple sectors.

The key metrics to track for investors who want an idea of the future impact of AWS's AI innovations on Amazon's bottom line will be revenue growth of AWS' AI and ML services and overall ad revenue growth. This is where the effectiveness of AI-driven advertising strategies can be understood by assessing user engagement and conversion rates.

How AWS's Bedrock and Custom Chips Are Driving Amazon's Growth Beyond Cloud DependencyExcessive reliance on cloud segment revenue can be considered a decisive weakness for Amazon. However, at the same time, Gen AI is making it a solid uplifter for Amazon. The Amazon Bedrock service provides secure access to leading foundation models, enabling clients to build and deploy AI applications.

Bedrock's broad selection of models and enterprise-grade security boost its appeal to businesses. These include major players like GE HealthCare (NASDAQ:GEHC) (NASDAQ:GEHC) and Iberdrola (BME:IBE) (IBDRY). Further, Amazon SageMaker is used to build, train, and deploy machine learning models. Its features (such as HyperPods) significantly improve performance and efficiency. This service supports various AI applications, including healthcare and energy sectors.

Moreover, AWS's investment in custom chips like Trainium and Inferentia boosts AI's price performance. The upcoming versions of these chips will derive vital demand. AWS's AI tools, like Amazon Q and Amazon Bedrock, are essential for applications in healthcare, energy, and business process optimization. These tools help accelerate development cycles, improve operational edge, and support advancement across industries. Hence, AWS's AI capabilities derive growth by seizing diverse client needs, from AI model training to application development, reinforcing Amazon stock's presence among Magnificent 7.

Lastly, according to the tech expert Panayot Kalinov, AWS's AI advancements have propelled Amazon's ad sales to exceed $50 billion annually, growing by over $2 billion year-over-year, providing the company with a powerful new revenue stream. As AWS continues enhancing its AI tools and cloud services, this synergy is expected to further boost ad revenue through improved targeting and personalization while enhancing other areas like logistics and customer servicedriving growth across the entire company.

Overall, AWS's AI and cloud technologies are likely to play a crucial role in further boosting Amazon's ad revenue. Looking forward, one should monitor AWS revenue and margin expansion as a critical signal for Amazon stock's bullish momentum.

Amazon's High P/E Ratio: Justified by Superior Growth and AWS EdgeAmazon is trading approximately 33 times forward earnings, higher than Microsoft's (NASDAQ:MSFT) 33x and Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) 19x. While this suggests Amazon is more expensive, considering the expected earnings growth changes the picture. Amazon's expected EPS forward long-term growth (3-5 year CAGR) is 23.44%, notably higher than Microsoft's and Alphabet's projections. Amazon's ratio becomes more attractive when adjusting for growth using the forward PEG ratio (forward P/E divided by expected EPS growth). A forward PEG of 1x implies fair value relative to growth; Amazon's forward PEG is higher than Alphabet's but lower than Microsoft's, indicating it is reasonably valued given its superior growth prospects.

AWS takes advantage of the high demand for cloud migration and AI services. AWS's largest strategic advantage over Azure is its in-house chips, which will reduce dependence on suppliers like Nvidia (NASDAQ:NVDA), thus allowing for improved profit margins. Amazon ramps up leverage in open-source AI models, too, boosting its competitive edge as Microsoft's early access advantage over OpenAI begins to fade. Although Amazon seems expensive at first glance, its strong expected earnings growth, and strategic advantages in cloud computing and AI, support the valuation, making it an attractive choice for growth-oriented investors.

Risk Assessment: Is Amazon's Heavy Reliance on AWS a Hidden Risk?Amazon's significant reliance on AWS poses a major risk. While AWS contributes 16% of net sales, it generates most of the operating income. A slowdown in AWS growth could severely impact overall profitability. The recent rebound in North American e-commerce may falter if consumer spending declines. Historically, Amazon struggles to maintain net margins above 25%; current margins may regress, affecting earnings.

Additionally, rising unemployment rates in 2024 and the recent un-inversion of the yield curvea traditional recession signalintensify these concerns. Deloitte forecasts slower holiday sales growth of 2.3%-3.3% for 2024, down from 4.3% last year, suggesting weakened consumer spending that could hurt Amazon's core retail business.

Businesses might reduce cloud and AI investments during economic downturns, potentially slowing AWS growth. Additionally, Amazon's forward price-to-sales ratio now slightly exceeds its five-year average, indicating limited upside and a narrower margin of safety for investors. Given the concentrated dependence on AWS, potential economic headwinds, and valuation concerns, Amazon faces significant downside risks that warrant careful investor consideration.

TakeawayAmazon's AWS is experiencing strong growth fueled by high demand for AI services and cloud migration, reinforcing its market leadership and boosting Amazon's overall revenue, including ad sales. While this success enhances Amazon's competitive edge, the company's heavy reliance on AWS poses a risk if growth slows; however, strategic investments in AI technologies and custom chips justify its valuation and position it for continued expansion.

This content was originally published on Gurufocus.com