DoorDash (NASDAQ:DASH), the leader in food delivery, connects millions of people with their favorite local restaurants through its robust platform. Users can browse a variety of restaurants, place orders, and have meals delivered to their door by DoorDash's delivery drivers, known as Dashers. This convenience has revolutionized how people enjoy meals from local restaurants without leaving home.

Though best known for restaurant delivery, DoorDash operates as a logistics and technology company, facilitating connections between consumers and local merchants. Over time, it has diversified into grocery, convenience, and retail delivery, broadening its service offerings. The company focuses on three main constituents: merchants, consumers, and Dashers. Merchants benefit from services that help grow their businesses; consumers enjoy a wide selection, consistent experiences, and affordability; while Dashers have access to flexible, earning opportunities.

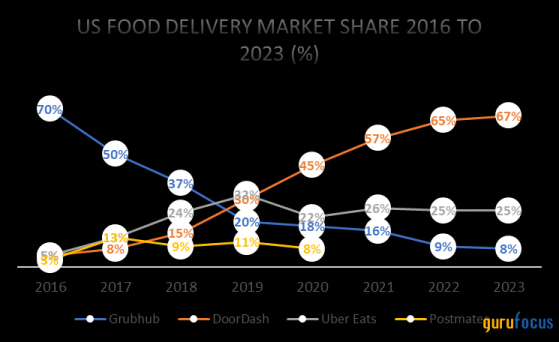

Despite increasing competition and rising economic concerns, DoorDash has strengthened its dominance in the U.S., the world's second-largest food delivery market.

Source: Author based on Business of Apps

While food delivery remains at its core, DoorDash is expanding aggressively into other verticals, such as retail and alcohol delivery. This diversification positions the company to capture a broader share of the estimated $1.2 trillion total addressable market for delivery services.

DoorDash has built a strong ecosystem with over 37 million monthly active users and partnerships with more than 550,000 merchants. As the number of active users grows, more merchants are willing to pay for exposure on the platform. What makes platforms like DoorDash so powerful is that customers are not tied to a specific restaurantthey are customers of the platform itself, with access to a wide variety of options. This creates a dependency for small and medium-sized businesses, many of whom rely on DoorDash for over 70% of their revenue. Furthermore, merchants can reduce staffing costs by utilizing Dashers instead of employing their own delivery drivers

Financial PerformanceIn 2024, DoorDash has demonstrated robust financial performance, driven by steady revenue growth despite challenging macroeconomic conditions. In Q2 2024, DoorDash reported a 23% year-over-year (YoY) increase in revenue, reaching $2.6 billion. This growth was fueled by a 19% rise in total orders (635 million) and a 20% increase in gross order volume (GOV) to $19.7 billion. DoorDash achieved an adjusted EBITDA of $430 million with a record margin of 16.3%, up from $279 million in the prior year.

Source: FinChat

The company's focus on growing both its core and new verticals has also led to expanding DashPass and Wolt+ memberships, which contributed to an increase in order frequency and customer engagement. DoorDash has added new merchants in its traditional core grocery business as well as in alcohol, beauty, home improvement, and sporting goods. DoorDash continues to expand its partnerships with over 550,000 merchants, including its ongoing growth in non-restaurant verticals such as grocery and retail.

On the balance sheet, DoorDash has never been healthier financially, with $4.85 billion in cash and short-term investments, and no debt, DoorDash is in a strong financial position to pursue new opportunities. Despite the unprofitable challenge, the company's strong free cash flow, which grew 45% YoY to $451 million, provides ample liquidity for reinvestment in growth.

Key Drivers and Investment Case

1. A New Business Cycle

As central banks around the world shift toward cutting interest rates, we are entering a new economic cycle. Lower rates should stimulate economic growth and improve consumer sentiment, especially in regions like the U.S. where a recession has been avoided. Increased consumer confidence and purchasing power are expected to drive more demand for DoorDash's services.Furthermore, the U.S. labor market remains resilient, which has a direct impact on discretionary spending for services like food delivery. As inflationary pressures subside and consumers feel less burdened by rising costs, DoorDash could see an uptick in both order frequency and average ticket size. This new cycle will likely provide the company with a much-needed boost, especially as the economy regains momentum.

2. The DoorDash Commerce Platform for Merchants

DoorDash has introduced several new products aimed at helping merchants manage and grow their businesses, including its Commerce Platform and a Business Manager App. These tools allow merchants to create their own branded websites and mobile apps for direct online ordering. This provides businesses with the ability to manage direct-to-consumer sales and digital presence independently, similar to Shopify's (NYSE:TSX:SHOP) model for retail businesses. While this strategy could be seen as a direct competition, DoorDash's platform is tailored to a more niche market related to food and local delivery merchants such as restaurants, grocery stores and convenience stores.What truly sets DoorDash apart is its integration of delivery logistics into this platform. By offering merchants the ability to manage both digital ordering and physical delivery in one place, DoorDash becomes a comprehensive solution for businesses seeking to streamline operations.

The Commerce Platform is designed to create an omnichannel focus, allowing merchants to have a seamless and integrated platform to manage their operations across multiple channels, whether in-store, online, or through delivery. Merchants can unify their customer interactions, simplify order management, and increase operational efficiency. This gives businesses the ability to leverage DoorDash's technology and reach a wider customer base, all while maintaining control over their brand and customer data.

Moreover, as merchants utilize more features of the DoorDash platform, they can reduce the commission fees they pay. However, DoorDash is creating powerful switching costs as businesses grow dependent on its technology, which fosters long-term partnerships. Ultimately, this strategy benefits both partiesmerchants grow their businesses on DoorDash's infrastructure, while DoorDash builds a more embedded and indispensable platform for local commerce.

3. Expanding Non-Restaurant Vertical and International Presence

DoorDash's efforts to diversify into grocery, alcohol, and retail have been highly successful. Non-restaurant verticals now account for 35% of total orders, reflecting the growing demand for delivery in sectors beyond food. The company has reported triple-digit growth in grocery delivery for three consecutive quarters, highlighting the immense potential in these adjacent industries.Internationally, DoorDash is just beginning to tap into a global market. DoorDash's current dominance in the U.S. market is undeniable, but on a global scale, it faces stiff competition. Apps like Uber Eats, Just Eat, and Delivery Hero continue to outpace DoorDash in terms of downloads and market presence.

Source: Author based on Business of Apps

Expanding internationally presents a significant opportunity for DoorDash, as it currently operates in only 25 countries. However, the acquisition of Wolt in 2022 has positioned DoorDash for further global expansion. Wolt's presence in Europe and other regions opens the door for substantial growth abroad. By integrating Wolt's network and expertise, DoorDash can more rapidly scale its non-restaurant verticals across international markets, especially in areas where digital commerce is accelerating.

4. Advertising Business

DoorDash's burgeoning advertising business generated approximately $450 million in the past year, far exceeding expectations. As the platform grows, merchants are increasingly incentivized to advertise to stand out among competitors. This revenue stream is likely to become a key driver of profitability, with minimal cost increases.Risks and ChallengesDoorDash operates in a highly competitive environment. Major players like Uber Eats and Grubhub (NYSE:GRUB) continue to vie for market share, while global competitors such as Just Eat and new entrants like Instacart (NASDAQ:CART) add further pressure.

Apart from competition, my thesis is based on the USA avoiding recession. While the current economic cycle appears favorable, any unexpected downturn could impact DoorDash's growth as consumers may cut back on discretionary spending, including food delivery. However, DoorDash's diversified verticals offer some protection against such headwinds.

Lastly, DoorDash faces various legal and regulatory challenges, particularly around worker classification and delivery fee legislation. These issues could increase costs and pressure profitability in the near term.

ValuationDoorDash is still not profitable on a GAAP basis. One of the best to assess its value is the price-to-sales (P/S) ratio. Currently, DoorDash trades at a trailing 12-month P/S ratio of around 6x and a forward P/S ratio of approximately 4.9x. While these numbers might seem high compared to peers, they are actually on the lower end of DoorDash's historical range. Thus, I believe DoorDash's growth could reignite after a difficult macroeconomic environment, leading to multiple expansions.

Source: GuruFocus

Another useful metric is the price-to-free-cash-flow (P/FCF) ratio, which stands at 34.6x. Though this may seem elevated in absolute terms, it's relatively low when considering DoorDash's historical levels and peer comparisons. The company has been growing its FCF much faster than its revenue, giving me more confidence in its future prospects.

Source: Author

Lastly, using a discounted cash flow (DCF) analysis that incorporates both a multiple method and a perpetuity growth model, I derived an average price target of $199 per share. This represents a potential upside of 40% from current levels, reinforcing the idea that DoorDash could be offering a great investment opportunity as the macroeconomic environment improves.

Source: Author

My Final TakeDoorDash's dominance in the food delivery market is clear, but now the next challenge is its ability to adapt and innovate beyond just restaurants. By strategically expanding into new verticals, coupled with the rollout of new merchant tools like the Commerce Platform, DoorDash is positioning itself as an essential partner for businesses seeking DoorDash's consumer base.

In addition, I believe DoorDash stands to benefit from favorable macroeconomic conditions as the global economy enters a new business cycle. With central banks lowering interest rates and consumer purchasing power expected to rise, DoorDash is well-positioned to capitalize on increased demand for delivery services. This cycle could provide the company with further tailwinds, amplifying its growth potential.

Although competition poses challenges, DoorDash's continued focus on operational efficiency and expanding its user base provides a strong foundation for sustained growth. At this price, DoorDash offers an opportunity to invest in a founder-led company poised to succeed.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI